Sibanye: Can raise $1B at 'the drop of a hat'

This article from Mineweb may be of interest to subscribers. Here is a section:

"We are looking at all platinum assets including what Anglo Platinum may sell," Froneman said, reiterating that he wanted to do a deal this year. He would not be drawn on who else besides Amplats was flagging platinum assets.

Sibanye's management team has a reputation for squeezing profit out of mines nearing the end of their lives and it could potentially fund the purchase by tapping cheap Chinese sources of finance given its connection to investors from the country.

Froneman formerly ran Gold One where he oversaw its acquisition by a Chinese consortium. Sibanye itself acquired Gold One's Cooke operations in an all-share deal that saw it issue new shares worth 17 percent of its total stock to the Chinese group known as the BCX Consortium.

Chinese investors open up avenues to cheaper rates of finance than South African companies can normally get, for example through the Chinese Development Bank, but Froneman said he had plenty of options.

Asked if he could raise, say, $1 billion for a platinum deal, he said he could do so "at the drop of a hat".

But he added that he did not think that any of the assets Sibanye was looking at "are anywhere near" $1 billion.

Analysts have said the five Rustenburg mines plus its Union mine that Amplats may put on the block could be worth between $1 billion and $2 billion.

"Since we have made our intention public, all the major investment banks have provided us with funding proposals. And in addition we have the support of our shareholders and in particular the Chinese," he said.

?"We generate a lot of free cash ourselves. So it could well be a combination of equity, debt and other instruments. But the bottom line is that everything that is possibly doable in the sector can be financed by ourselves."

Sibanye has prospered since being split off from Goldfields not least because they have successfully contained costs and followed through on their commitment to become a high dividend paying South African gold miner. The company’s commitment to only engage in an acquisition that helps achieve that goal should help moderate investor anxiety about the cost of talking additional mines.

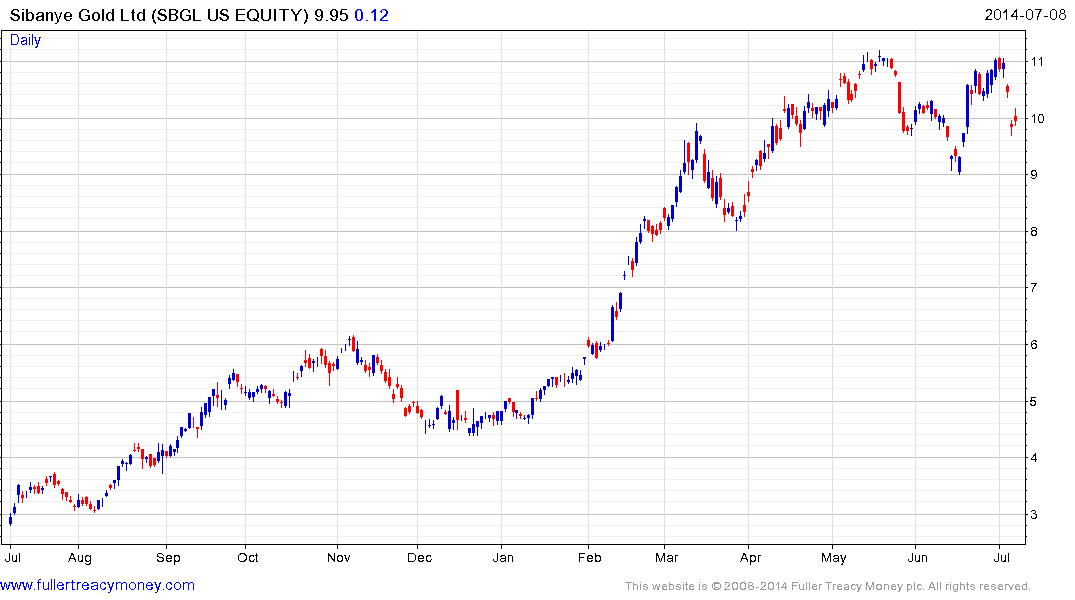

The share rallied from $3 to $11 in the last year and has paused over the last month in a reasonably steady reversion towards the mean. Platinum mines are certainly distressed following the labour disruptions that plagued the sector over the last year, so Sibanye may have the opportunity to acquire assets at favourable prices. A sustained move below $9 would be required to question the broad consistency of the medium-term uptrend.

Back to top