Stocks Could Post Limited Gains in 2017 as Yields Rise

Thanks to a subscriber for this transcript of Barron’s annual roundtable. Here is a section:

Gundlach: People have forgotten the mood regarding stocks and bonds in the middle of 2016. Investors embraced the idea that zero interest rates and negative rates would be with us for a very long time. People said on TV that you should buy stocks for income and bonds for capital gains. This is when 10-year Treasuries were yielding 1.32%. Someone actually said rates would never rise again. When you hear “never” in this business, that usually means what could “never” happen is about to happen. I told our asset-allocation team in early July that this was the worst setup I’d seen in my entire career for U.S. bonds. It occurred to me that the bond-market rally was probably very near an end, and fiscal stimulus would soon become the order of the day.

Schafer: People were also worried about deflation back then.

Gundlach: Based on a comparison in July of nominal Treasuries to Treasury Inflation-Protected Securities, or TIPS, the bond market was predicting an inflation rate of 1.5%, plus or minus, for the next 30 years. Now, that is implausible, and kind of proves the efficient-market hypothesis is wrong. More likely, the inflation rate would increase not in five or 10 years, but one year, because commodity prices had already bottomed. The Federal Reserve Bank of Atlanta’s wage-growth tracker is now up 4%, year over year. Oil prices have doubled since January 2016, to around $52 a barrel, which likely means that headline CPI [the consumer-price index] will be pushing 3% in April.

I expect the history books will say that interest rates bottomed in July 2012, and double-bottomed in July 2016. At some point, the backup in rates will create competition for stocks. Bonds could rally in the short term, but once the yield on the 10-year Treasury tops 3%, which could happen this year, the valuation argument for equities becomes problematic. When the long bond [the 30-year Treasury] was at 2%, bonds had a P/E of 50. Compared with that, a P/E of 20 on stocks didn’t look all that bad. But if the 10-year yield hits 3%, you could be talking about 4% on the 30-year, which implies a P/E of 25.

Something else happened in 2016: The Fed capitulated, as I predicted a year ago. The Fed gave up on its forecast for higher interest rates and lowered its dot projections for 2017, just when it might have been right. [The Fed’s so-called dot plot shows the interest-rate projections of the individual members of its policy-setting committee.] In December, the Fed had to reverse itself and raise rates.

Priest: For the first time in years, the Fed didn’t lower its forecast for GDP [gross domestic product] growth in coming years. Central banks and the International Monetary Fund have been dead wrong for years with their annual forecasts for world GDP growth. The danger now is that pressure on P/E multiples will be negative. Unless we get tax reform and more growth in the real economy, the chances of a down stock market aren’t insignificant this year.

Gundlach: Fed Chair Janet Yellen suggested a few months ago that running a “hot” economy might not be such a bad idea. But when unemployment is low, wages are rising, and significant fiscal stimulus is likely, inflation could exceed consensus expectations. Jim Grant, the founder of Grant’s Interest Rate Observer, wrote a fantastic article a few years ago likening the current environment to the 1940s and ’50s. Short-term interest rates were at 3/8s in the late 1940s, and long rates were around 2%-2.5%. Inflation was running at 2%. Everyone had been predicting higher inflation rates, but after a long period of 2%, they gave up. Then inflation spiked to 8%. It came out of the blue.Gabelli: Does the strength of the dollar change your thinking?

Gundlach: A strong dollar keeps inflation lower. It is helpful to the bond market. A weak dollar isn’t helpful to the bond market. However, I brought along a quote from President-elect Trump today because it makes me think. He said, “While there are certain benefits to a strong dollar, it sounds better to have a strong dollar than it actually is.” Is it really a given that Trump will bring us a strong dollar if he is supposed to be helping the forgotten middle class.

Here is a link to the full report.

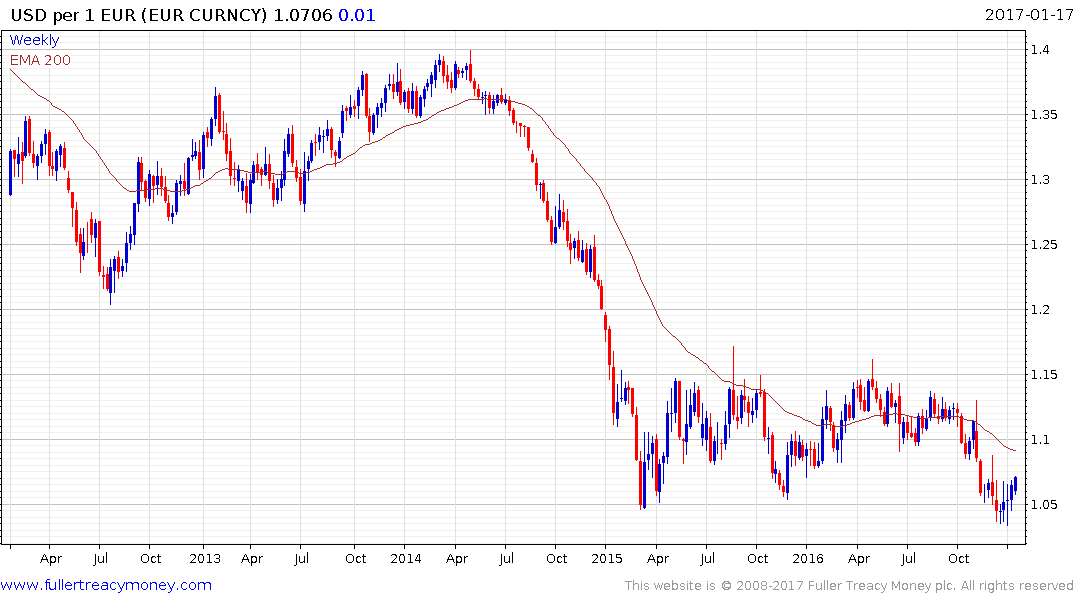

Bonds sold off very aggressively following the November election result and the Dollar surged. The news flow has been sensational and Twitter has probably never been so popular but the reality is that both of these overextended short-term moves are unwinding.

What happens following that mean reversion will give us a lot of clues as to what to expect from the both Treasuries and the Dollar over the balance of the year. If Treasury yields bounce from the 2% area and subsequently sustain a move above 2.6%, we will have both a higher low and higher high which is the foundation of an uptrend. Above 3% and yields will be at six-year highs. The 10-year hasn’t yielded more than 4% since early 2008. These are big levels with a great deal of psychological impact for investors.

It might sound trite but the market adage “everything is priced off the 10-year” is nothing to scoff at. That is why the question of whether yields bounce from the region of the trend mean is so important. Corporate profits have to be that much better if Treasuries yields are rising rather than falling. It’s possible but with valuations at such elevated levels corporate profit growth and margin expansion are essential to the health of the bull market.

The S&P500 has paused over the last month following an impressive post-election rally but a sustained move below 2180 would be required to question medium-term scope for additional higher to lateral ranging.

Meanwhile the Dollar’s performance has been mixed depending on whether one compares it to G7, developed Asia, emerging or commodity-related currencies. Both the Euro and Yen are rapidly unwinding short-term overextensions relative to their respective trend means.

The Singapore Dollar is also unwinding its short-term oversold condition.

The Australian Dollar pushed back above its 200-day MA today to confirm more than temporary support near 71.50¢.

The Pound rallied impressively on Teresa May’s commitment to put her Brexit plan to a parliamentary vote to form a large upside weekly key reversal.

Meanwhile currencies like the Brazilian Real have been relatively quiet by comparison.

Back to top