Stocks Pare Gains Amid Hawkish Fedspeak, Earnings

This article from Bloomberg may be of interest. Here is a section:

A rally in the S&P 500 faded after Philadelphia Fed President Patrick Harker said officials are likely to raise interest rates to “well above” 4% this year and hold them at restrictive levels to combat inflation, while leaving the door open to doing more if needed.

Traders also sifted through a mixed bag of corporate earnings, with Tesla Inc.’s sales disappointing and International Business Machines Corp. surging on a bullish forecast. Several market observers remarked that the bar has been lowered quite a bit ahead of the current earnings season, boosting the odds of upside surprises. It’s also worth pointing out that there’s been no shortage of warning signals about the economy when it comes to corporate outlooks.

Alcoa Corp. -- which is a dependable barometer of US economic health across industries including construction, automotive, aerospace and consumer packaging -- said demand for the world’s heavy industries is falling. Union Pacific Corp., the largest US freight railroad, cut its forecast for volume growth to reflect a “challenging year.”

As traders wade through corporate results, “with an extra eye on guidance, expect volatility to remain elevated,” said Mike Loewengart at Morgan Stanley Global Investment Office

Earnings are holding up but guidance is being lowered. CEOs are at their most bearish in years but investors have cash to burn and are eager to salvage a dire year for their performance. Appetite for buying the dip following upside key day reversals for mega-cap stocks last week is still evident.

The 1000-day MA is the secular trend mean. It is the point where buying the dip has tended to be most fruitful. That is teasing appetites for bargain hunting. The challenge at present is every other bounce from the 1000-day MA, during this 14-year bull market, has been accompanied by monetary and/or fiscal easing. That wrinkle suggests any rebounds will be short lived or the bottoming process will be lengthier than many assume.

The 1000-day MA is the secular trend mean. It is the point where buying the dip has tended to be most fruitful. That is teasing appetites for bargain hunting. The challenge at present is every other bounce from the 1000-day MA, during this 14-year bull market, has been accompanied by monetary and/or fiscal easing. That wrinkle suggests any rebounds will be short lived or the bottoming process will be lengthier than many assume.

The FANGMANT Index is bouncing from the region of the 1000-day MA too. This is the first time since 2012 it has come close to testing this trend mean. That alone is a trend inconsistency. I will be looking for additional opportunities to short rallies until the trend of central bank tightening ends.

The FANGMANT Index is bouncing from the region of the 1000-day MA too. This is the first time since 2012 it has come close to testing this trend mean. That alone is a trend inconsistency. I will be looking for additional opportunities to short rallies until the trend of central bank tightening ends.

Microsoft and Apple firmed following their upside key day reversals last week. However, the bounces have been modest and rising yields are a burden.

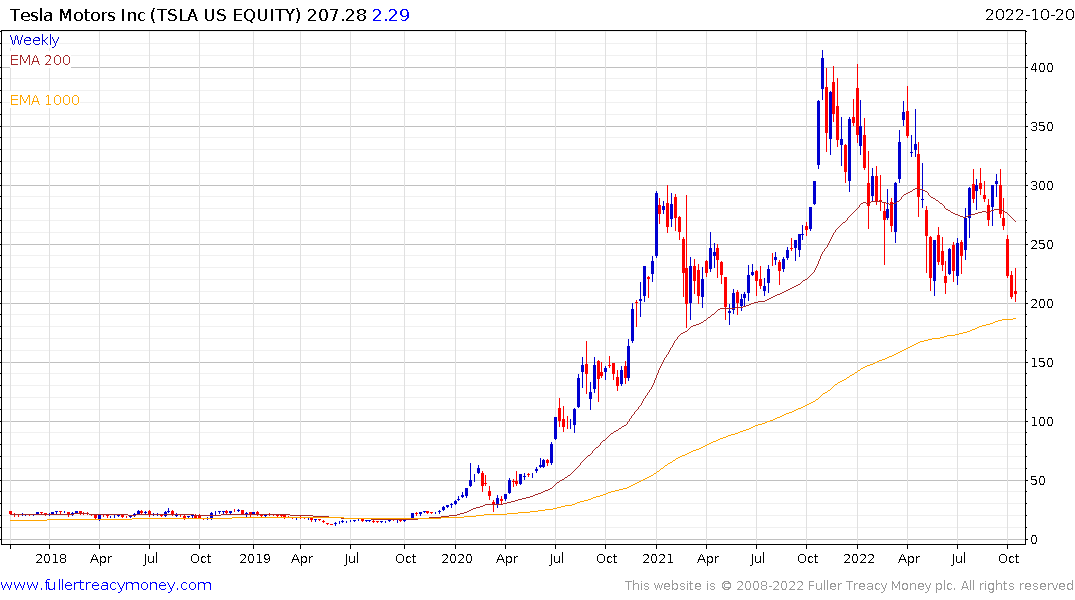

Tesla dropped back to test the psychological $200 area today. The share is short-term oversold but it’s a very liquidity dependent market that is a favoured trading vehicle for speculators.

Netflix’ stronger subscriber numbers yesterday suggest the success of the Dahmer series is supporting subscriber numbers this quarter. This helps to highlight the company is heavily dependent on producing quality content people want to watch. The days of volume over quality are over.

Netflix’ stronger subscriber numbers yesterday suggest the success of the Dahmer series is supporting subscriber numbers this quarter. This helps to highlight the company is heavily dependent on producing quality content people want to watch. The days of volume over quality are over.

The share has unwound the overextension relative to the 200-day MA but this is first area of potential resistance. Valuations have much improved but the share is a good candidate for prolonged ranging.

Twenty years ago, the phrase “everything is priced off the 10-year” was regarded as a truism. When yields went to historic lows and the total for negative yield debt hit $17 trillion that was not nearly as relevant. This is a case of back to the future. The 10-year yield is marching higher, having crossed the psychological 4% level yesterday. That’s a significant discount rate for returns to surmount before then become appealing.

Twenty years ago, the phrase “everything is priced off the 10-year” was regarded as a truism. When yields went to historic lows and the total for negative yield debt hit $17 trillion that was not nearly as relevant. This is a case of back to the future. The 10-year yield is marching higher, having crossed the psychological 4% level yesterday. That’s a significant discount rate for returns to surmount before then become appealing.