Sudden Dry Spell for Bond Sales

This blog post on the Wall Street Journal by Cynthia Lin may be of interest to subscribers. Here is a section

Why the sudden stop? Recent market-volatility may to be blame, which often discourages corporation from pricing securities. Some traders also point to more expectations that the Fed may keep its policy rate near zero for a little longer, which gives companies more time to enjoy cheap borrowing costs.

Of course, investment-grade offerings may come back into full swing, analysts say, especially if financial markets stabilize.

“To think August was supposed to have been a massive month, [the lull] suggests there’s an issuance wall waiting in the wings,” says CRT Capital bond strategist David Ader.

Invesco last week said it expects a record-breaking amount of supply to hit the market between Labor Day and the Fed’s Sept. 17 policy announcement. With about $190 billion in the pipeline needed to finance M&A deals, the firm says about $80 billion in investment-grade offerings could hit the market in early-September.

The bond market has been fertile ground for companies seeking to raise capital throughout the era of quantitative easing. Much of this capital has been devoted to buying back shares, paying dividends and refinancing old debt. The strength of the US Dollar and the threat of higher interest rates have acted as a headwind for fixed income funds in particular.

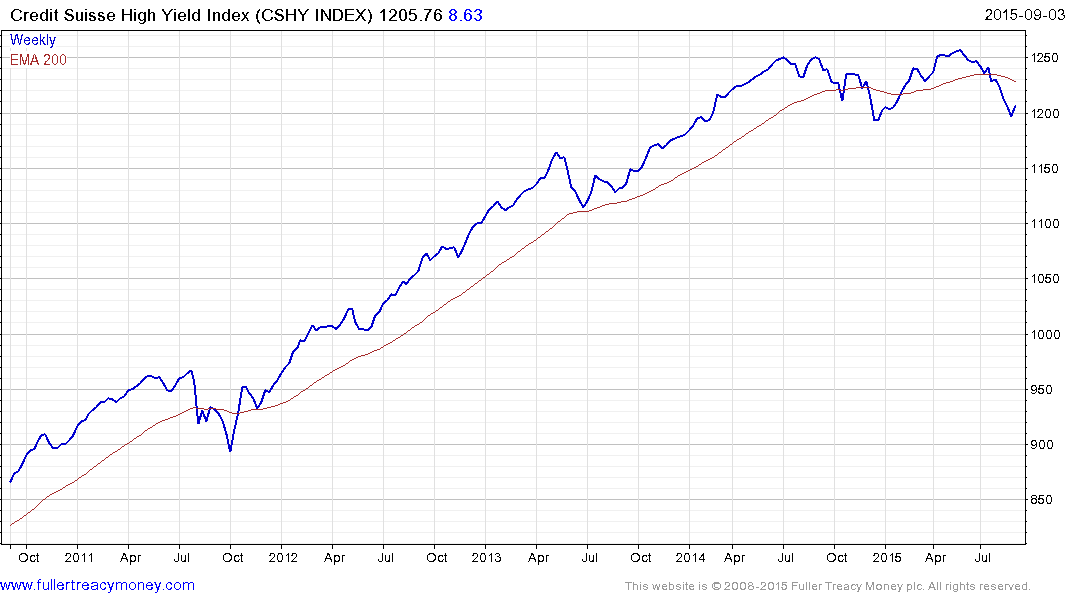

The Credit Suisse High Yield Index has been ranging for the last year, mostly below 1250, in a marked loss of momentum. It has found at least short-term support this week in the region of 1200 but a sustained move above the highs would be required to signal a return to demand dominance.