Surprise Korea Rate Cut Adds Pressure on Funds to Invest Abroad

This article by Moonyoung Tae for Bloomberg may be of interest to subscribers. Here is a section:

“In general, we are underweight on local-currency bonds due mainly to the concern about currency, but favor neutral to overweight in duration in some local bond markets, including Korea,” Arthur Lau, the Hong Kong-based head of fixed income at PineBridge, said by e-mail on March 11.

Global funds have bought $6.8 billion more of South Korean debt than they sold this year through March 13, following $35.4 billion of net purchases in 2014, data compiled by Bloomberg show. The won rose 0.1 percent to 1,130.21 a dollar as of 11:30 a.m. in Seoul on Tuesday and is 3.5 percent weaker versus the greenback this year.

“Overseas investments will increase going forward,” Moon Hong Cheol, a fixed-income analyst at Dongbu Securities Co. in Seoul, said by phone Monday. “South Korean institutional investors can consider U.S. bonds with high credit ratings, such as Treasuries and bank debt. Some bigger investors may also buy U.S. corporate bonds and emerging market notes.”

The Yen’s devaluation has put a great deal of pressure on the national champions of countries like South Korea, whose export oriented business models compete with Japan’s. With Japan still engaged in QE, other countries have little choice but to ease their own monetary policy in order to maintain their competitiveness.

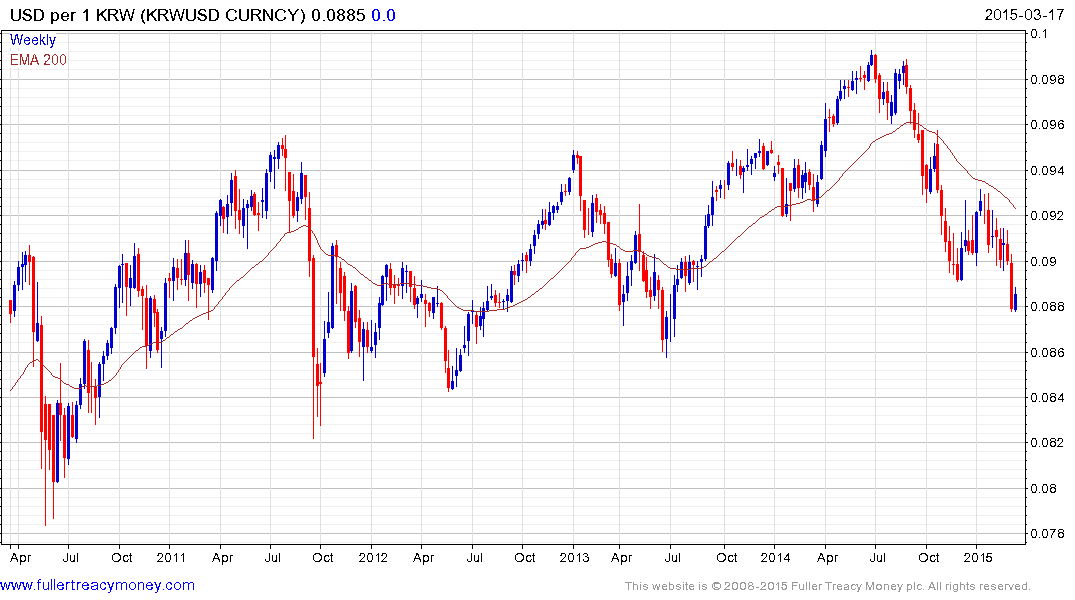

The Korean Won was among the strongest currencies in the region until June last year. It has since fallen against the Dollar to test the region of the medium-term progression of higher reaction lows. Some steadying in the current area is a possibility but a sustained move above the 200-day MA would be required to signal a return to demand dominance beyond the short term.

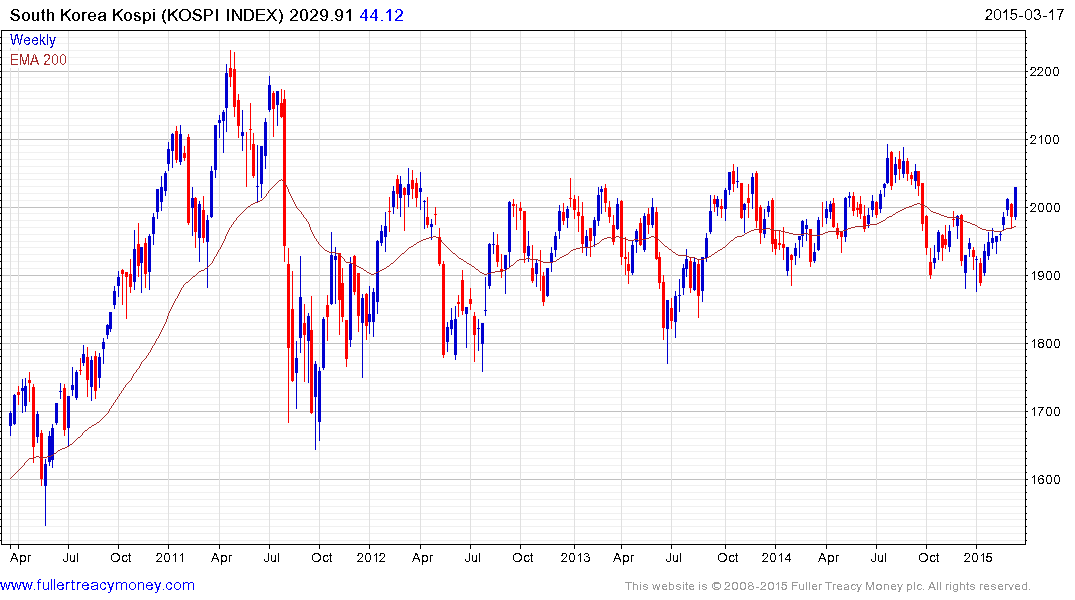

Today’s surprise interest rate cut reignited demand for South Korean shares with the Kospi rallying impressively from the region of the 200-day MA. The Index has been rallying back from the lower side of its three-year range since January. There is potential for some consolidation in the region of the upper side but a sustained move below the MA would be required to suggest more than temporary resistance in this area.

Back to top