Stocks Decline as Treasury Yields Resume Climb

This article from Bloomberg may be of interest to subscribers. Here is a section:

U.S. stocks fell as the selloff in Treasuries resumed, with the rates market hedging the possibility that the Federal Reserve will tighten policy more aggressively. The dollar gained.

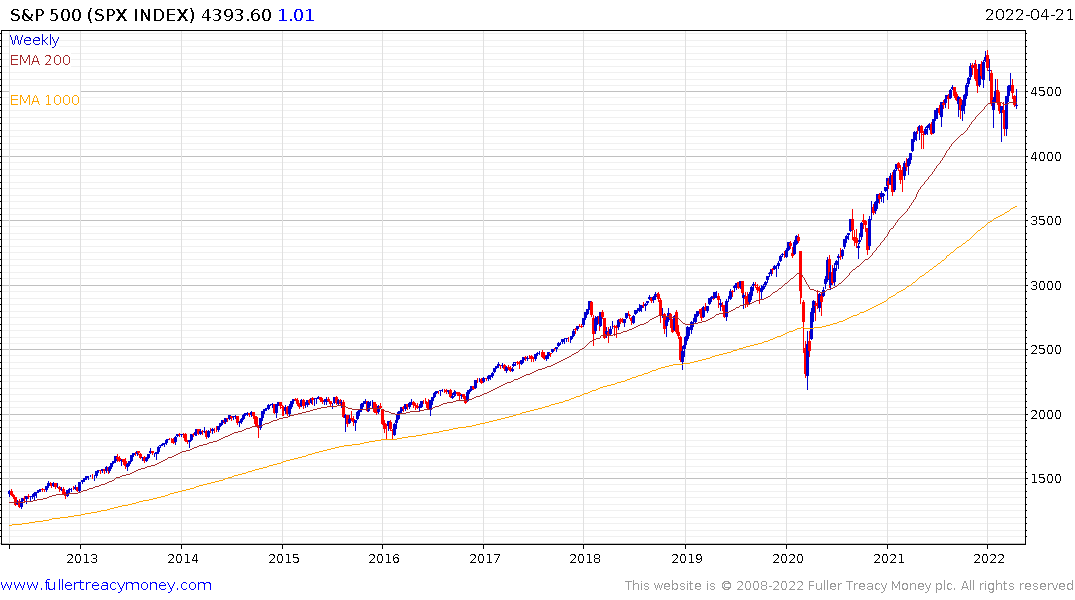

The S&P 500 dropped, reversing gains of as much as 1.2%. The tech-heavy Nasdaq 100 extended losses, underperforming major benchmarks, as the jump in yields weighed on growth-related stocks.

Treasury yields rose across the curve, with the policy-sensitive two-year rate climbing 14 basis points 2.72% as traders priced in 50 basis-point rate hikes at each of the next three meetings. The dollar gained against all of its major peers following the surge in yields.

Fed Chair Jerome Powell said he saw merit in the argument for front-loading interest-rate increases and that a half-point hike “will be on the table for the May meeting.”

Tesla’s earning buoyed sentiment this morning but the momentum was short lived. The Federal Reserve wants to kill off demand. They know as well as the rest of us raising rates will do nothing to increase oil supply, clear port congestion or boost crop yields. The tools they have at their disposal all target demand.

The reason inflation tends to peak during recessions is because demand falters. Consumption has rocketed higher since the pandemic stimulus and until it reverts to the mean, the Fed is unlikely to waver in its determination to raise rates.

I remain of the view a stock market reaction of at least 20% will be required for the Fed to relent. Frankly, I’m surprised it has not happened already. We also see plenty of interest in buying dips whenever bond yields contract so whenever the Fed decides to claim victory over inflation, we can expect a sharp rally.

I played tennis last night with a local real estate agent. I quizzed him about the market, which remains buoyant. We also discussed leverage in the market. He said most buyers are still putting down 20% deposits.

He also said there has been significant increase in cash buyers borrowing against their stock portfolios in the $500K+ price bracket. He said he sold a $2 million property in December to a cash buyer who had borrowed against his stock portfolio. The usual practice appears to be 50% leverage. That suggests the wider economy is a lot more sensitive to stock market volatility than many realise.

Back to top