Sugar Futures Climb on Bullish Energy Signs as Coffee Gains

This article from Bloomberg may be of interest to subscribers. Here is a section:

Raw sugar headed for the biggest gain in a week amid bullish signs from energy markets and lingering concern about constrained supplies in top shipper Brazil.

The March contract climbed 1.6% to 20.04 cents a pound on ICE Futures U.S. after adding 0.8% a day earlier. The commodity has climbed 29% this year after adverse conditions hurt plants in the South American giant.

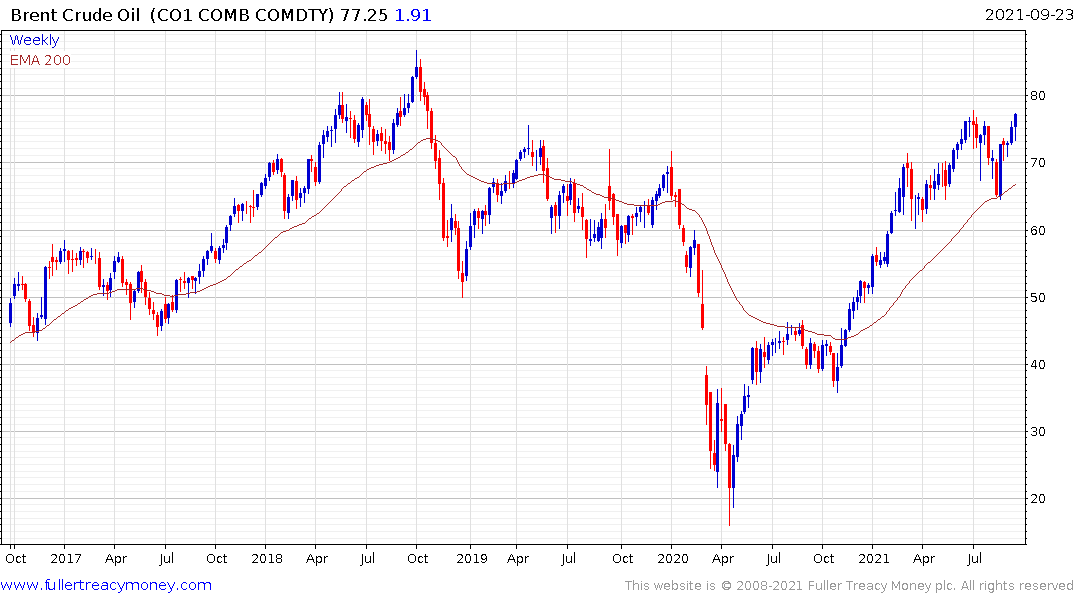

Higher energy costs are boosting the outlook for cane-based ethanol demand in Brazil, increasing incentives for mills there to direct the raw material toward making more biofuel and less sweetener. West Texas Intermediate crude climbed 1.9%, bringing its year-to-date rally to 48%.

There are expectations for a poor crop next year as effects of drought and frost linger. Offsetting lower supplies are concerns about flagging demand, spurred by Covid-related restrictions and high transportation costs.

“On one hand, Brazilian production is low, on the other, there are uncertainties about the world demand for sugar because of the increase in sea freights,” said Heloisa Lee Burnquist, analyst for the University of Sao Paulo.

It is hard to get around the fact that the world has progressed economically in leaps and bounds since the advent of fossil fuels and is struggling to cope as they are excised from the system. That’s going to be a major topic of conversation at the upcoming climate conference in the UK. The resilience of the supply chains upon which modern life relies is under threat.

Concurrently, investment in oil and gas exploration and infrastructure is trending lower. That virtually ensures there will be future problems with limited supply. Crude oil remains supported by the determination of OPEC+ to withhold supply from the market amid the pandemic uncertainty. That’s putting upward pressure on the cost of producing just about all commodities.

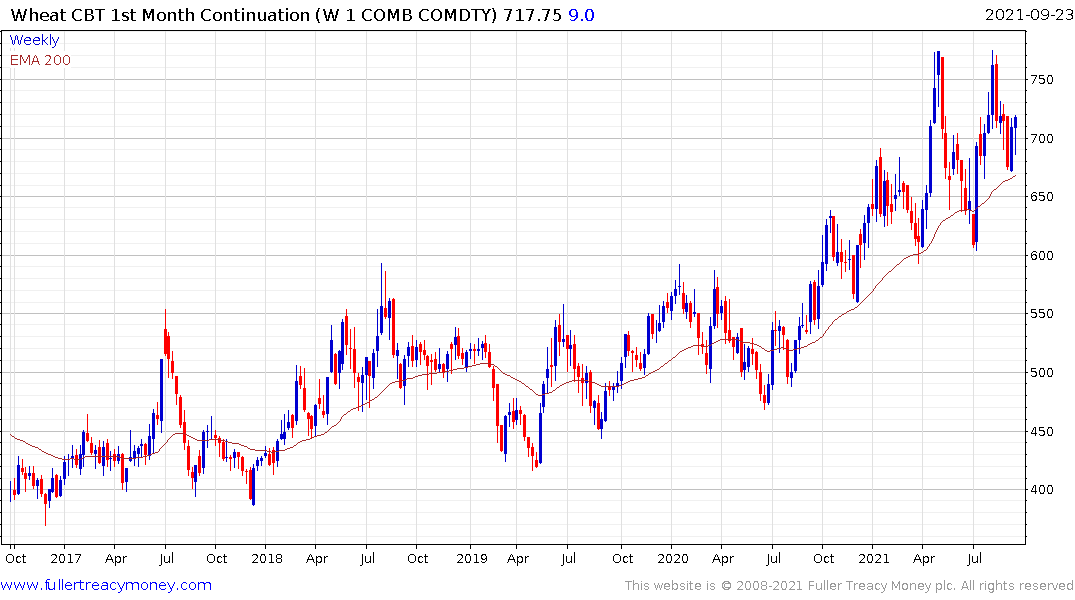

Wheat, arabica and robusta coffee, cotton and sugar are all firming and continue to exhibit recovery trajectories.

