Stock Markets Face Historic Lack of Dry Powder

This article by Julie Segal for Institutional Investor may be of interest to subscribers. Here is a section:

“The main reason is simply that the more a relationship moves to an extreme end of its range, the more likely it becomes that it will begin to move back toward its longer-term average.”

A historically high level of assets in money market funds, which are a home for risk-averse investors, would generally indicate that investors are feeling cautious. But Becker argued that relative to equity fund assets, money markets are actually low.

Becker said that for asset level data he used the full history offered by Morningstar, which goes back to February 1993, covering 25 years of data. “This suggests that over the last 25 years investors have never felt more confident,” he says.

In this case, such a move could happen quickly or slowly. It could happen more slowly through changes in allocations of new money (e.g. investors decide to stop putting new 401[k] money into equity mutual funds and start putting it into MMFs). Or it could happen quickly through a sharp decline in the stock market, causing equity funds to and money-market fund assets to get larger relative to equity fund assets.

There is certainly a concern that we are late in the cycle but there is another reason why there is so little cash in money market funds compared with historical totals. They have not been paying any interest so why would anyone invest in them. That’s changing now with more than a few institutions and family offices I talk to moving cash into money market funds.

The broader question is where all the trillions of Dollars invested in somewhat longer-dated bonds is going to be invested if yields continue to rise. Equities have to be a potential answer to that question.

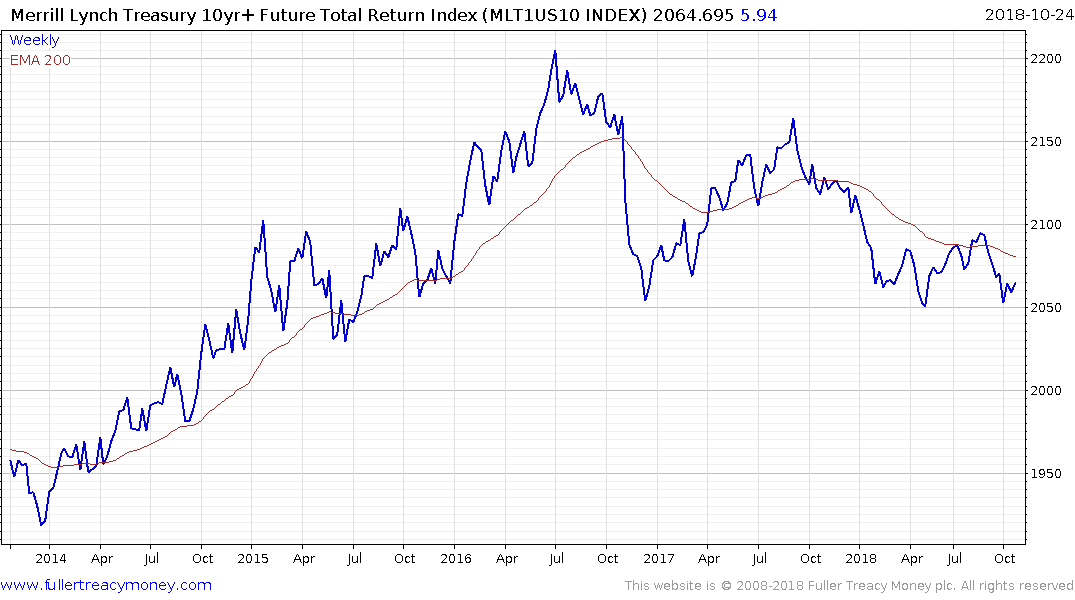

The total return on bonds is losing momentum and has evolving top formation characteristics. However, the clearest signal that the bull market in bonds is over will be if the breakout in yields holds when liquidity conditions tighten.