South Africa Rate Hike Fails to Stop Rand Slumping to Record Low

This article from Bloomberg may be of interest. Here is a section:

“The health of the local economy is now the primary concern,” said Brendan McKenna, an emerging-markets strategist at Wells Fargo Securities in New York. “It’s difficult to make a really compelling case to deploy capital toward South Africa and the rand at the moment. The rand has been an EM currency that has underperformed for most of this year, and given the commentary from the SARB today, that underperformance is likely to continue.”

Bloomberg’s forecast model based on prices of options to buy and sell the rand shows a 53% chance of the currency breaching 20 per dollar within the next week. That compares with a probability of just 6.8% before Thursday’s rate decision.

All of the monetary policy committee’s five members voted for the half-point increase, the first such unanimous decision since September 2021. There have been a cumulative 475 basis points of interest-rate hikes since November 2021, the most aggressive tightening cycle in at least two decades.

“The rand should strengthen after an interest rate hike, but given the poor reaction in the currency, the market seems to think that this is a potential policy mistake,” said Michelle Wohlberg, a fixed-income analyst at Rand Merchant Bank in Johannesburg. “The yield curve has steepened aggressively post the rate hike as fiscal fears start playing in investors’ minds on the back of poor growth prospects.”

When the former CEO of Eskom writes a book called Truth to Power and refers to the company as South Africa’s largest organised crime network, it is not exactly good for the country’s international reputation. The cholera outbreak north of Pretoria, which has killed 17 people so far, is an additional sign that South Africa’s water infrastructure is also in need to remedial care.

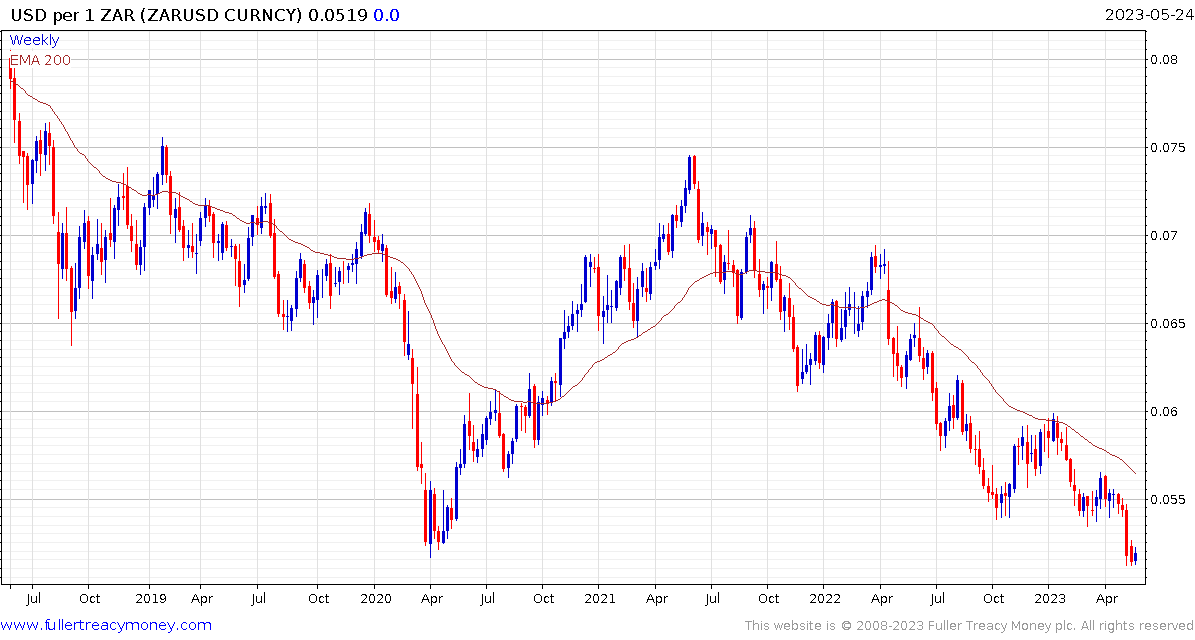

The rand broke downwards against the Dollar this week to a new all-time low. The trend remains downwards, and the deteriorating standards of governance are a medium-term obstacle to recovery.

The rand broke downwards against the Dollar this week to a new all-time low. The trend remains downwards, and the deteriorating standards of governance are a medium-term obstacle to recovery.

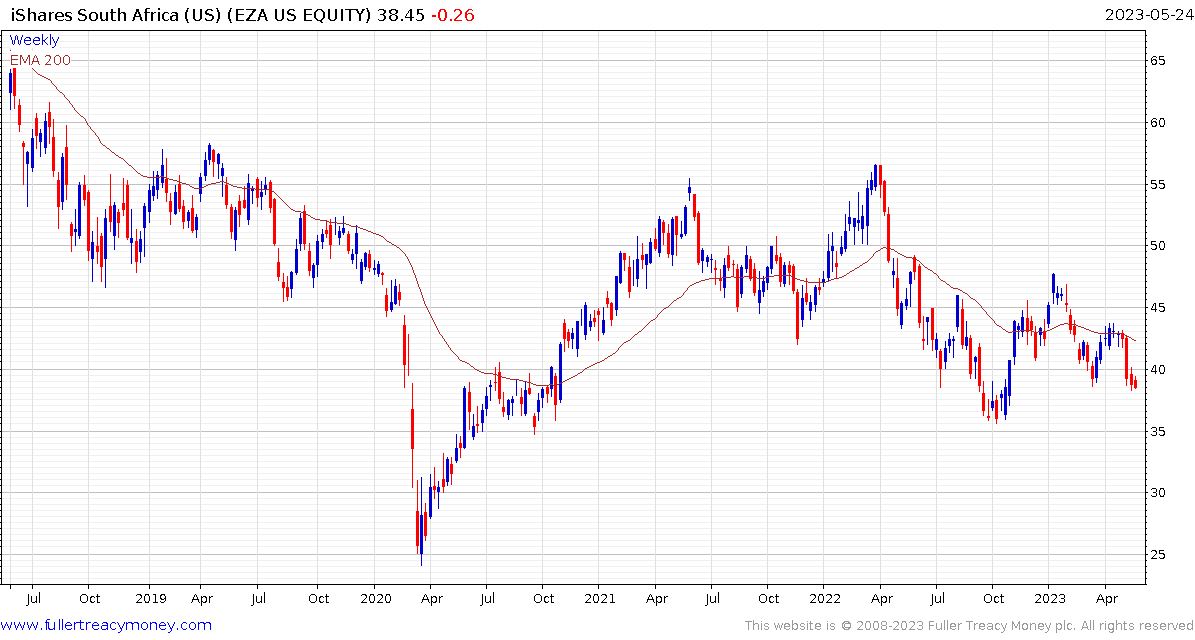

The iShares MSCI South Africa ETF is trending lower and susceptible to additional weakness.

The iShares MSCI South Africa ETF is trending lower and susceptible to additional weakness.

Anglo American broke below the 1000-day MA in late April and continues to extend the breakdown.

Anglo American broke below the 1000-day MA in late April and continues to extend the breakdown.