Tapering on Deck-Stick with Defensive Quality in Factor Frenzy

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

Tapering is tightening for markets, if not the economy. Due to the much greater than expected rise in inflation, the Fed is pivoting to a more aggressive removal of monetary accommodation. We believe this is warranted and supported by an administration that appears less focused on the stock market as a barometer of its success. Furthermore, tapering is different than in 2014 for 3 reasons: 1) the Fed is exiting QE twice as fast this time,2) asset prices are much richer today and 3) growth is decelerating rather than accelerating. This could be important for the economy, too, given how levered consumers are to stock prices today.

Here is a link to the full report.

The uptrend over the last 13 years has been liquidity fuelled. That’s been the abiding factor behind every correction and every recovery since the initial lows in late 2008. It is reasonable to expect the end of the latest quantitative easing program will have a similar effect on market prices as every other one.

When quantitative easing programs have ended, they coincided with medium-term corrections for Wall Street. That was true in 2010, 2012, 2015/16, and of quantitative tightening in 2018. The Nasdaq-100 has more than doubled since the pandemic low in 2020, so a lengthier pause and partial loss of momentum is a likely outcome from the removal of liquidity infusions.

Every time the market has pulled back by between 10% and 20%, the Federal Reserve has reversed course and begun to re-inject liquidity into the market. Has anything really changed? The dependency on liquidity to support valuations and the risk-seeking activities of a large proportion of companies has multiplied over the years.

The fact that bond yields are compressing ahead of the news of tapering suggests investors are seeking safe havens. That’s despite market expectations the Fed will raise rates up to seven times in the next three years.

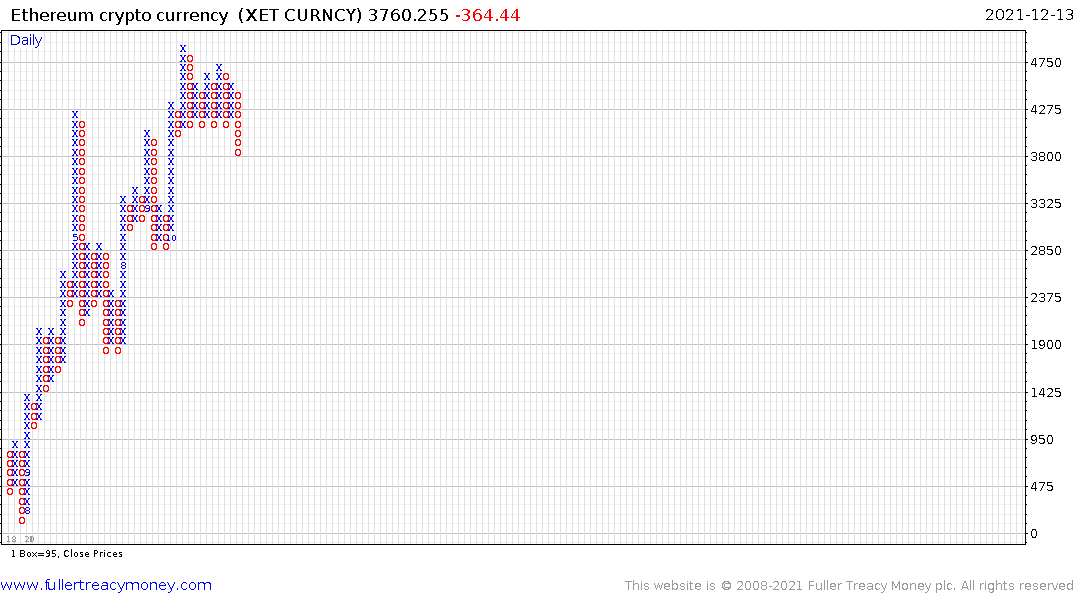

Continued weakness in bitcoin and Ethereum breaking lower today is another sign that risk aversion is rising.

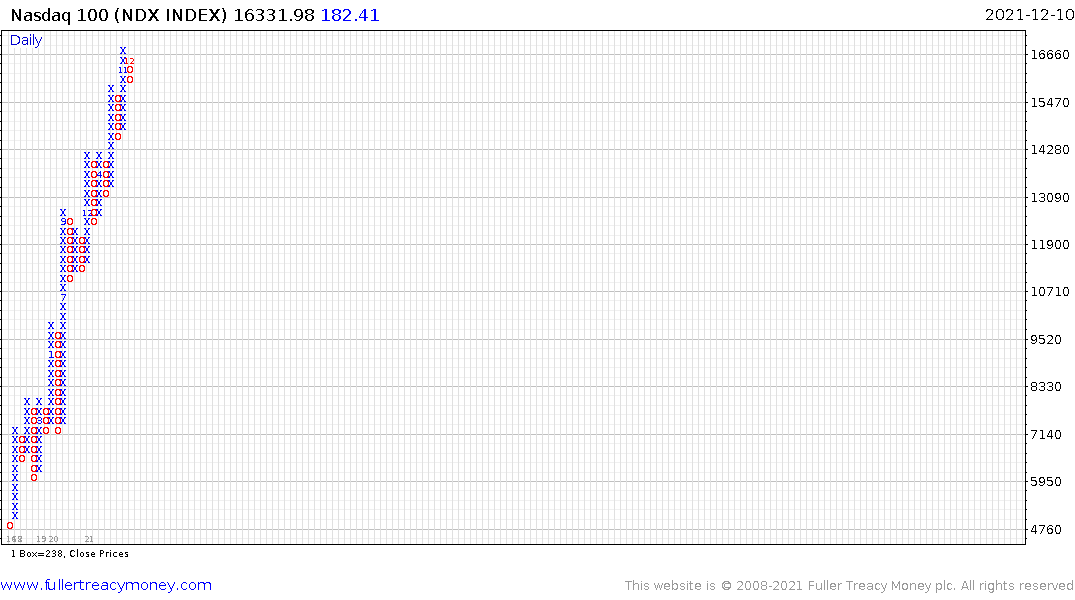

This 5-year p&f chart of the Nasdaq-100 helps to illustrate how consistent the trend has been. Each of the range has been above the last and each of the breakouts has been explosive.

This 5-year p&f chart of the Nasdaq-100 helps to illustrate how consistent the trend has been. Each of the range has been above the last and each of the breakouts has been explosive.

The most recent breakout has been much less explosive, so even a mild reaction has brought the price back to test the upper side of the underlying range. The February-June range this year did dip back into the underlying congestion area for three days. Then it rebounded emphatically. We saw an impressive rebound last week from the region of the 200-day MA, that level needs to hold if the trend is to remain consistent.

There are three important potential sources of additional new liquidity that could support asset prices. These are the potential for the Biden administration to finally push through their multi-trillion spending package, the potential for China to intervene to support the property market by boosting stimulus in a big way and the scope for global stimulus to be boosted to combat the omicron variant. At present none of these are actively evolving so that is also fuelling risk-off activity.

Back to top