Stunning coking coal rally wreaks havoc in steel, iron ore

This article from mining.com may be of interest to subscribers. Here is a section:

In a new research note Adrian Lunt of the Singapore Exchange says margins for steelmakers in China, which forges almost as much steel as the rest of the world combined have come under pressure again and the tight conditions may continue:

"The recent spike in coking coal prices has sent spot steelmaker margins plummeting back to around their lows last seen in Q4 2015. And unless coking coal prices reverse course soon, this is likely to weigh on steelmaker earnings through the course of Q4 2016, particularly as restocking needs have provided some support to iron ore prices

"With Chinese steel output remaining strong and demand sentiment relatively robust (with continued support from both real estate and infrastructure in particular), steelmaker margin pressures appear likely to persist over the coming months."

While the price of iron ore has also recovered this year – up 31.5% year to date holding above $55 a tonne on Monday – the iron ore/coking coal ratio is now at its lowest level this century according the SGX calculations.

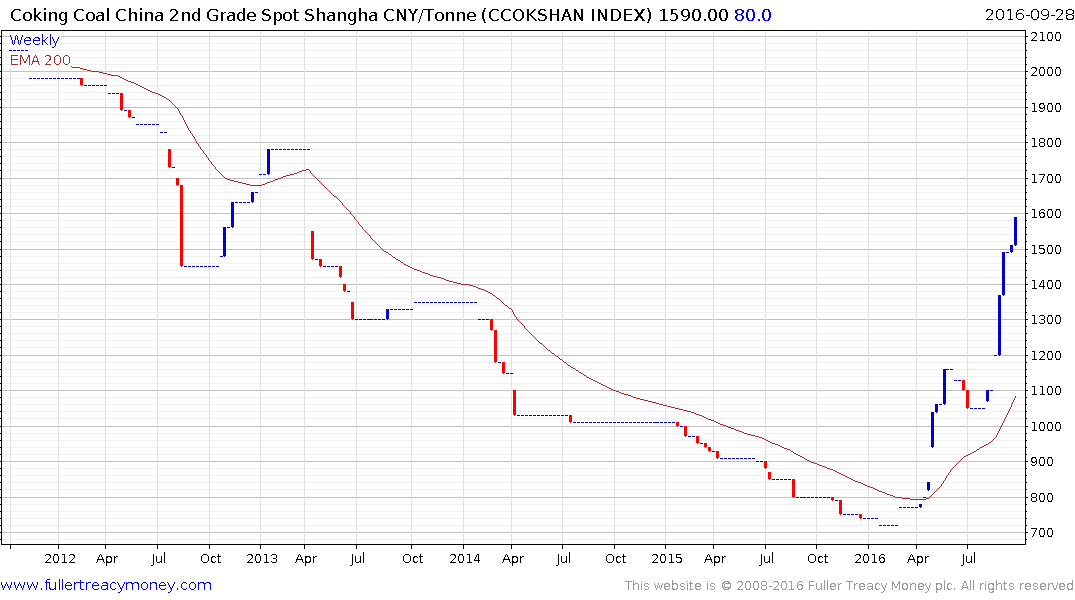

Coking coal prices have been rallying all year but the recent surge is a clear acceleration of that trend and suggests there is at least a near-term supply deficit. Many investors have been switched off from investing in coal because of tighter environmental regulations but there is no getting around the fact that coking coal is essential in producing steel at a competitive price and is very different market from steaming coal.

Coking/Metallurgical Coal represents almost half of Teck Resources revenue. The share has been trending higher for most of the year and continues to hold a progression of higher reaction lows.

Glencore also has a substantial coking coal operation and has held a progression of higher reaction lows since early this year.

Among steel manufacturers Arcelor Mittal is currently rallying from the region of the trend mean and has held a progression of higher reaction lows since early this year.