Soaring Real Yields Suggest Fed's Inflation Battle Isn't Over

This article from Bloomberg may be of interest to subscribers. Here is a section:

But the latest swing higher in real yields shows that in spite of fraught debt-ceiling negotiations, the world’s biggest bond market senses another jolt of policy tightening and an extended period of staying on hold may be warranted. A similar outlook is being echoed in the swaps market, with traders almost fully pricing in a quarter-point hike within the next two policy meetings.

That view has found support in recent data pointing to a resilient US economy and sticky inflation. A report on Friday showed the inflation rate for US personal spending on items excluding food and energy running firmer than forecast at an annual pace of 4.7% in April. That comes amid upside surprises in UK and European inflation numbers, reminders that central banks may have more work to do and bond yields may keep climbing.

PCE inflation, the trimmed kind followed by economists who don’t like volatile real life data, surprised on the upside today. That is a mirror of the UK result earlier this week. It suggests the primary sources of inflation are now services and shelter. The sources of inflation which can be influenced by interest rates are already subsiding. For example food prices are now contracting.

That is a real issue for central banks because the only way to influence prices that are immune to interest rates is to combat demand. That suggests tightening liquidity to the point where it will influence buying decisions by making credit unappealing and/or raising unemployment.

Corporate profits rolled over in Q1. The chart looks like a medium-term peak and that is not generally consistent with a new bull market. Overextensions relative to the 1000-day MA, like what we have now, are followed by mean reversion.

The strong earnings from the AI sector are supporting the perception earnings growth is going to reflate later this year. This is fuelling a momentum move similar to the meme stock phenomenon of the pandemic. Whether that can turn the trend for the whole economy is doubtful.

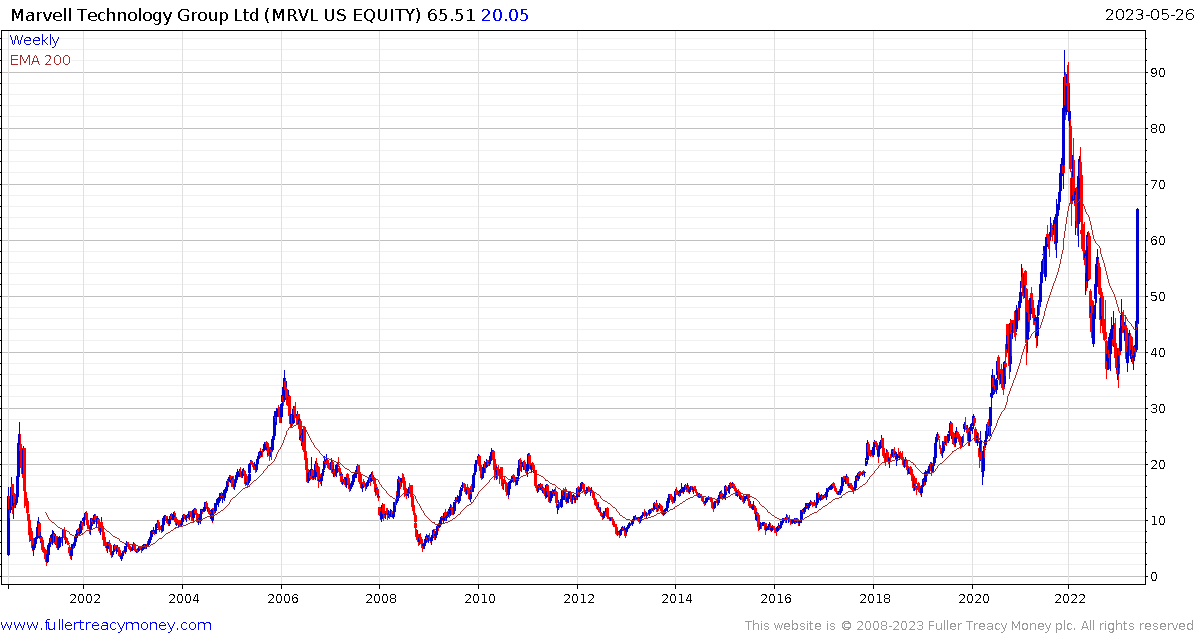

Marvell Technology surged today on strong guidance for example.

Marvell Technology surged today on strong guidance for example.

The time to be particularly cautious will be when the yield curve turns upwards and trends back up through 0%. For now it continues to contract which supports the momentum move higher.

Back to top