Sustained high palladium price favours substitution

This report from Heraeus may be of interest to subscribers. Here is a section:

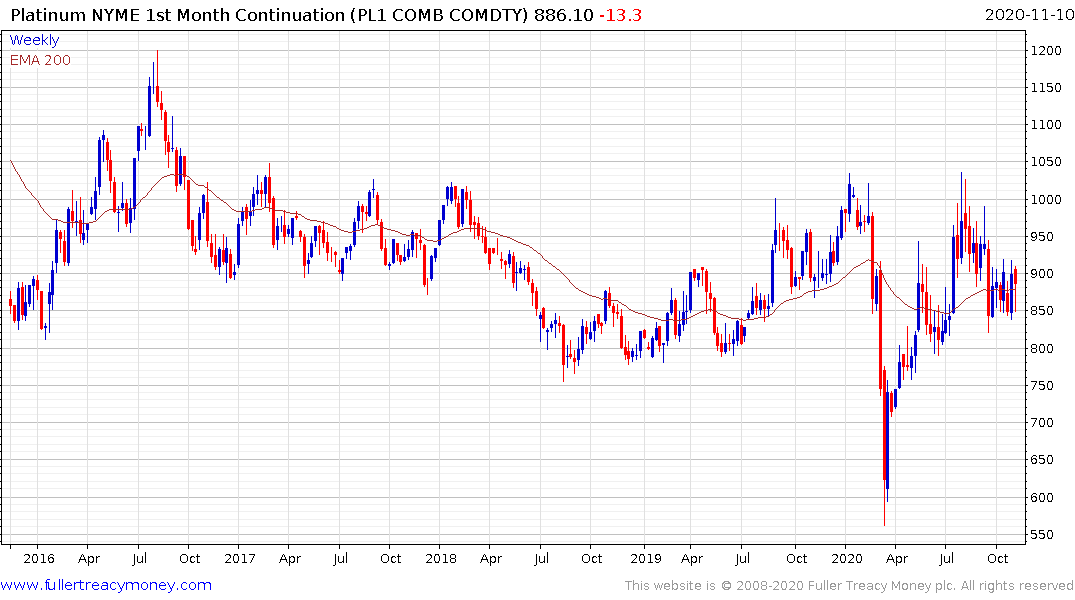

Substitution of palladium with platinum in three-way autocatalysts will help to offset platinum’s decline in time, but near-term upside is limited. A modest level of substitution is expected in gasoline autocatalysts from 2021, initially in the US where vehicles are generally larger with lower temperature engines. In China and Europe, car manufacturers have prioritised meeting increasingly tight emissions legislation, so will be behind on changing catalyst formulations compared to the US.

