Taiwan Stocks Jump Most in a Year as Apple Suppliers Lead Surge

This article by Kyoungwha Kim for Bloomberg may be of interest to subscribers. Here is a section:

Taiwanese shares jumped the most in a year amid speculation Apple Inc.’s latest iPhone model will prove popular, boosting earnings for the island’s suppliers.

The Taiex index advanced 2.8 percent at the close, its biggest gain since September 2015. Taiwan Semiconductor Manufacturing Co., a major Apple supplier, posted its biggest gain in a year, while Hon Hai Precision Industry Co., the main assembler of iPhones, added 3.9 percent. Apple has jumped 6.5 percent since Taiwan’s markets last traded on Wednesday amid holidays. The island’s dollar strengthened by the most since Aug. 1 against the greenback.

“It’s the Apple story again,” said Michael On, president of Beyond Asset Management in Taipei. “There’s a revived optimism that Apple will increase orders for Taiwanese suppliers after better-than-expected sales of the iPhone 7.”

T-Mobile US Inc. and Sprint Corp. said they’d received almost four times as many orders for the iPhone 7 as previous models, fueling speculation that the new product is off to a faster start than usual. Expectations for the iPhone 7 line had been muted before it was unveiled in San Francisco this month amid slowing growth in global smartphone sales.

As the world’s largest company Apple outsources all of its manufacturing which means it has a vast ecosystem of suppliers that are responding favourably to the release of the company’s new products as well as to the relative difficulties being experienced by Samsung.

Taiwan’s market rallied impressively today on a stronger Taiwan Dollar, a firmer tone in the banking sector as well as the boost from Apple suppliers. The Apple story might have been the catalyst for additional investor interest but the more attractive yield and potential for leverage to the return to outperformance by ASEAN overall is potentially a more important consideration.

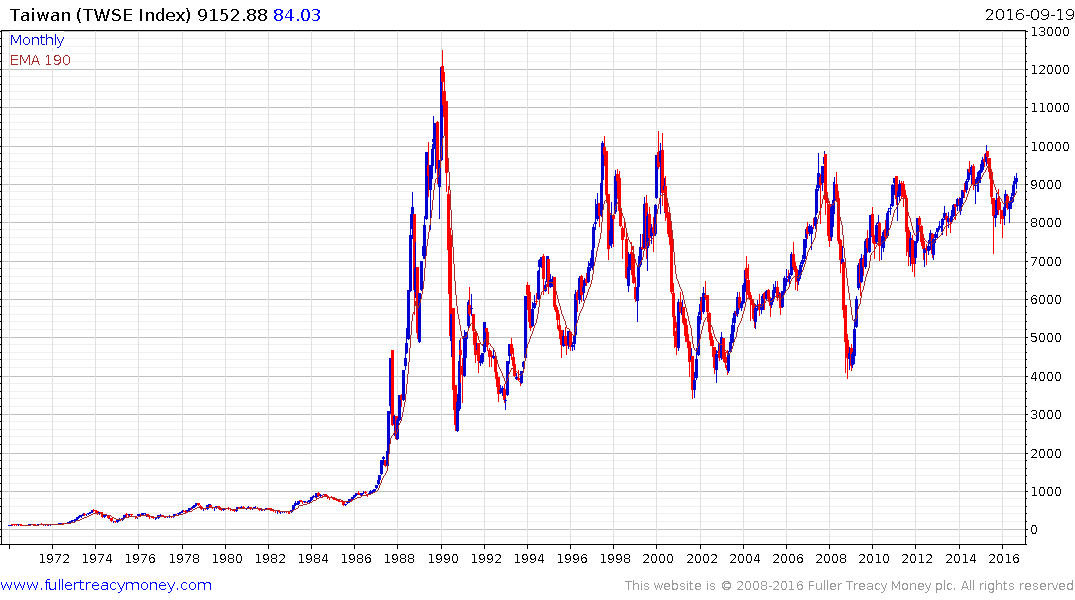

The TAIEX broke out to new recovery highs in July and has been consolidating that move since. Today’s upward dynamic confirms support in the region of the upper side of the underlying range and a sustained move below the trend mean would be required to question medium-term scope for continued upside.

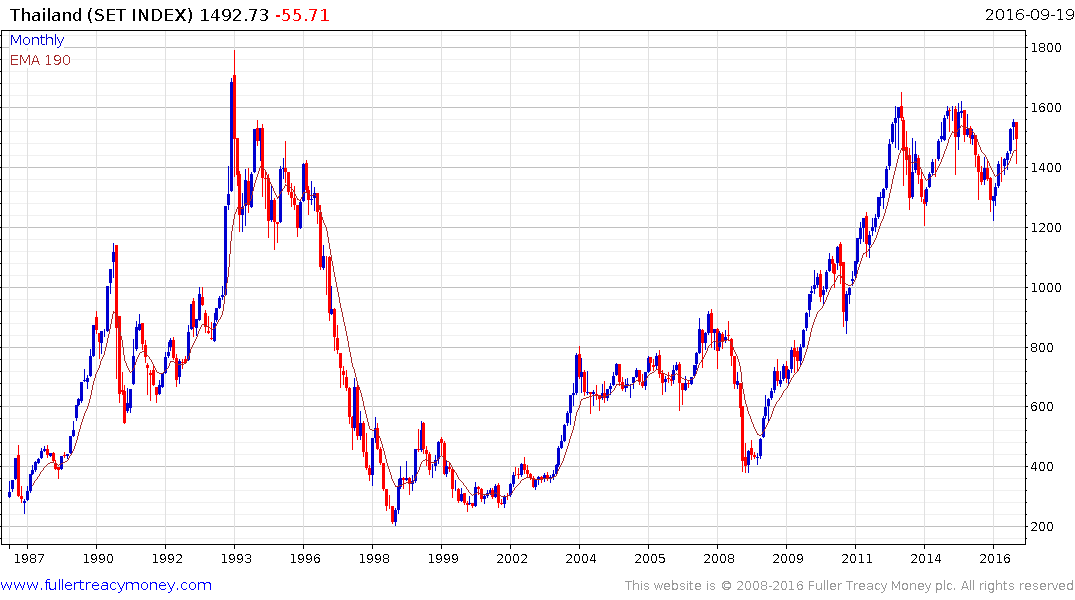

Meanwhile the Thai SET Index is rebounding from the region of the trend mean as it unwinds a short-term oversold condition.