Summers Sees 'Tumult' in 2023 With Reckoning for Bond Market

This article from Bloomberg may be of interest to subscribers. Here is a section:

“I suspect tumult” for markets in 2023, Summers told Bloomberg Television’s “Wall Street Week” with David Westin. “This is going to be remembered as a ‘V’ year when we recognized that we were headed into a different kind of financial era, with different kinds of interest-rate patterns.”

In every other instance where quantitative tightening has been attempted bonds yields go up first. That is fuelled by fears central bank selling of bonds will crowd out other investors which pushes down prices. That process lasts for several months, then yields come back down. The collapse in yields is driven by rising deflationary fears as liquidity is drained out of the economy.

Global sovereign yield surged to a peak in October and most have now begun to pull back. Fears about recessions in Europe, the UK and North America are creating demand for bonds amid higher rates than anyone has seen in a decade. With wage growth beginning to moderate and manufacturing activity declining there is reason to believe inflation has already peaked and the surprises will be on the downside.

China’s reopening and the rebound for industrial commodities suggests there is scope for inflationary pressures to reappear. The wide disparity between available jobs and available workers suggests inflation is not going to retreat to pre-pandemic levels in the hurry. However, Treasury yields could be at 2% before that question becomes truly relevant.

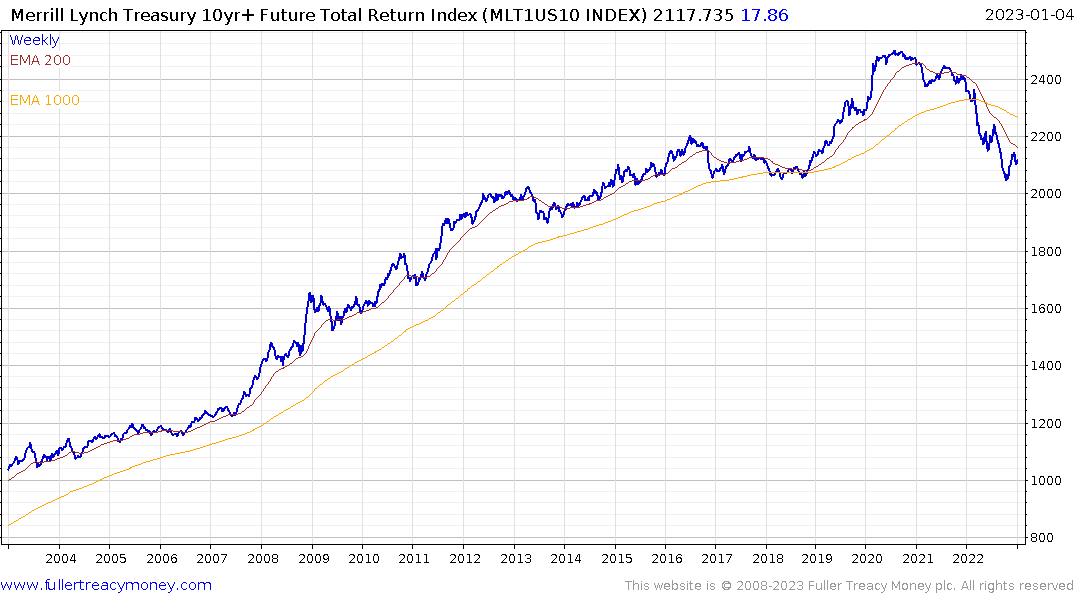

If we are in a new secular bear market for Treasuries the total return chart will fail to sustain a move back up through the 1000-day MA. However, that also implies significant scope for a reversionary rally.