Short Term Oil Market Outlook DNB March 9th

Thanks to a subscriber for this report from DNB which may be of interest. Here is a section:

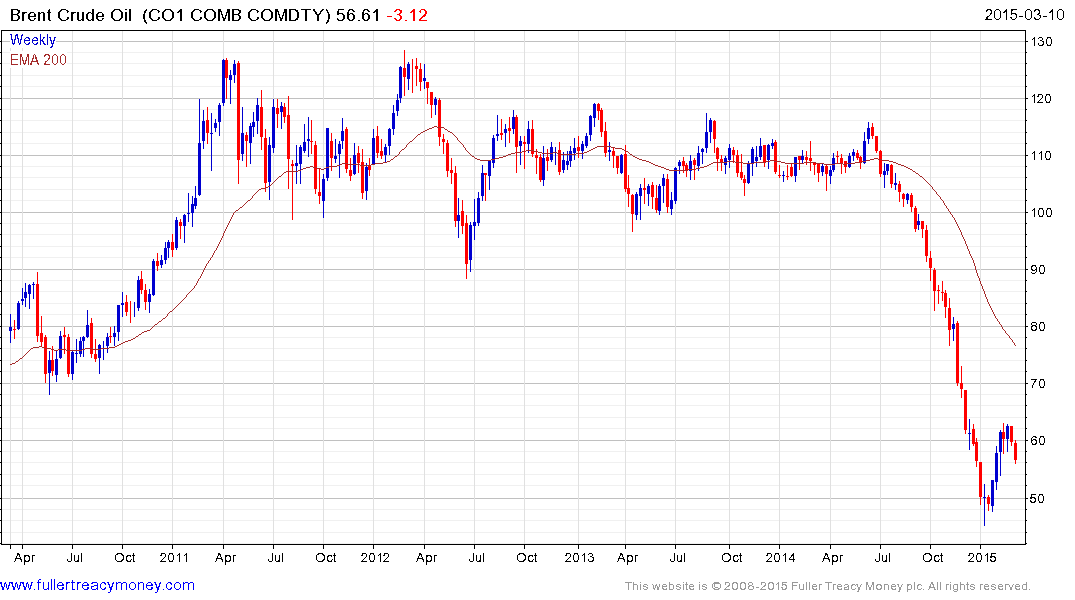

Since it seems the longer end of the 12-month forward Brent curve is anchoring up at around 66-68 $/b and we see limited upside for that part of the Brent price curve in the coming couple of months, we believe it will have to be mainly the spot Brent price that will have to do the job of creating the expanding contango required to incentivize the traders to continue to buy crude oil. Since global demand for crude oil will probably continue to drop seasonally until May, we believe the turning point for crude buying for crude processing (and not for storage) will be late April or early May. From then on and into late summer we should see more demand for crude oil as global refineries are ramping up their runs.

This will remove the worry of continuous crude stock builds as the market turns to build products instead (where stock levels are much lower). The acid test for the global oil market will then be what happens to global refinery margins when throughput is ramping up after May. Will oil consumption then be strong enough to withstand all the extra supply of products? That question can however be put aside for later reports closer to the summer. Before that, we believe in a bearish couple of months for the Brent price.

We do not subscribe to the view that Brent will fall into the 30’s, which we have seen advocated by several other analysts the past month or so. If the one-year ahead Brent price has an anchor in the 66-68 $/b range is should not be possible for the front of the market to drop much lower than the low 50’s because then it will pay of to store crude on ships and traders will be willing to buy the crude.

Here is a link to the full report.

The collapse in oil prices over the last year helps to hammer home the conclusion that the bull market in oil prices is over. It is open to question whether we have already seen the peak in oil demand but if not we are a lot closer to that event that we were a decade ago. The evolution of competing sources of energy is occurring so rapidly that the risk of oil shares disappointing over the medium to long-term has increased fairly substantially.

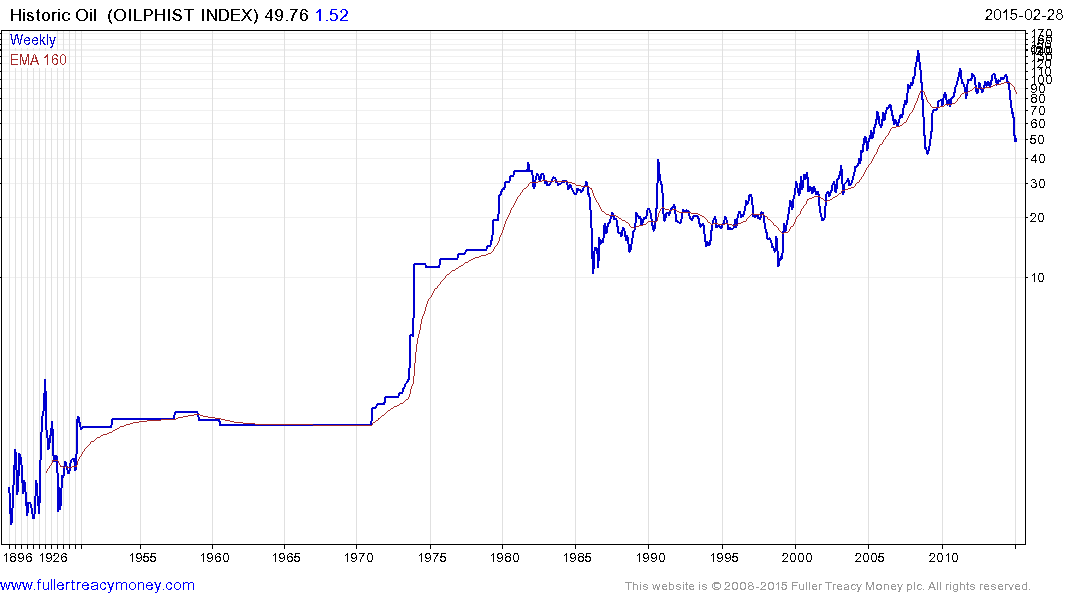

Looking at the long-term chart of oil prices on a log scale we are presented with a series of cycles where prices rally impressively for a number of years but give way to more than decade long volatile ranging patterns. This is now the most likely path for oil prices following what had been a prolonged period of strong pricing.

Today’s $2 retreat by Brent crude suggests the short-term outlook is for a retest of the region of the lows.

Back to top