Stocks Pare CPI-Fueled Rally With Fed Set to Hike

This article from Bloomberg may be of interest to subscribers. Here is a section:

“While the war against inflation is turning, we are a long way off declaring victory and the Fed will keep its hawkish stance for a while longer, even if it does potentially force a recession,” said Richard Carter, head of fixed interest research at Quilter Cheviot.

The CPI-fueled stock rally fails to recognize that corporate earnings are just starting to see the impact of tight monetary policy, James Athey, investment director at Abrdn.

“As the full effects of the Fed’s aggressive actions this year play out next year, it seems inevitable that we will see a significant repricing lower in EPS forecasts and thus the broad market,” Athey said.

The stock market has been pricing in the likelihood Inflation has peaked since October. Now is the time to start thinking about the knock-on effects of inflation peaking. Economic activity will slow as the race to overtake inflation with purchase subsides and as savings are eroded. Corporate profits will inevitably slow in response and unemployment will likely rise from Q2 onwards.

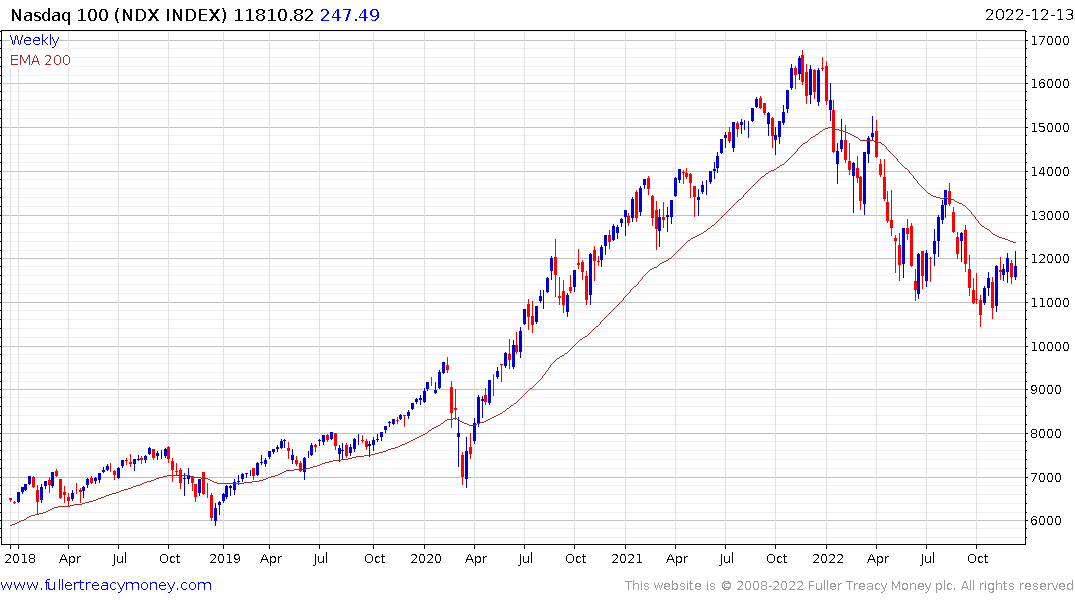

The Nasdaq-100 gapped higher this morning to test the region of the 200-day MA and gave up much of the advance by the close. The sequence of lower rally highs is still intact and a sustained move above the MA will be required to question scope for additional downside.

The Nasdaq-100 gapped higher this morning to test the region of the 200-day MA and gave up much of the advance by the close. The sequence of lower rally highs is still intact and a sustained move above the MA will be required to question scope for additional downside.

The Dollar remains under pressure as its interest rate differential shrinks versus the Euro in particular. That’s also burnishing gold’s reputation as anti-dollar play. The price did not hold all of the advance today but it did close above the psychological $1800 level.

The Dollar remains under pressure as its interest rate differential shrinks versus the Euro in particular. That’s also burnishing gold’s reputation as anti-dollar play. The price did not hold all of the advance today but it did close above the psychological $1800 level.

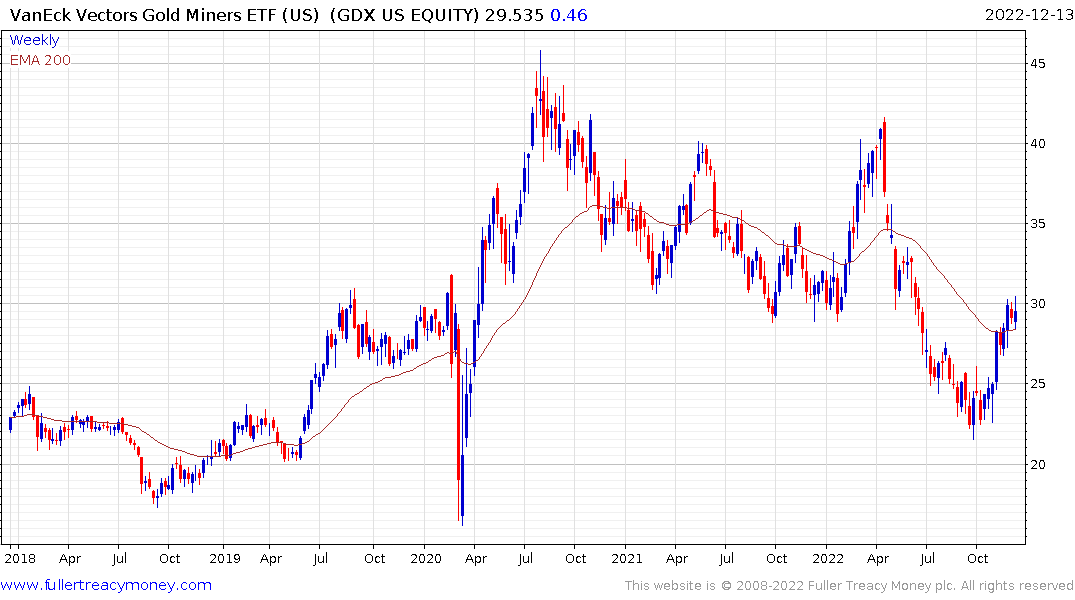

The VanEck Gold Miners ETF (GDX) is back testing the psychological $30 area, which now also coincides with the 1000-day MA. A sustained move above that level would confirm a return to medium-term demand dominance.

The VanEck Gold Miners ETF (GDX) is back testing the psychological $30 area, which now also coincides with the 1000-day MA. A sustained move above that level would confirm a return to medium-term demand dominance.