Stevens Rate 'Chill Out' Rattled as Australia Easing Case Builds

This article by Michael Heath for Bloomberg may be of interest to subscribers. Here is a section:

Yet the economy and wages are in the weakest stretch of growth since the country’s last recession in 1991. The Treasury last week bowed to reality and lowered the economy’s speed limit -- the level at which it begins to generate inflation -- to 2.75 percent from 3 percent estimated in its May budget.

Deloitte Access Economics forecast in a report Monday, ahead of the government’s mid-year budget update due next month, that fiscal deficits over the next four years will be A$38 billion worse than predicted in May.

“What the Deloitte report shows today is the stresses and the pressures on the budget,” Treasurer Scott Morrison said Monday. “They note particularly in terms of the global situation commodity prices, changes in China.”

Indeed, only a surge in the volume of resource exports is likely to cover the drag on growth from weak investment by companies last quarter. Economists are predicting ahead of data due Wednesday the economy grew 0.7 percent in the three months through September from the prior quarter and 2.3 percent from a year earlier.

With Sydney and Melbourne housing prices off their highs there is no prospect of the RBA raising rates and with resources’ sector capex close to an all-time low, the prospect of an interest rate cut next year is looking more likely than not. Australia successfully avoided the majority of the ill effects of the credit crisis not least because it was such a beneficiary of China’s stimulus program, through commodity exports. China’s moderating consumption rate for Australia’s exports represents a headwind and suggests the outlook for inflation will be closely tied to what happens in the commodity sector.

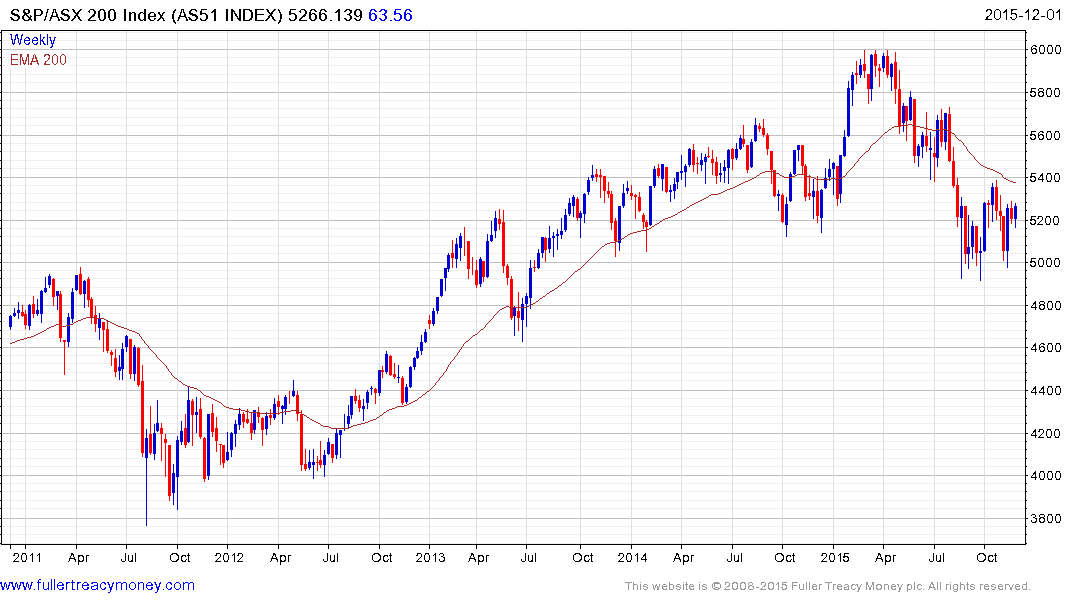

With the prospect of easy monetary policy stretching into the medium term, the stock market continues to hold above the psychological 5000 level and there is evidence of bullish trampolining with the range. A sustained move below this year’s lows would be required to question potential for additional higher to lateral ranging.

