Sugar Bulls Rewarded With Best Rally Since 2013 on Tight Supply

This article by Marvin G. Perez for Bloomberg may be of interest to subscribers. Here is a section:

“Much of this move has come on the back of a tightening market,” said Harish Sundaresh, a portfolio manager and commodities analyst in Boston for the Loomis Sayles Alpha Strategies team, which oversees $5 billion. “There seems to be weather problems in Brazil, in certain parts of the country’s Center South region, and India is also worried about the monsoon effect on crops.”

Sugar futures in New York climbed 16 percent over the past three months, the biggest such gain since 2013. Prices are rebounding after reaching a seven-year low in August, spurred by declines for Brazil’s real that encourage exporters to increase shipments that fetch dollars in return. Since then, declines for the South American currency have eased, while dry weather is posing risks to the nation’s crop.

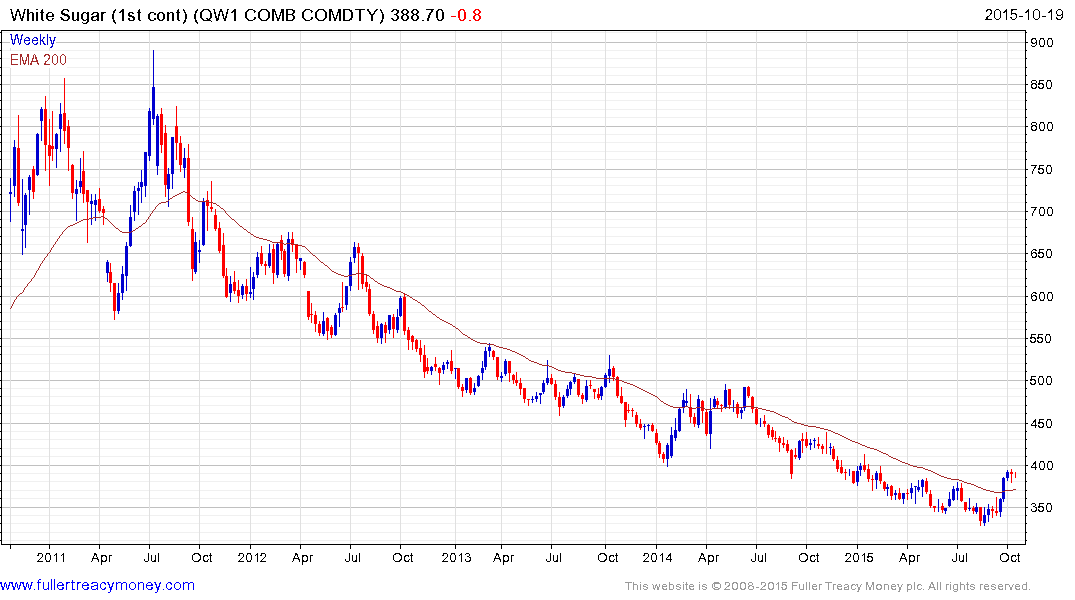

White Sugar trended lower for five years which has had an effect on supply as other cash commodity prices held up better. The question for bulls is now how much remains in Brazilian and Indian reserves that were built over the course of record crops of the last few years.

If the modest pause currently evident in White Sugar’s rebound is any guide, the market is not paying a great deal of attention to potential supplies on the side lines. A sustained move below the trend mean would be required to question potential for additional upside.

