Strong Earnings vs Mid Cycle De-Rating

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

High leverage and waning liquidity adds to our caution on risk/reward. Leverage is high. FINRA's reported broker-dealer margin balances relative to credits securing them (a leverage ratio) are now past the 2 prior highs of the last 20+ years: the TMT-bubble and 3Q18. High leverage is bullish until it is not, but history is clear that once this leverage ratio starts to turn, derisking flows through to price quickly.

Today, we also published a new report called What Are Companies Saying? (see US Equity Strategy: What Are Companies Saying?). This will be a recurring publication from equity strategy focused on key topics of discussion from US companies. Key takeaways include: (1) transcript mentions of "cost inflation" are at all time highs and survey data shows that inflation is increasingly being cited as a key problem for companies and a risk to margins; (2) intentions to raise wages amid the labor shortage are accelerating; (3) in response to these cost pressures, companies are raising prices at a historic clip; (4) our work shows that a surge in cost pressure mentions tends to precede a consolidation in profit margins; (5) the Delta Variant is increasingly being discussed, but has largely not yet been factored into guidance.

The big question for investors is how to attribute responsibility for the strong earnings growth in the 2nd quarter. There is a good argument that much of the surge in earnings was due to pent up demand and outsized liquidity provision. As the economy opened up and confidence built around the protection offered by vaccinations there was a surge of economic activity. In order for the pace of the recovery to be self-sustaining, consumer confidence has to continue to recover and liquidity needs to remain abundant.

The prospect of $4.5 trillion ($1 trillion infrastructure and $3.5 trillion budget) in spending from the USA answers the liquidity question. There is still a lot of negotiation which will need to occur before either the proposed bills become law but the question of where the next round of liquidity is going to come from has at least been partially answered.

The delta variant is the wild card in estimations. Two parties my daughters were invited to were cancelled because of the delta variant this weekend. That suggests consumers are now taking the threat of the virus seriously and that will have a knock-on effect for company earning in the 3rd quarter. This change of sentiment increases potential negotiation on additional support will be accelerated.

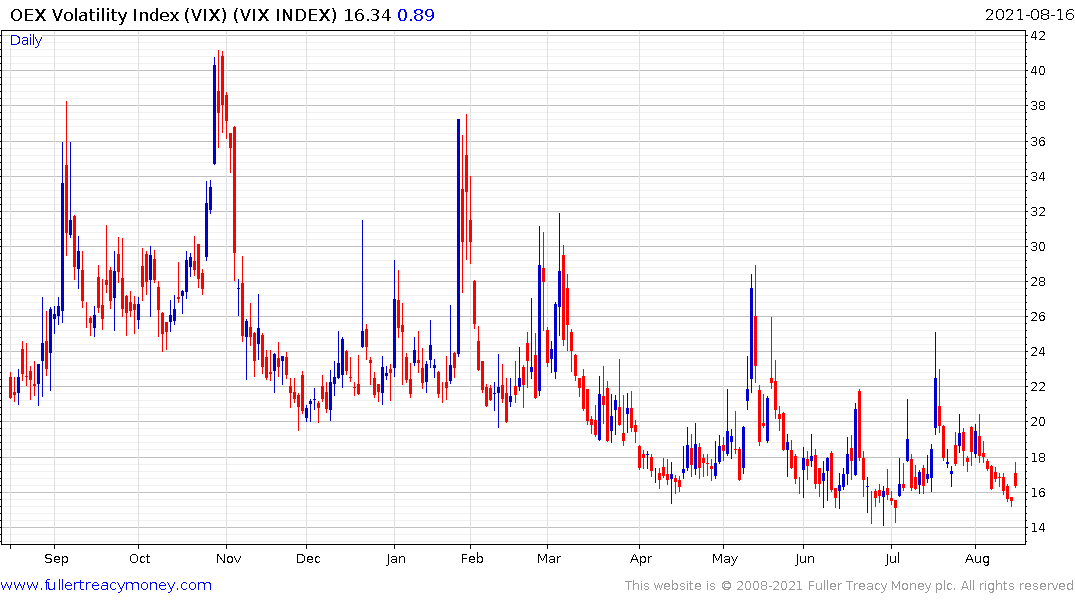

The VIX Index popped on the upside off the open today but was unable to hold the move. Follow through on the upside will be required to signal more than a pause for the stock market.

The S&P500 has not pulled back by more than 5% since October so a reaction of more than that will be required to signal a peak of more than short-term significance.