Six Impossible Things Before Breakfast

Thanks to a subscriber for this report by James Montier for GMO which may be of interest. Here is a section:

It appears that asset markets are priced as if secular stagnation were a certainty. Certainty is a particularly dangerous assumption when it comes to investing. As Voltaire stated, “Doubt is not a pleasant condition, but certainty is absurd.”

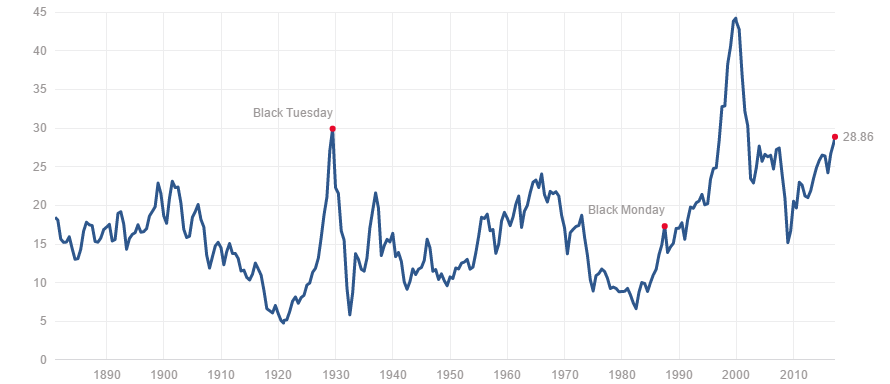

In order to believe that asset market pricing makes sense, I think you need to hold any number of “impossible” (by which I mean at best improbable, and at worst truly impossible) things to be true. This is certainly a different sort of experience from the bubble manias that Ben mentioned in the opening quotation, which are parsimoniously captured by Jeremy’s definition of bubbles – “excellent fundamentals, irrationally extrapolated.” This isn’t a mania in that sense. We aren’t seeing the insane behaviour that we saw during episodes like the Japanese land and equity bubble of the late 1980s, or the TMT bubble of the late 90s, at least not at the micro level. However, investors shouldn’t forget that the S&P 500 currently stands at a Shiller P/E of just over 28x – the third highest in history (see Exhibit 17).

The only two times that level was surpassed occurred in 1929 and in the run-up to the TMT bubble. Strangely enough, we aren’t hearing many exhortations to buy equities because it is just like 1929 or 1999. Today’s “believers” are more “sophisticated” than the “simple-minded maniacs” who drove some of the other well-known bubbles of history. But it would be foolish to conflate sophistication with correctness. Current arguments as to why this time is different are cloaked in the economics of secular stagnation and standard finance work horses like the equity risk premium model. Whilst these may lend a veneer of respectability to those dangerous words, taking arguments at face value without considering the evidence seems to me, at least, to be a common link with previous bubbles.

Here is a link to the full report.

I find myself agreeing with a great deal of what James Montier is arguing. I believe that it does not make sense to take a secular trend which is obviously at a highly developed stage and extrapolate it into infinity. That is just not how markets work. Yet that is exactly what we see in the bond markets.

The 2-year yield on US Treasuries is trading at 1.25%. The Fed funds rate is 1%. That implies the market is unwilling to price in even half of what the Fed says it is going to do this year, not to mind next year.

Veterans from The Chart Seminar will recognise the Type-3 base formation and will remember the three psychological perception stages of bull and bear markets. The above scenario is analogous with Disbelief. That is despite the fact that the base has been completed and a first step above it is now being formed. It’s as close to text book as anyone could wish for and yet we are still having an argument about whether we are going to have a low interest rate environment forever.

We know what the next stage of the cycle is; Acceptance. That’s when everyone gets the message, yields are rising and they have to do something about it. Since yields are the inverse of prices that means a sell the rallies strategy should work best despite the cost of contango.

Turning to the Case Shiller P/E Index, it is certainly true that the only two times the Index was higher than it is today were in 1929 and 2000. Both peaks occurred at the climax of accelerated advances. The Index is high today but it is not, yet, accelerating. That holds out the prospect that this market will in fact approach bubble valuations before the next valuation contraction cycle begins. That would appear to be an uncomfortable potential outcome for those who are not fully invested.

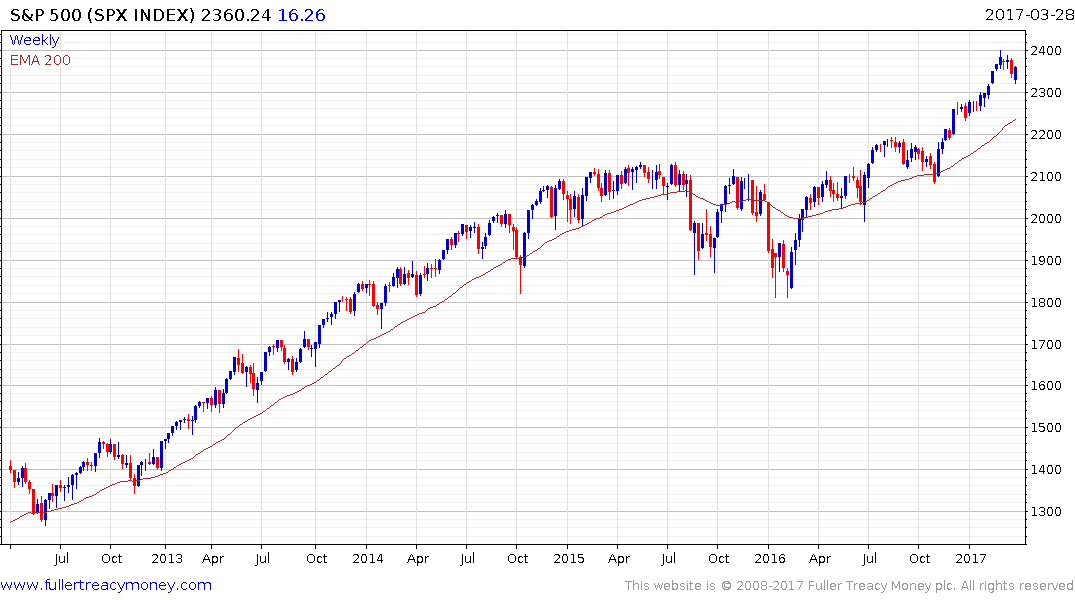

A sustained move below the 200-day MA for the S&P500 would be the minimum required to give credence to the belief that a peak of more than short-term significance has been reached.