Signals Cross in U.S. Stocks as Oil, Lower Yields Double Swings

This article by Callie Bost for Bloomberg may be of interest to subscribers. Here is a section:

This market has been very difficult to explain day-to- day,” Walter Todd, who oversees just over $1 billion as chief investment officer for Greenwood, South Carolina-based Greenwood Capital Associates LLC, said by phone Jan. 12. “Oil continues to drop 2, 3, 4 percent, day in and day out, and people are scratching their heads saying, ‘Why is the 10-year yield below 2 percent if the economy is doing so well?’”

U.S. gross domestic product grew at a 5 percent annual rate in the third quarter, the biggest advance in 11 years, the Commerce Department said on Dec. 23. Consumer spending is poised to grow in 2015 as stronger employment and lower gasoline prices boost household buying power.

As the S&P 500 trades about 2.3 percent below a record high, other markets reflect lingering concerns. Tumbling oil prices have crimped the outlook for inflation, depressing yields on 10-year U.S. Treasuries to the lowest in about 20 months on Jan. 12.

Following on from the discussion of volatility in last night’s audio I thought it would be useful to post some of the relevant charts. What we are presented with is a situation where volatility has been edging higher but stock markets are still reasonably steady. As we enter earnings season there is potential for companies with large foreign earnings to undershoot as a result of the Dollar’s strength. Tiffany’s results today where the US market did not make up for declining overseas earnings is an example.

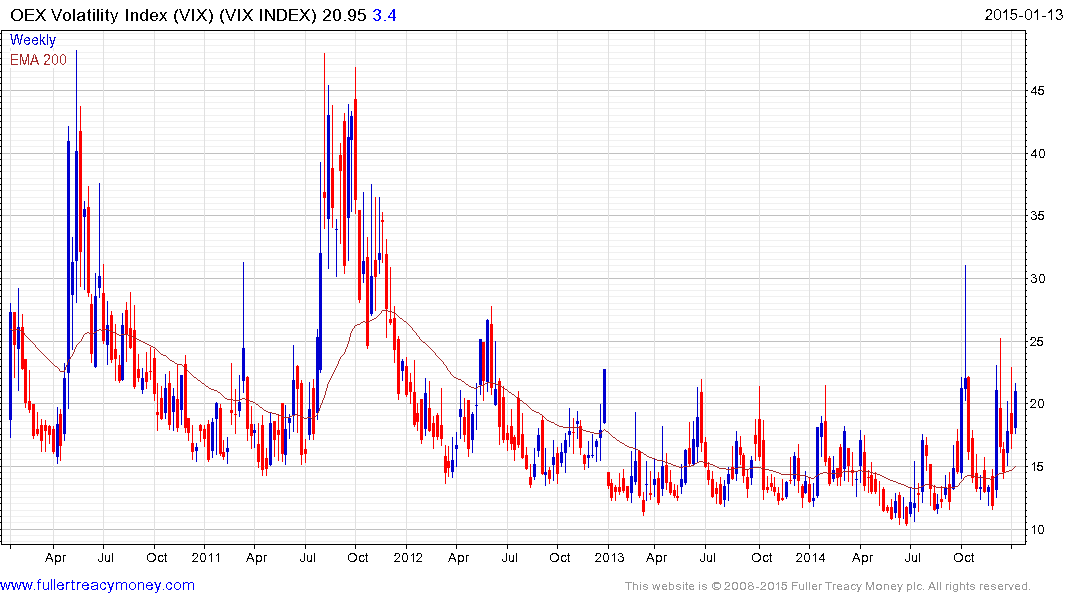

The VIX has been edging higher and the 200-day MA has turned upwards suggesting that surprises are likely to be to the upside.

Against this environment, the S&P 500 has been relatively steady but intraday swings have increased suggesting indecision. Despite this fact the Index continues to hold in the region of its peak, the 1970 area will need to hold if medium-term potential for additional higher to lateral ranging is to be given the benefit of the doubt In the short term it is looking increasingly likely that the December lows will be tested.

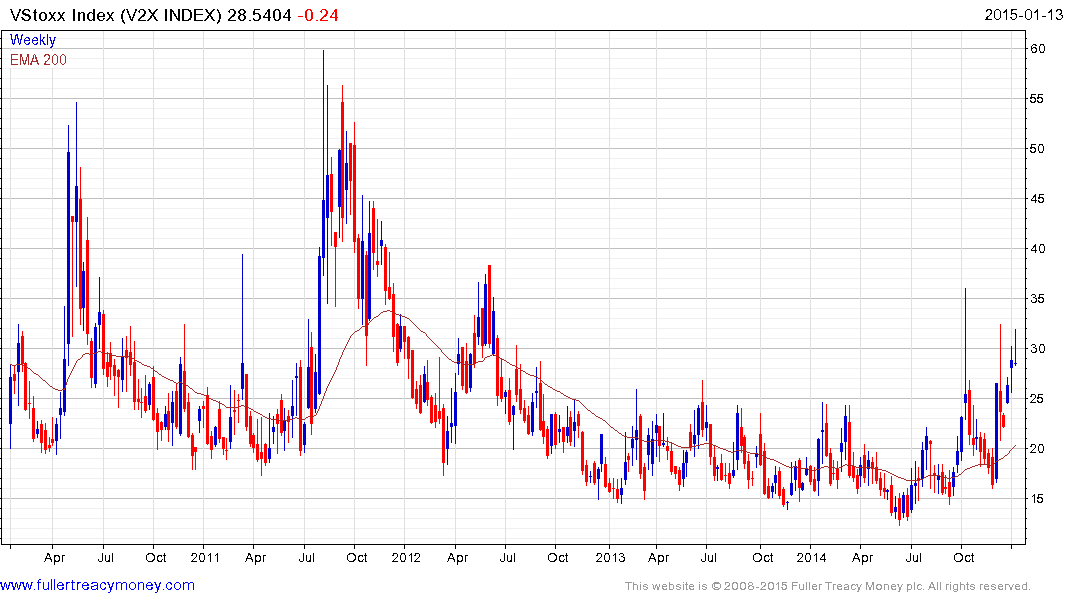

The VStoxx Index of Euro Stoxx 50 volatility is also edging higher

The Euro Stoxx 50 has held in the region of 3000 for much of the last year but two lower highs are evident since June to form a triangular pattern from the October lows. The 3000 level will need to hold if potential for additional higher to lateral ranging is to be given the benefit of the doubt.

If nothing else, the above volatility indices suggest that the unusually quiescent environment that prevailed between 2012 and mid 2014 is over.