Swatch CEO Says Words Fail Me as SNB Shock Hits Exporters

This article by Jan Schwalbe and Simeon Bennett for Bloomberg may be of interest to subscribers. Here is a section:

“Words fail me,” Swatch Chief Executive Officer Nick Hayek said by e-mail. “Today’s SNB action is a tsunami; for the export industry and for tourism, and finally for the entire country.”

Swatch, the world’s biggest maker of Swiss watches, dropped 17 percent as of 3:37 p.m. in Zurich, on track for the biggest decline in more than two decades. Holcim Ltd., the world’s biggest cement maker, slid 13 percent. Nestle SA, the world’s largest food company, which gets about 98 percent of its revenue from outside Switzerland, declined as much as 11 percent, the biggest intraday drop in more than 17 years.The benchmark 20-company Swiss Market Index dropped 10 percent, wiping 133 billion francs off its value.

A strong franc is a challenge for exporters like Swatch and small- and mid-size companies with factories in Switzerland, where shop-floor workers earn some of the highest wages in Europe. Timepieces make up more than a 10th of the country’s total exports, led by brands including Rolex, Swatch’s Omega and Richemont’s Cartier.

The franc surged as the Swiss National Bank unexpectedly removed the cap of 1.20 francs per euro, concluding that it was no longer justified. That ended a three-year policy designed to shield the economy from the euro area’s sovereign debt crisis.

The SNB’s decision to abandon its peg to the declining Euro represents an admission that the expense of holding back the Franc is just too much to bear when Switzerland does not have the same challenges as the Eurozone. For those holding Swiss Francs today was a good news day. For Swiss based investors with overseas holdings the news was not so good.

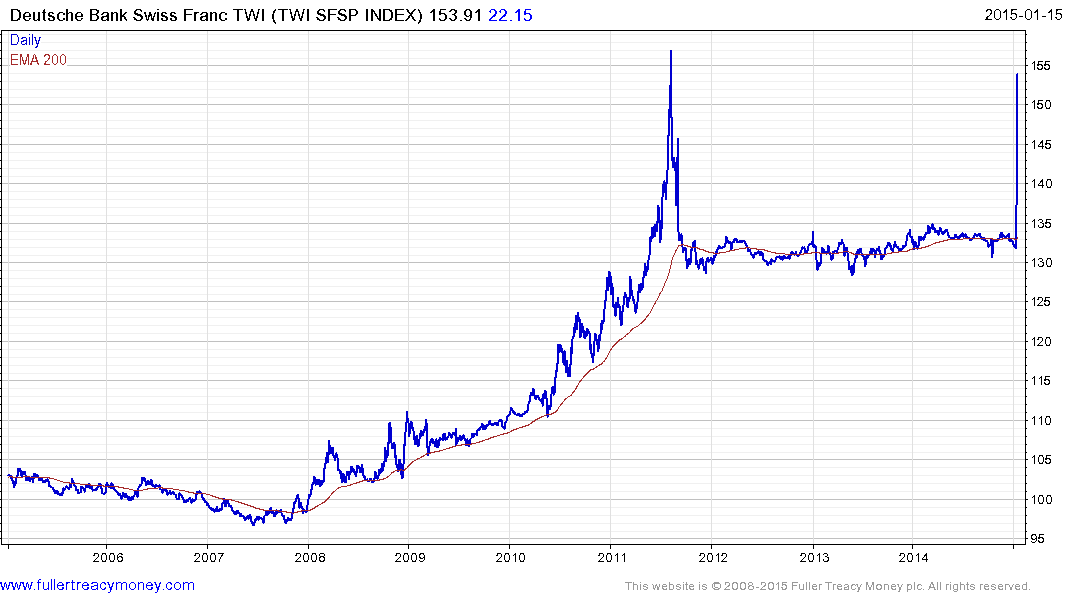

The Swiss Trade Weighted Index had accelerated to a medium-term peak in 2011 forcing the SNB to intervene. Today’s surge opens up potential for a retest of that peak but we can anticipate additional volatility as traders spar over the currency’s value.

There will be some panicky meetings in the boardrooms of Swiss exporters this week as the full ramifications of the Franc’s strength are digested. Margin compression will top of the agenda and the loss of competitiveness experienced represents a significant challenge. The extent to which a company’s manufacturing is based in Switzerland is likely to be an important consideration suggesting that Swatch is probably going to be more affected than Nestle.

