Stocks Drop as Powell Signals No Fed Cuts For Now

This article from Bloomberg may be of interest to subscribers. Here is a section:

Instead, the FOMC will take into account various factors “in determining the extent to which additional policy firming may be appropriate.”

“That’s a meaningful change that we’re no longer saying that we anticipate” further increases, Chair Jerome Powell said at a press conference after the decision, when asked whether the statement is a signal that officials are prepared to pause rate increases in June. “So we’ll be driven by incoming data, meeting by meeting, and we’ll approach that question at the June meeting.”

The increase lifted the Fed’s benchmark federal funds rate to a target range of 5% to 5.25%, the highest level since 2007, up from nearly zero early last year. The vote was unanimous, and Powell said support for the 25 basis-point rate increase was “very strong across the board.”

Whether that rate will prove to be high enough to bring inflation back to the Fed’s 2% target will be an “ongoing assessment” based on incoming data, Powell said, adding later that Fed officials’ outlook for inflation does not support rate cuts.

The Fed Funds Rate is now at the same level it was between 2006 and early 2008. The big takeaway from today’s press conference was they have no intention of cutting even if they are potentially pausing with the hiking program.

Powell appeared bemused that unemployment had not already jumped higher. That’s based on historical precedence when rates have gone up some quickly and other forms of credit have tightened. He continues to express hope a recession will be avoided but the reality is the longer high rates are sustained, the more likely a recession becomes.

10-year yields are compressing which suggests bond investors have concluded inflation is not going to be an issue. The potential signal from that is an inflationary boom is followed by an inflationary bust.

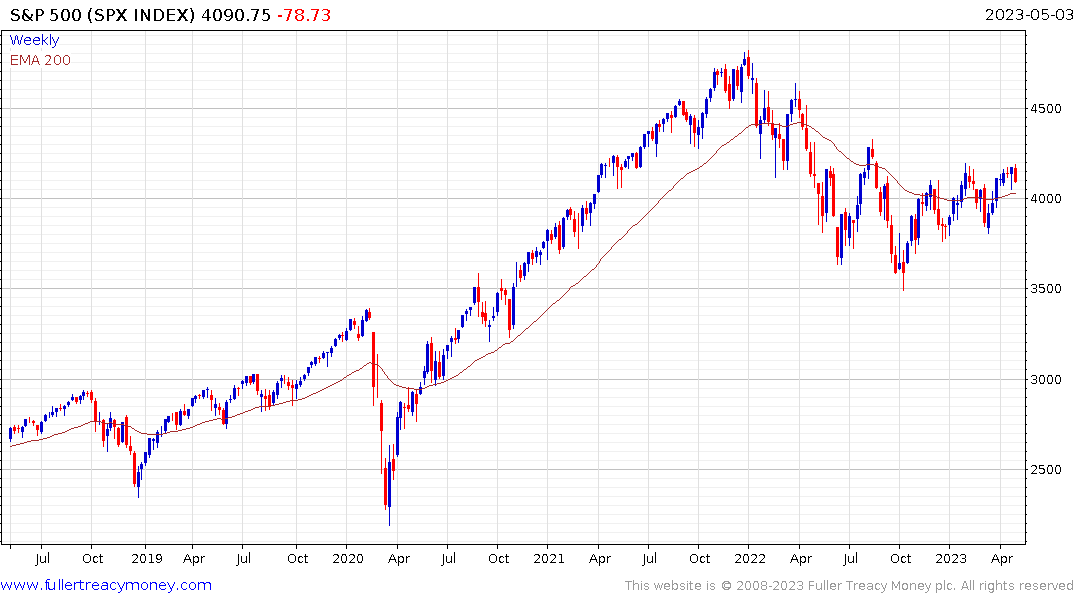

The S&P500 continues to ease back from the 4200 level and a clear upward dynamic will be required to question scope for additional downside.