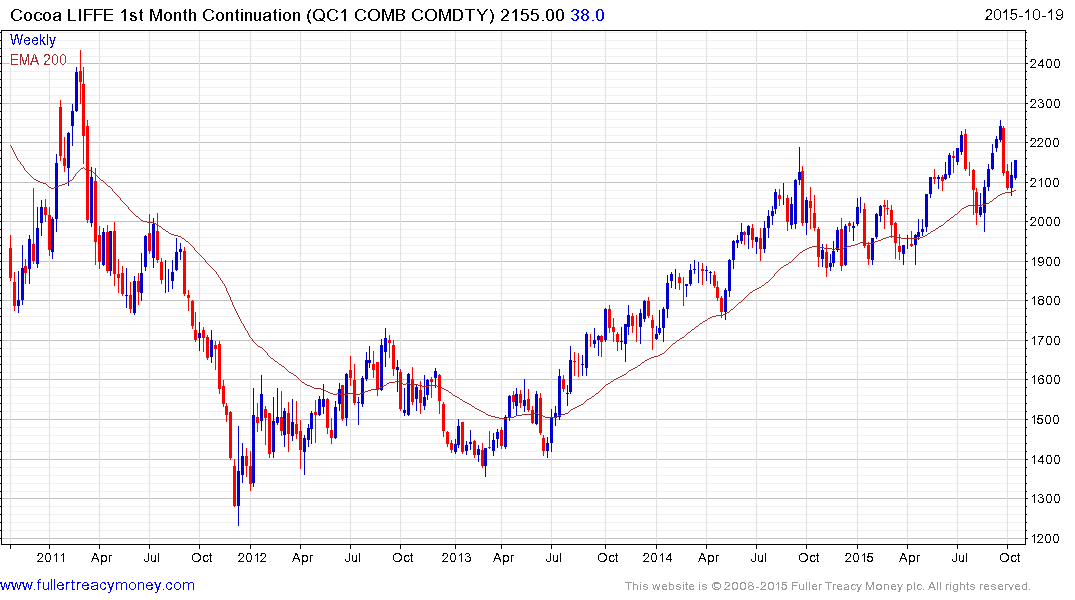

There has been a great deal of bearish news about the cocoa price. For example I saw the CEO of a major chocolate producer saying last month that prices were likely to fall quickly. Nevertheless, cocoa continues to hold a medium-term progression of higher reaction lows and a sustained move below £2000 would be required to question scope for additional upside.

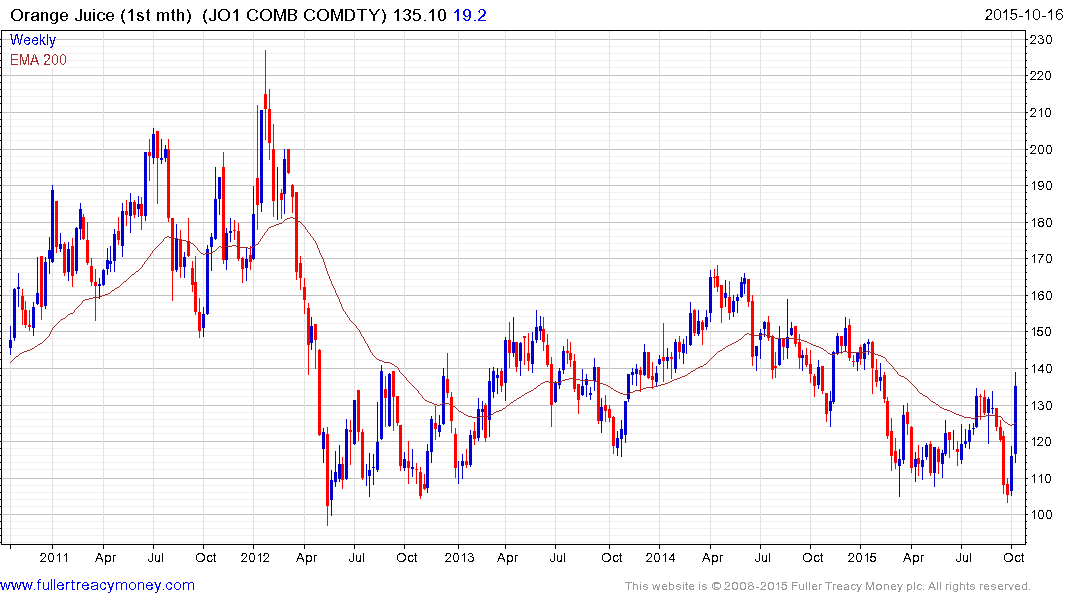

Orange Juice rebounded impressively last week, from a retest of the 2012 lows, to break the 18-month progression of lower rally highs. A sustained move below 120¢ would be required to question current scope for continued higher to lateral ranging.