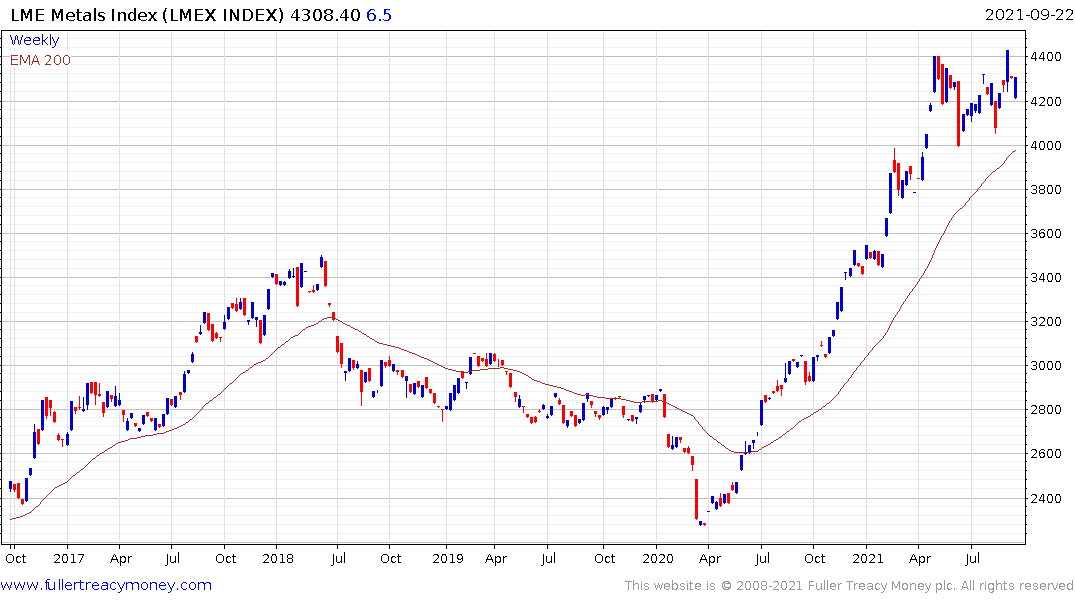

The London Metals Index is also firming in the region of the all-time peaks and a breakout to new highs is looking more likely than not.

The London Metals Index is also firming in the region of the all-time peaks and a breakout to new highs is looking more likely than not.

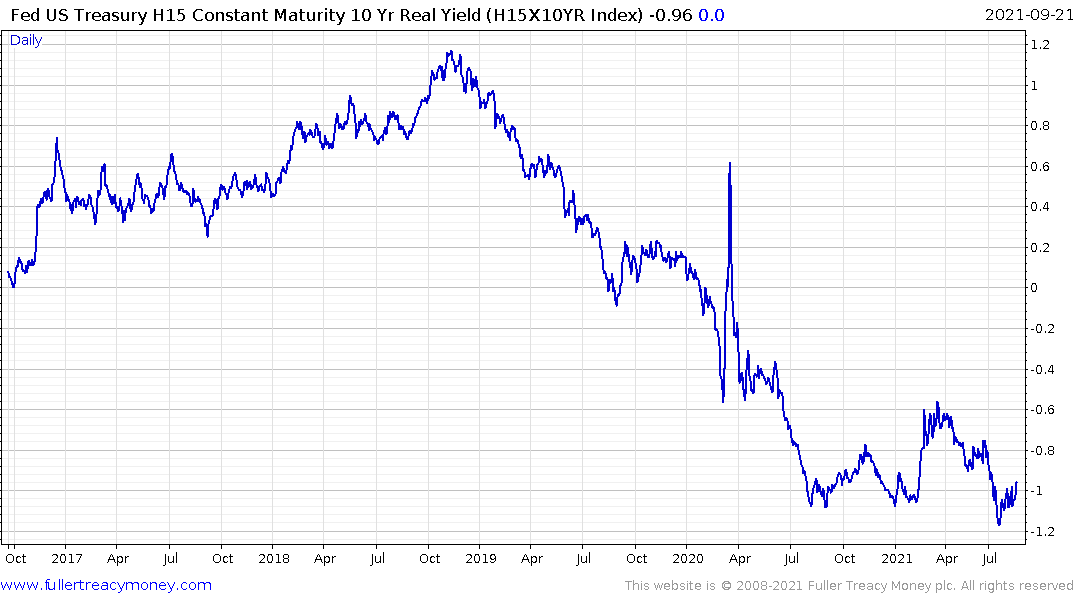

Against this background precious metals are lagging. Gold is struggling to hold rallies. The primary rationale I can think for this less than inspiring performance is the lack of clear demand in India and China and the prospect of the negative real interest rate situation narrowing rather than expanding in the near term.