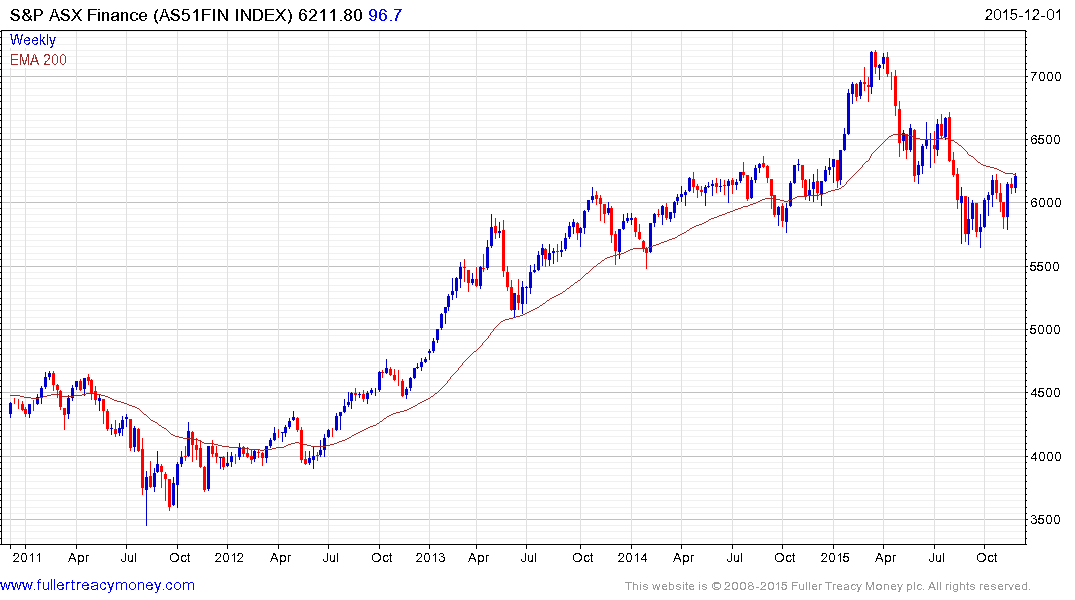

The Financial sector which accounts for 48% of the S&P/ASX 2000 has a similar pattern but has been less volatile and moved to a new three-month high today.

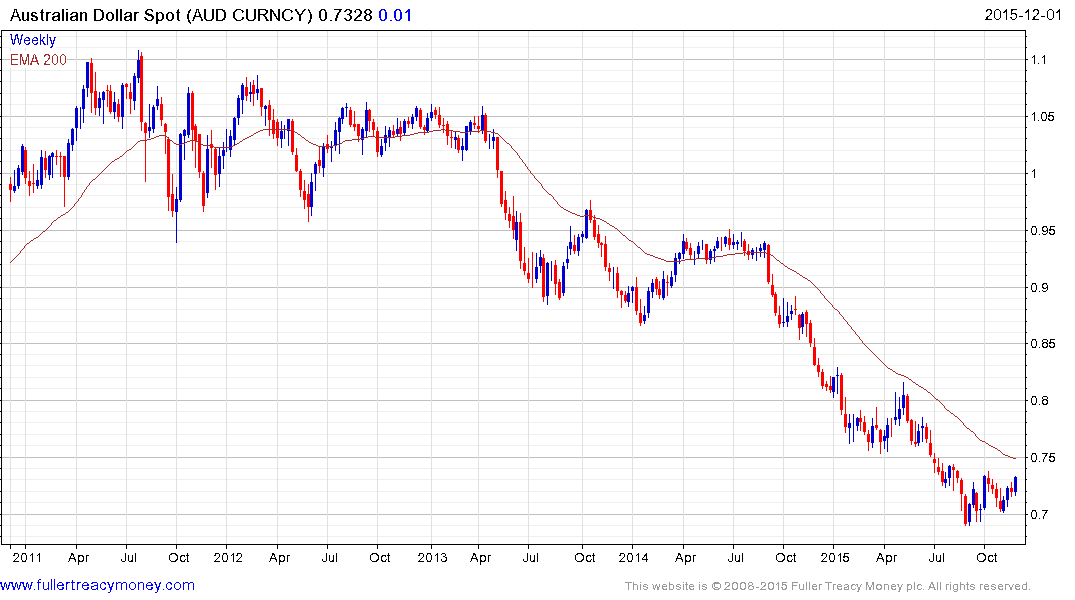

The Australian Dollar was quite oversold relative to the trend mean when it found support in September. A reversionary rally remains underway but a sustained move above the 200-day MA will be required to begin to signal a return to demand dominance beyond the short term.