Signs Are Flashing That Bond Rout Has Gone Too Far, Too Fast

This article by Yun Li for Bloomberg may be of interest to subscribers. Here is a section:

Expectations that Trump, along with a Republican-led Congress, would make good on pledges to spend $550 billion on infrastructure improvement to stoke economic growth sent inflation expectations to the highest since 2015. Yields on two-year notes, the coupon maturity most sensitive to monetary-policy expectations, rose to above 1 percent on Monday for the first time since January as traders added to bets the Federal Reserve will raise interest rates next month.

"The consensus has shifted for good reason," Matthew Hornbach, head of global interest-rate strategy at Morgan Stanley, said in an interview with Bloomberg Television. "There is some concern over the timing and the extent to which President-elect Trump will be able to follow through on some of his campaign promises specially with respect to infrastructure spending and the tax cuts."

This sell off in bonds has been both swift and aggressive with the net result that yields have surged to levels not seen in at least a year. For bond investors who have been conditioned by a 35-year bull market the natural response is to buy the dip. As with any bull market that has been a winning strategy for as long as anyone cares to remember and in order to conclusively signal this historic bull market is over it will have to stop being a profitable strategy.

As I pointed out on Friday, yes, yields have already priced in some of the risk from interest rate hikes. However since they were not pricing in any risk ahead of the election, they are barely pricing in one interest rate hike within the next 12 months following last week’s selling pressure.

That is pretty typical of the first psychological perception stage of a bull market which we characterise as disbelief. Interest rates have been so low for so long that investors are unwilling to bet on the prospect of higher rates because being early in making such a call has spelled underperformance over the last seven years. Most people want to see evidence before they change a winning strategy which is why the buy the dips mantra will have to be seen to fail in order to change long-term investor sentiment.

The election of a fiscal stimulus oriented government in the USA is a major change following a lengthy period when attempts to control deficits have dominated discourse; although arguably not particularly successfully. Considering that an economic expansion has been underway for seven years, employment is already close to optimal and wages are demonstrably rising, there is potential for inflation to surprise on the upside.

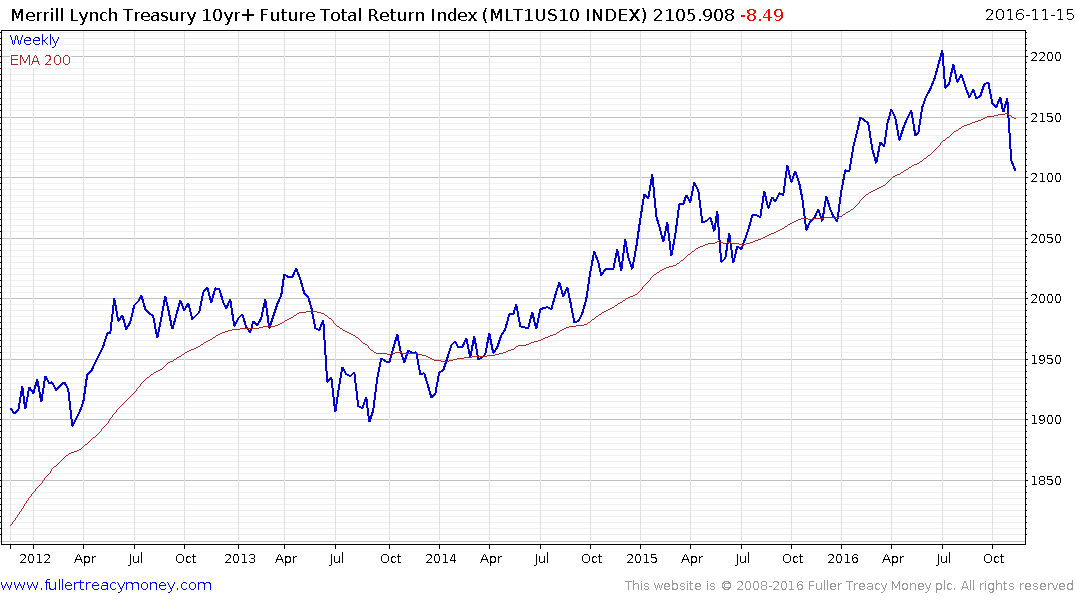

Even if the Fed is willing to run hot on monetary policy the bond market is likely to demand a higher return to offset reduced purchasing power. The Merrill Lynch 10yr+ Total Return Index has now dropped below the 200-day MA. This is not the first time such an event has occurred but overall the Index looks like it is being softened up after an historic advance. Nevertheless, it is due a bounce and would need to encounter resistance in the region of the MA to confirm a return to supply dominance beyond the short term.