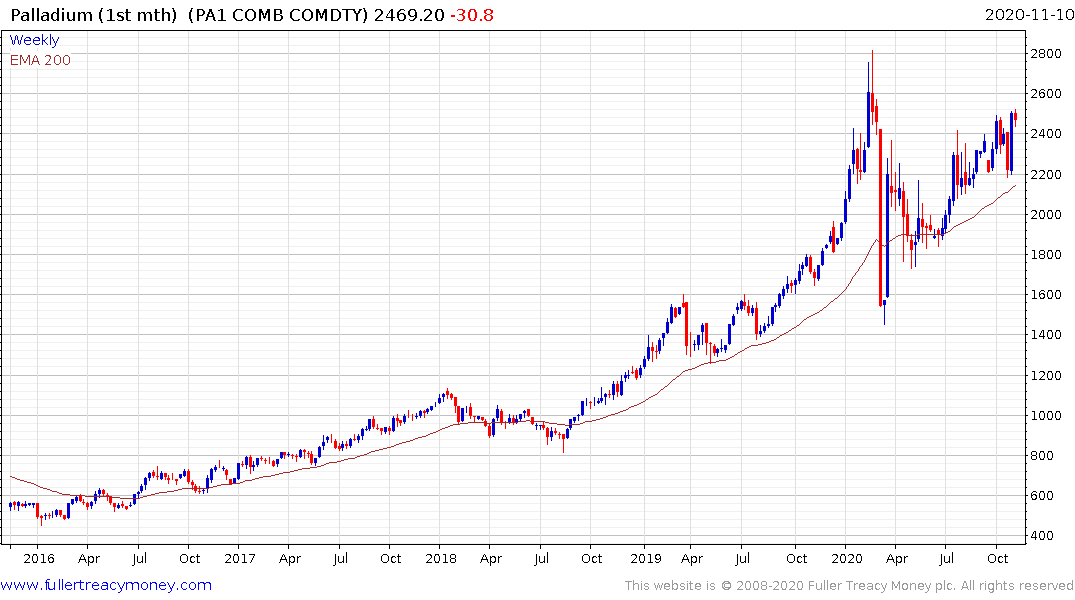

However, a sustained palladium price above that of platinum could be tipping the balance in favour of increased substitution, which is necessary to bring both the platinum and palladium markets closer to balance. Palladium has traded at an average of $2,187/oz this year, despite being in the midst of a pandemic and a global recession, with significant contractions to demand. The palladium market deficit is forecast to shrink to around 340 koz this year (as demand was impacted more than supply by Covid-19), and again in 2021 due to work-in-progress stock but is expected to expand significantly thereafter as light-vehicle production recovers.

Both platinum and palladium are industrial metals with precious metal attributes. They have both been used for catalytic converters and it usually takes a very large move to initiate the retooling necessary to switch from one to the other.

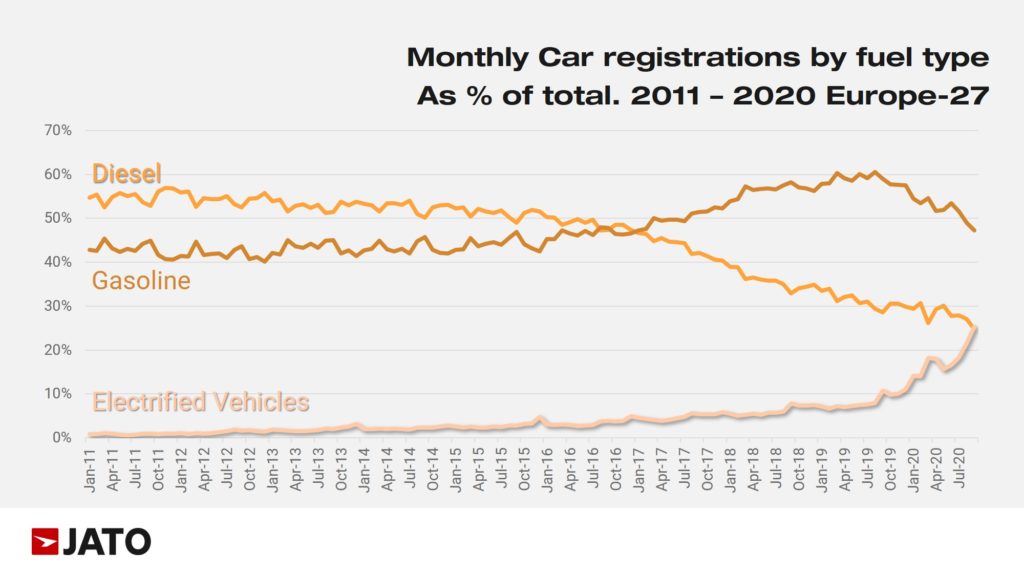

On this occasion there is the added consideration posed by the growth of electric vehicles. For example, electric car registrations overtook diesel in the EU for the first time in September. Arguably that is because of the demise of diesel following the emissions cheating scandal but it is also reflects the falling cost of EVs and the rising duties on fuels.

