Taiwan Dollar Climbs to 11-Month High as Equity Inflows Quicken

This article by Justina Lee for Bloomberg may be of interest to subscribers. Here is a section:

Global funds have injected a net $1.4 billion into the territory’s stocks this week through Wednesday, the most among eight Asian markets tracked by Bloomberg. Developing-nation currencies are recovering this month after plunging in the aftermath of the U.K.’s vote to leave the European Union in June. Futures are now pricing in less than even odds of a Fed rate increase in 2016.

“The market thought that, after Brexit, funds would leave Europe and go to the U.S., but it seems some are entering emerging markets because U.S. rate hikes will be delayed," said Cary Ku, an economist at Jih Sun Securities Co. in Taipei.

"Taiwan stocks’ higher yield also attracts foreign investors."

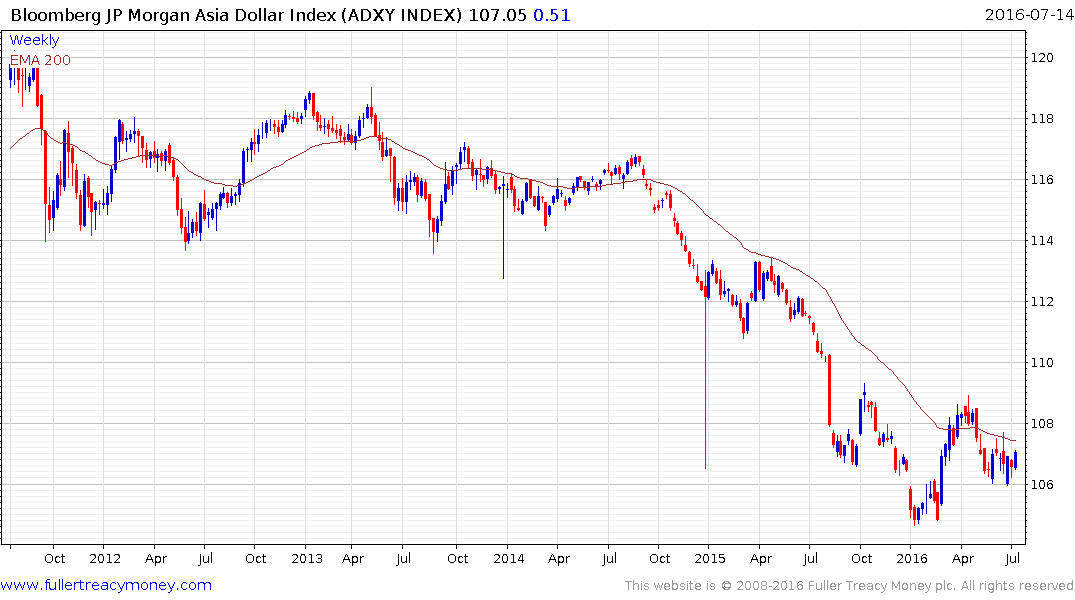

Despite the fact the Chinese Renminbi remains in a consistent, though somewhat oversold, downtrend against the Dollar, the majority of ASEAN currencies found medium-term support last year. For example the Indonesian Rupiah hit a low in October, the Thai Baht in October and the Taiwan Dollar in January and that was following multi-year declines in all cases.

International investors are beginning to be attracted back to the ASEAN region this year because following a multi-year downtrend when currencies were falling and stock markets underperformed, they are now returning to outperformance on a currency adjusted basis. The Thai and Indonesian markets are up 18.86% and 17.67% respectively year to date.

The US listed Aberdeen Indonesia Fund trades at a discount to NAV of 15.6%. Following a clear upward dynamic three weeks ago, to confirm a higher reaction low, it would need to sustain a move below the trend mean to begin to question recovery potential.

The UK listed Aberdeen New Thai Investment Trust trades at a discount to NAV of 14.2% and also remains on a recovery trajectory.

The iShares MSCI Philippines ETF continues to pull away from the region of the trend mean and a break in the progression of higher reaction lows would be required to question medium-term scope for continued upside.