South African platinum production to fall by 600k ounces next year

This article by Sungula Nkabinde for Mineweb may be of interest to subscribers. Here is a section:

The report states that the proportion of expansion capital relative to total capital expenditure has decreased as fewer new mines and shafts have been commissioned. Mining has become increasingly capital intensive over the years, and this is reflected in the inability to reverse the decline in output, despite record levels of capital expenditure in 2007 and 2008. The report also shows that the average capital intensity for the period 1999–2003 compared to the period 2009-2013 had risen by 39%.

“Another reason (for the apparent ineffectiveness of capital expenditure) is that some of the capital spent in 2008 and 2009, was for projects that had subsequently been suspended or not completed,” said Raymond, citing Anglo American’s Twickenham operation as an example.

The report focuses only on capital expenditure, which it concedes is not the sole driver of output – for instance, it excludes the impact of platinum demand, operating margins, profitability, closure of operations or the impact of labour productivity on output levels. It further states that all other factors remaining constant, there is a two- to four-year time lag for capital expenditure to affect output levels.

The report reads: “…the time-lag effect means that there is limited opportunity for capital expenditure to lift 2016 output beyond the levels indicated by the research projections, although capital expenditure for the remainder of 2015 and 2016 could still impact 2017 output. In the event that 2016 capital expenditure is consistent with the level announced for 2015, the platinum output projected for 2017 could also be at least 16% below 2015 levels.”

The majority of mining operations are under pressure from lower commodity prices and have had to cut back on expansion plans. This will eventually result in higher prices once excess supply has been worked through. South Africa’s mining unions represent an additional complication because the acrimonious environment with management represents a headwind to additional investment in supply.

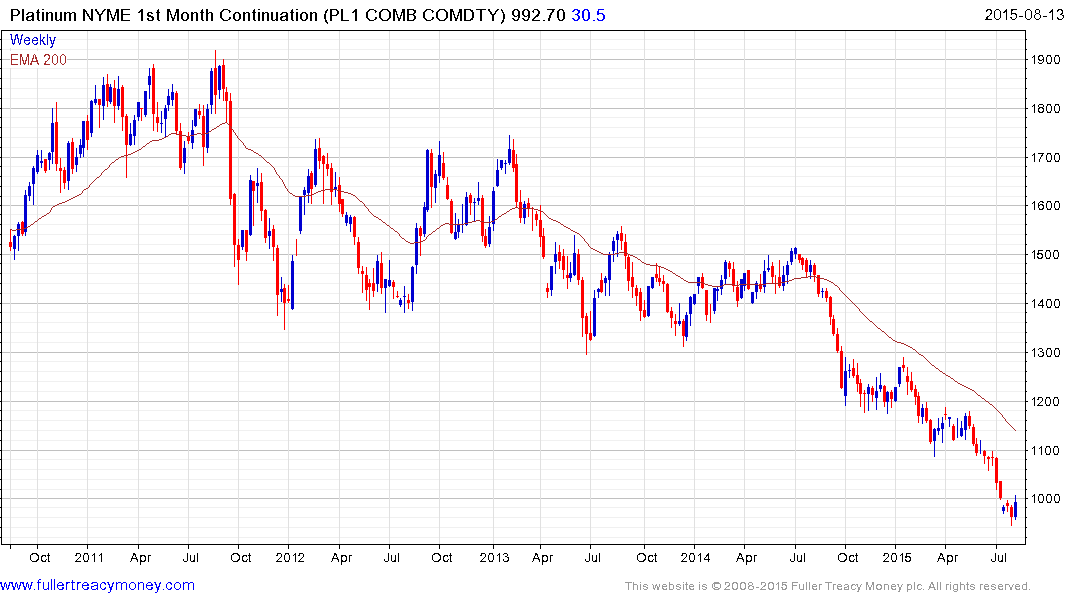

Despite the weakness of the South African Rand, the Johannesburg Platinum Mining Index has accelerated lower to test the 20 level; not seen since the 2001 through 2003 range lows. It is oversold at present with an almost 50% overextension relative to the 200-day MA. However this week’s low near 20 will need to hold if mean reversion is to be given the benefit of the doubt at this stage.

Platinum found at least near-term support in the region of $950 last week and rallied on Tuesday to break the short-term progression of lower rally highs. It is now testing the psychological $1000 and a sustained move above that level would improve potential for a further reversionary rally.