Silver Strategy - Price momentum building as macro fundamentals improve

Thanks to a subscriber for this report from RBC which may be of interest. Here is a section:

Physical deficits forecast in 2020 and 2021. We have updated our supply-demand forecasts for silver, which now see physical deficits in 2020 and 2021, from modest surpluses previously. This primarily reflects a stronger rebound in economic activity than we had expected and we now forecast demand in 2020 down -4% vs. -17% previously. We have also incorporated a material ETF inventory build, resulting in even larger net deficits. Our near-term supply forecasts were relatively unchanged.

Underlying industrial & commercial demand more robust. In the initial stages of the COVID-19 pandemic, Industrial Production (IP) on a period-over-period basis went to a highly negative level, driving a sharp move lower in silver prices. While we continue to assume YoY declines in global GDP and IP, we now think there could be a better outcome than previously expected, reflecting recent strength across industrial sectors in China, supportive global central bank stimulus and apparent rebounds in global PMIs. As such, our forecasts for industrial and commercial demand have improved.

Investment demand accelerating. Silver offers many of the same investment qualities as gold even with 50-55% of demand coming from industrial use. This means it is similarly attractive in the current supportive gold macro environment. Notably, physically backed silver ETF holdings have risen +140 Moz over the past 3 months and this appears to have continued to support prices in recent weeks. We now add significant ETF build into our demand forecast to reflect likely further investment interest.

Here is a link to the full report.

Silver is high beta gold but it takes time for investors to get the message that a new gold bull market is in the offing. Therefore, it is quite normal for silver to underperform, often by a wide margin, until investors begin to think about how they can gain leverage to the gold price. Therefore, the return to outperformance of silver relative to gold is a significant transition in the psychological make-up of the market.

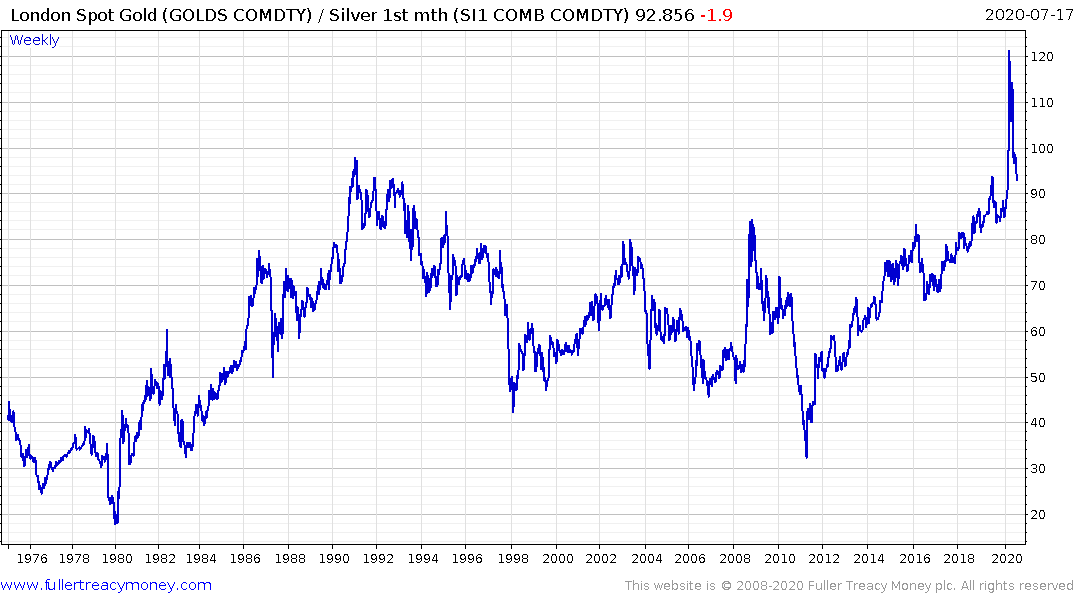

The gold/silver ratio hit a new all-time peak in March when silver prices collapsed during the panicky lockdown selling climax. Since then the ratio has unwound much of the overextension and is now back testing gold’s nine-year relative uptrend.

In absolute terms, silver is on the cusp of breaking above the psychological $20 which would signal base formation completion.

A number of the larger silver producers are also now turning to outperformance. Fresnillo has broken its downtrend.

KGHM rallied this week to break a more than 3-year downtrend.

SSRM, Polymetal International continue to rebound from the recent test of their respective 200-day MAs.

Pan American Silver broke out to new highs today, countermanding the downside key day reversal on Monday.