Tech Surge Lifts Stocks Back Into the Green

This article from Bloomberg may be of interest to subscribers. Here is a section:

Stocks are advancing for a third day in four amid optimism over the earnings season and growing speculation markets may have bottomed out. While that debate continues, with Sanford C. Bernstein strategists saying markets have yet to see full capitulation, rates markets have discarded bets the Federal Reserve will hike rates by a full percentage point next week, bolstering optimism the central bank will take a more measured approach to policy tightening.

“The fact that companies are showing a certain resilience to the current environment is reassuring market operators who have now started betting on a less aggressive monetary tightening than initially expected,” said Pierre Veyret, a technical analyst at ActivTrades. “Even if we’re not out of the woods yet, more and more traders now tend to believe the worst is behind for equity markets this year.”

Recession fear is now a consensus among investors. Therefore it is reasonable to question how the market can continue to rebound. Netflix is a good example to examine. The share collapsed because subscriber growth was unrealizable. The share rebounded this week because its loss of million subscribers was less bad than had been priced in.

The challenge for investors is they, and I, are convinced a recession is inevitable. The yield curve is inverted, and oil prices are too high. That is enough to signal a recession is inevitable before one looks at any other suite of factors. The reality however is that it takes time for financial condition tightness to show up in weaker demand.

Historically, the market rebounds immediately after a yield curve inversion and real trouble in the stock market doesn’t begin until the yield curve surges higher following the inversion. That’s usually the time when central banks panic because growth is surprising on the downside.

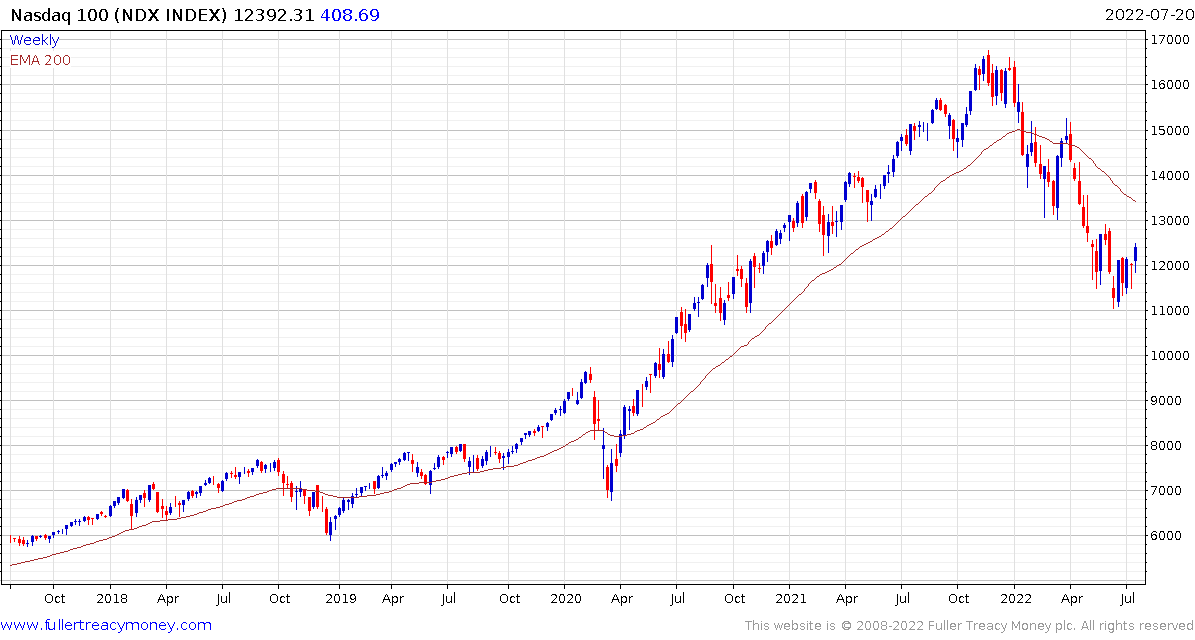

The Nasdaq-100 is unwinding its short-term oversold condition as it bounces from the region of the 1000-day MA. A sustained move back above 14,000 will be required to question the consistency of the downtrend.

The Ark Innovation ETF hit a new recovery high today to suggests there is scope for a reversionary rally.

As you will see from the following pieces, demand for speculative assets is increasing as dates are set for significant market events. These are likely to provide short sharp moves on the upside, that serve to lull bulls into a false sense of security and convince the Fed that speculative fervor is still too active in the market so tightening will need to proceed.