Spared in 2020, Debt-Heavy Companies Cede Control to Creditors

This article from Bloomberg may be of interest to subscribers. Here is a section:

Many junk-rated companies will require urgent funding. They may struggle to find it at a time when investors’ demand for sky-high premiums has effectively shut public capital markets as a refinancing avenue for the most stressed firms.

While default rates are expected to increase, it may not immediately become a flood of failures. A large chunk of high-yielding debt has weak investor safeguards — loose covenants that mean highly indebted firms will be able to delay engaging with creditors until further down the line.

Moody’s forecasts the global default rate for high-yield companies will increase to 4.9% by November, up from 2.9% a year earlier. In a “severely pessimistic scenario,” however, the rate could go up to 12.6%, it said in a report published last month.

It stands to reason that when the artificial support for failing companies is removed, they will go bust. Interest rates have surged over the last 12 months, the availability of credit is drying up as banks withdraw from lending and money supply growth is close to contraction on a year over year basis. That suggests many highly leveraged companies will have issues refinancing.

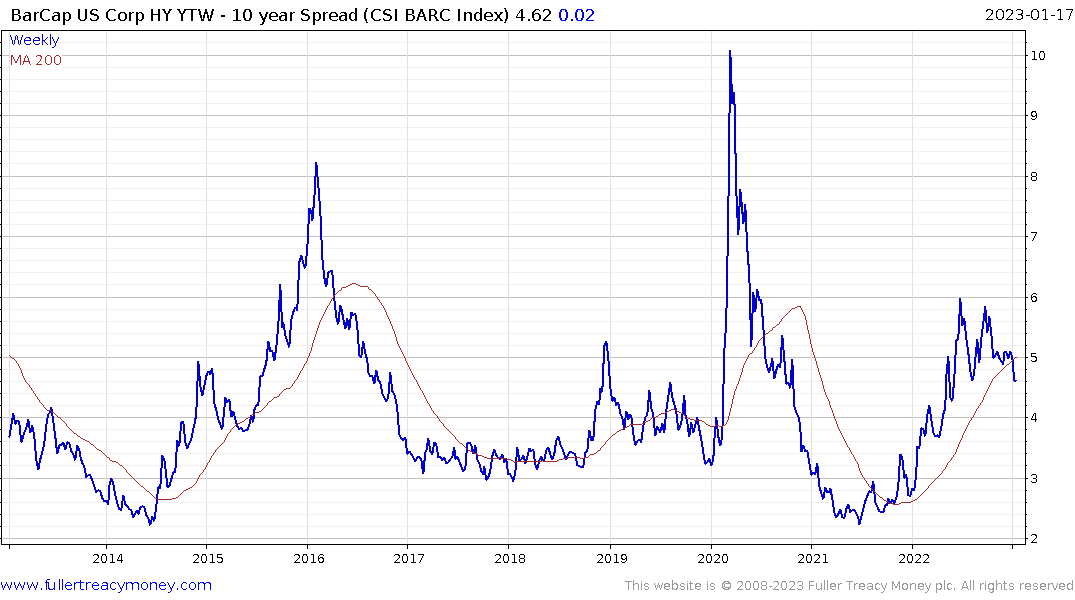

The is well understood by investors and yet high yield spreads have been contracting and the total return on leveraged loans is still trending higher. Therefore there must be some fresh rationale to explain that divergence. Here is a section from a December article from Pitchbook which may be of interest:

Fortunately, high levels of opportunistic issuance through the pandemic years have lowered the heat under refinancing risk. As of Nov. 30, outstanding bonds with 2023 and 2024 maturity dates totaled $40.3 billion and $74.4 billion, respectively, down from $128.4 billion and $155.2 billion outstanding at year-end 2020. Per the S&P US Issued High Yield Corporate Bond Index, the total amount outstanding as of Nov. 30 has receded to $1.6 trillion, from its peak overall total of $1.8 trillion as of Nov. 30, 2021.

