Short-term Overbought Conditions

Wall Street has been rallying impressively on consecutive weeks as optimism about the scale of the reforms that could potentially be introduced by the Trump administration has increased.

There is no denying the prospect of deregulation represents a powerful bullish factor for the banking sector. Likewise lower corporate taxes, simplifying the tax code and infrastructure spending all represent potentially bullish outcomes in their own right, but in aggregate would represent a sea change in US economic policy.

That is of course on the assumption these measures are delivered upon which is why investors are waiting with baited breadth for what President Trump will have to say tomorrow.

The S&P500 rallied almost 100 points in July following its breakout from three-month range. It rallied by almost 100 points between late November and December following the breakout from a four-month range and has now rallied almost 100 points again following the breakout from a two-month range earlier this month. That would suggest another pause is likely if the consistency of the yearlong advance is to hold true.

The S&P500 Banks Index remains a relative strength leader and broke out of a short-term range two weeks ago. A sustained move below 290 would be required to signal mean reversion is underway.

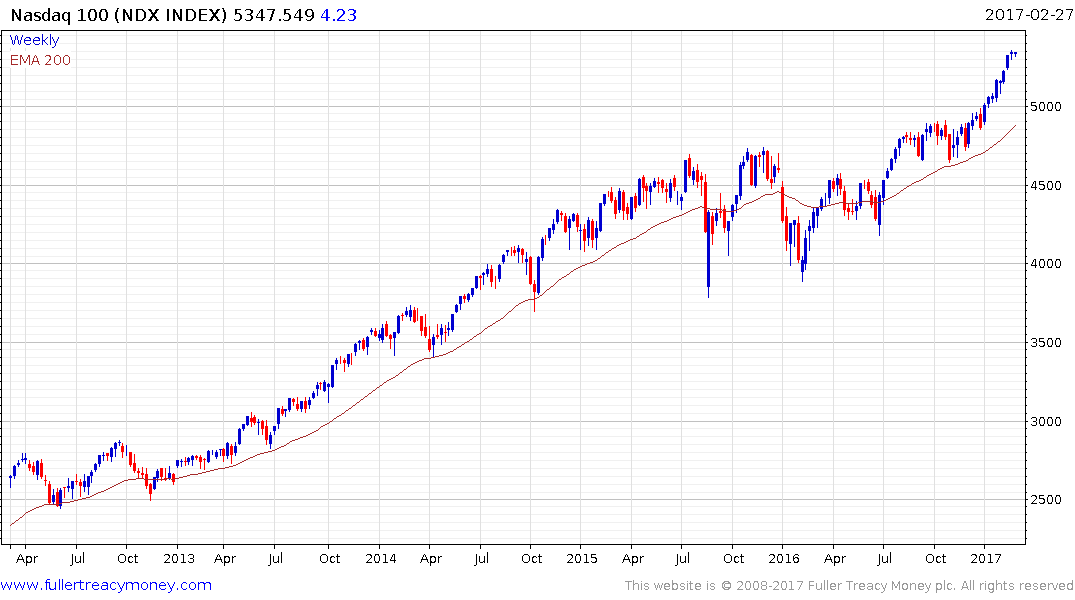

The domestic orientation of the Russell 2000 and the technology focus of the Nasdaq-100 help to explain their respective outperformance but they are also increasingly at risk of some consolidation following what have been impressive moves so far.