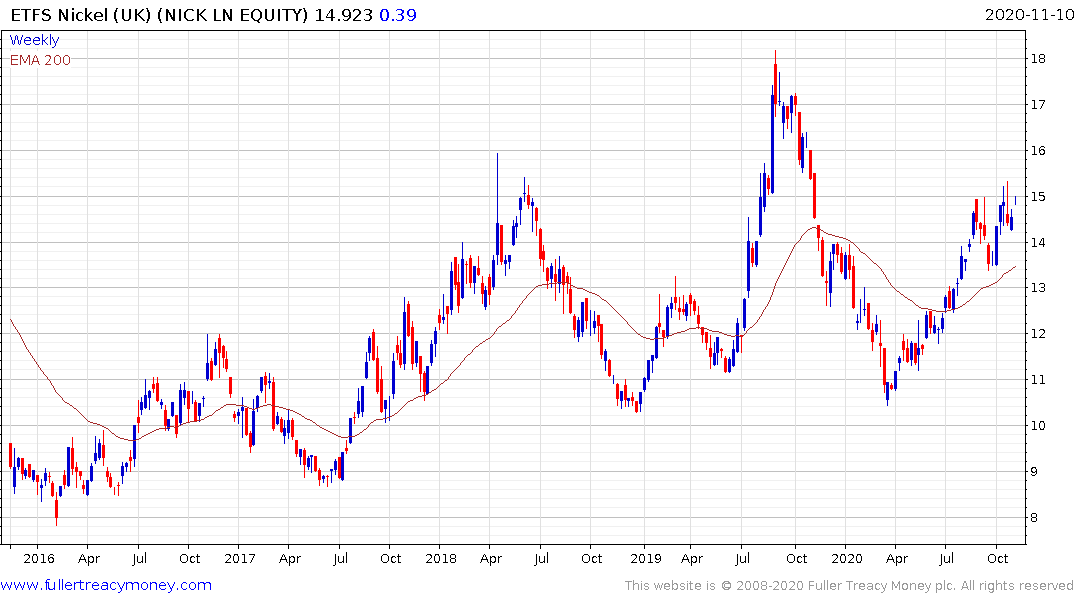

Against that background, the rationale for retooling is much less compelling. Why go to the bother of retooling to supply a market where demand is falling. The challenge for palladium bulls will be in calculating how increased demand for nickel in batteries will affect supply of palladium since it is a by-product of nickel mining.

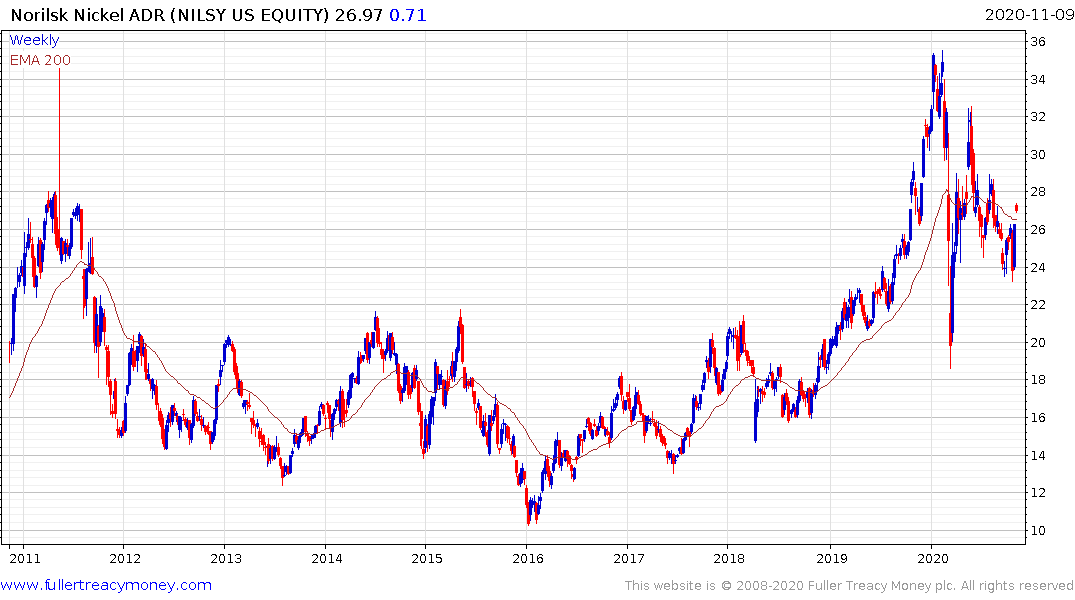

Nickel remains in a choppy uptrend but the price is not so high just yet to spur significant additional investments in supply expansion.

Palladium continues to steady from the region of the trend mean.

The primary demand growth argument for platinum is as a catalyst in hydrogen fuel cells. That’s a high growth sector but is still in its infancy. Platinum continues to range above the trend mean.

Norilisk Nickel still has first step above the base characteristics.