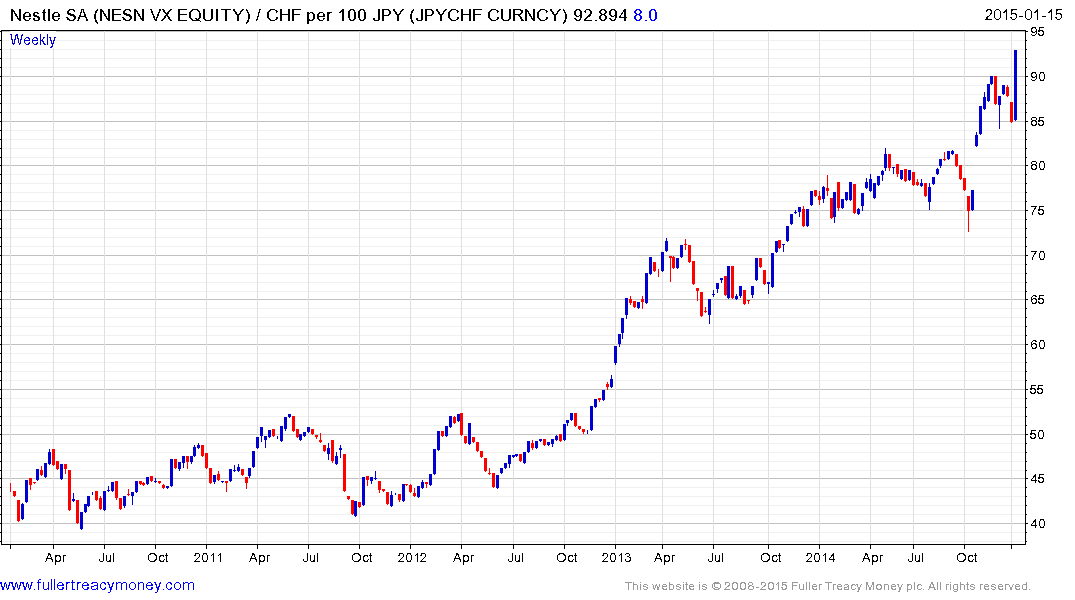

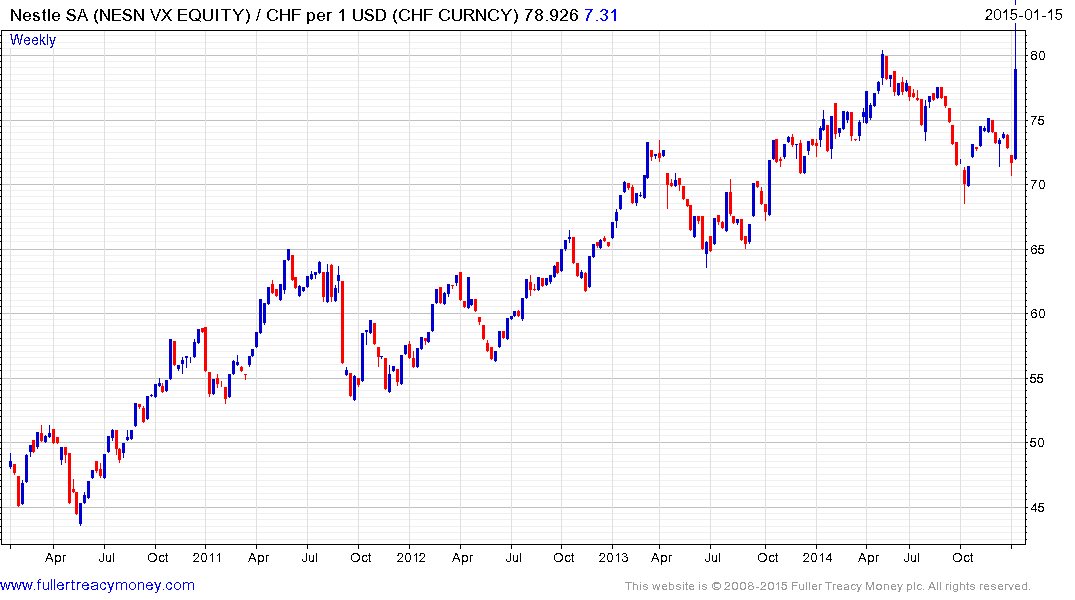

I thought it would be instructive to compare charts of Nestle in different currencies to highlight the differing effects of this development.

.png)

In local currency terms the share bounced back from this morning’s lows to pause in the region of the 200-day MA. Considering the size of the weekly key reversal and damage to confidence some consolidation is likely. The CHF65 area will need to hold if medium-term scope for additional upside is to be given the benefit of the doubt.

.png)

When redenominated to Euro the share surged to more than €70 and some consolidation of that gain now appears likely.

When redenominated to Yen, the share has returned to test the upper side of the short-term range following the initial surge and remains in a relatively consistent uptrend.

When redenominated to US Dollars, the share held half its initial gain and remains in a relatively consistent uptrend.

Back to top