SVB Plunges Most Since 1998 on Stock Offering, Securities Sales

This article from Bloomberg may be of interest. Here is a section:

The firm said it had sold about $21 billion of securities from its portfolio with a plan to reinvest the proceeds, which will result in an after-tax loss of $1.8 billion for the first quarter. SVB also announced offerings for $1.25 billion of its common stock and $500 million of securities that represent convertible preferred shares. Additionally, General Atlantic committed to purchase $500 million of common stock, taking the total amount being raised to about $2.25 billion.

The offering is expected to price Thursday after the market closes and trade on Friday, according to a person familiar with the matter.

“The improved cash liquidity, profitability and financial flexibility resulting from the actions we announced today will bolster our financial position and our ability to support clients through sustained market pressures,” the company said in a letter to stakeholders.

This year has been characterised by a series of mark to market events although that is not how they have been described. When alternative asset managers default on properties because that is the quickest route to renegotiate terms, that is effectively marking the portfolio to market. Silicon Valley Bank (SVB) selling $21 billion of positions in smaller companies and hard to value startups is a similar development.

Alternatives promise higher returns and during benign liquidity conditions investors have the luxury of forgetting they are illiquid. When monetary conditions tighten and rates rise, liquidity becomes a central concern. 10-year lockups were common in private investing deals ahead of the pandemic. That suggests the institutional investors in these structures have no choice but to sell more liquid assets when the returns from private assets deteriorate.

Bitcoin is a major liquidity barometer, and the price continues to retreat from the psychological $25000 level. Unfortunately, Silvergate, the crypto-bank, is about to be liquidated following Coinbase and Binance deciding to withdraw deposits. My small options position will likely be worthless, but I will continue to hold since they have already lost most of their value anyway.

Bitcoin is a major liquidity barometer, and the price continues to retreat from the psychological $25000 level. Unfortunately, Silvergate, the crypto-bank, is about to be liquidated following Coinbase and Binance deciding to withdraw deposits. My small options position will likely be worthless, but I will continue to hold since they have already lost most of their value anyway.

Coinbase continues to drift, and the share has been largely inert for the last three weeks. It requires a bitcoin revival to drive renewed interest in the share.

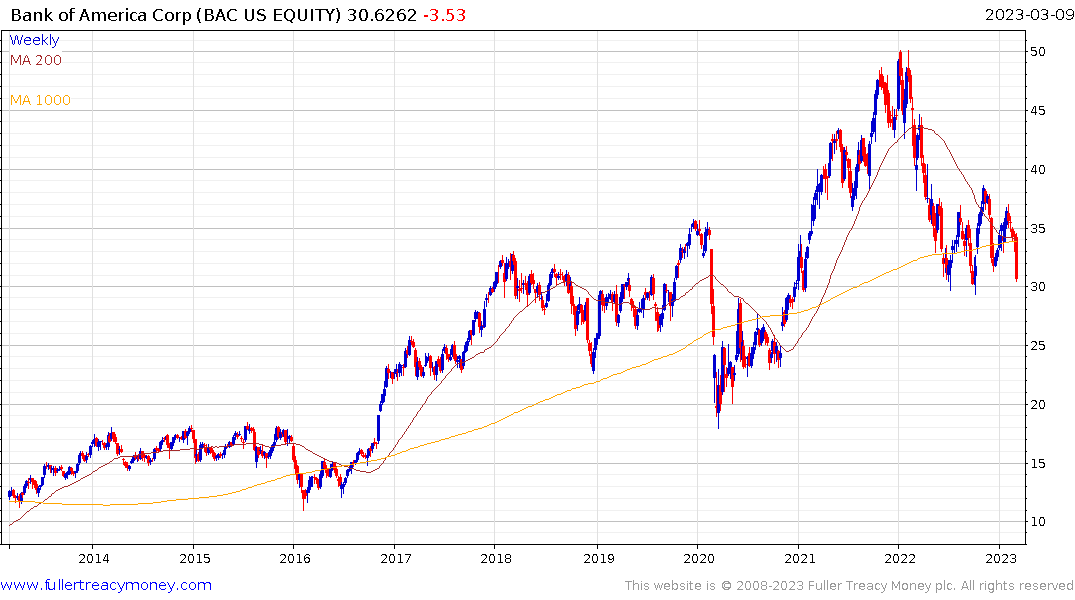

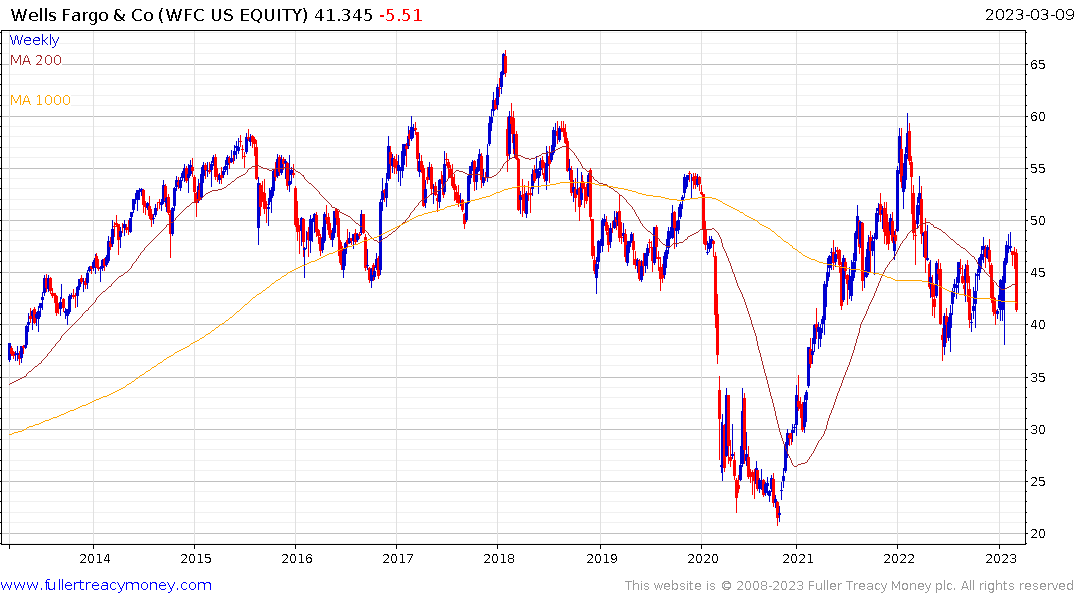

While it may be esoteric to talk about liquidity barometers, the downward dynamics in major bank stocks should have everyone sitting up and paying attention. Bank of America, JPMorgan, Citigroup, Wells Fargo and Bank of New York Mellon are all money centre banks. They all posted large downward dynamics this week to cap strong rebounds from the October lows.That suggests the market is beginning to price in the potential that the lag between aggressive rate hikes and obvious effects on the broader economy is closing.