“We’re down in size but having said that, most of the issuers in the market have refinanced in 2020-21,” said Mike Donelan, senior managing director and senior portfolio manager of US Total Return Fixed Income at SLC Management. “Looking forward, 2024-2025 will create challenging situations where more maturities come due. 2023 is going to present different challenges behind the backdrop of the interest rate environment and how risk assets will perform given that.”

With fewer bonds to refinance bond traders are free to bet the peak of the hiking cycle will occur in 2023 so the pressure on refinancing will be lower in 2024/25. The high absolute yields on offer make that an easier sell. With several high yield issues trading close to double digits as recently as December the prospect of interest rates peaking is alluring to bond investors.

The CCC-B spread of very risky over merely high risk bonds is also contracting and now testing the region of the 200-day MA. That supports the view risk appetite is recovering in the near term. This is the clearest argument in the market right now that a soft landing is possible.

The CCC-B spread of very risky over merely high risk bonds is also contracting and now testing the region of the 200-day MA. That supports the view risk appetite is recovering in the near term. This is the clearest argument in the market right now that a soft landing is possible.

The challenge is tight liquidity will hit earnings eventually. Layoffs in the tech sector are indicative of slowing economic activity in the wider US economy.

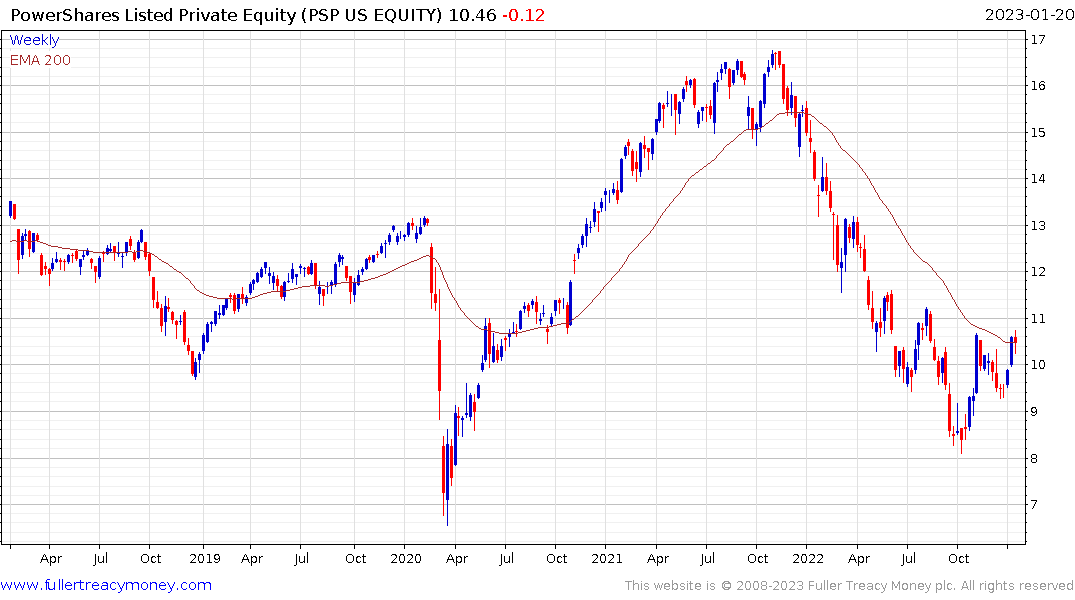

I’m paying attention to the performance of the listed private equity sector. It is showing signs of steadier action with KKR outperforming and Brookfield and Blackstone still weak. The Invesco Global Listed Private Equity ETF is currently testing the region of the 200-day MA following a very steep decline in 2022.

I’m paying attention to the performance of the listed private equity sector. It is showing signs of steadier action with KKR outperforming and Brookfield and Blackstone still weak. The Invesco Global Listed Private Equity ETF is currently testing the region of the 200-day MA following a very steep decline in 2022.

Without a return to outright money printing on a grand scale, the most likely scenario is for lengthy ranging with violent trough to peak swings and one of those rebounds may be starting since short-term support has been found.

Back to top