Shiozaki Roils Yen Bears as GPIF Reform Takes Japan Center Stage

This article by Mariko Ishikawa and Hiroko Komiya for Bloomberg may be of interest to subscribers. Here is a section:

The yen fell the most in a week and domestic stocks unwound some of their slide after Shiozaki, whose ministry overseas the nation’s $1.2 trillion Government Pension Investment Fund, said today the government will conduct some reforms within the existing law and there is no intention of postponing the process. The GPIF changes are accompanying Abenomics, a three- pronged policy of radical monetary easing, fiscal stimulus, and pro-growth policies.

?The currency strengthened 0.3 percent yesterday, the most since Sept. 3, after a Yomiuri newspaper report cited Shiozaki as saying that he is in no hurry to submit a bill needed to review GPIF’s allocations.

“The yen’s reaction after Shiozaki’s remarks explains how closely the market is listening to him,” said Daisaku Ueno, the Tokyo-based chief currency strategist at Mitsubishi UFJ Morgan Stanley Securities Co. “It helps explain the enormous expectations there are around how the minister in charge of the world’s largest pension fund will revamp GPIF in a way that cater to Abenomics’ fight to exit deflation. Shiozaki is ‘Mr. Risk-on’.”

The three arrows of Prime Minister Abe’s program for Japanese economic revival are fiscal stimulus, monetary easing and structural reform. Of these the monetary stimulus has been both the easiest to achieve and the highest profile. The Yen has been among the weakest currencies in the world over the last two years and extended its decline this month to reassert the medium-term downtrend.

Fiscal stimulus has been more difficult to achieve not least because of the government’s debt burden. Japan cannot afford for borrowing costs to rise because of the constant need to roll over maturing debt. Therefore the VAT increase was not a choice but a necessity and the bond buying program accompanying the monetary stimulus is required to ensure JGB yields do not rise.

Repositioning the assets of the world’s largest pension fund falls into the third category of structural reform and is what investors have been waiting for since late last year. This transition can be justified as being in the interests of savers since the negative real interest rates created by quantitative easing are counter-productive to capital appreciation.

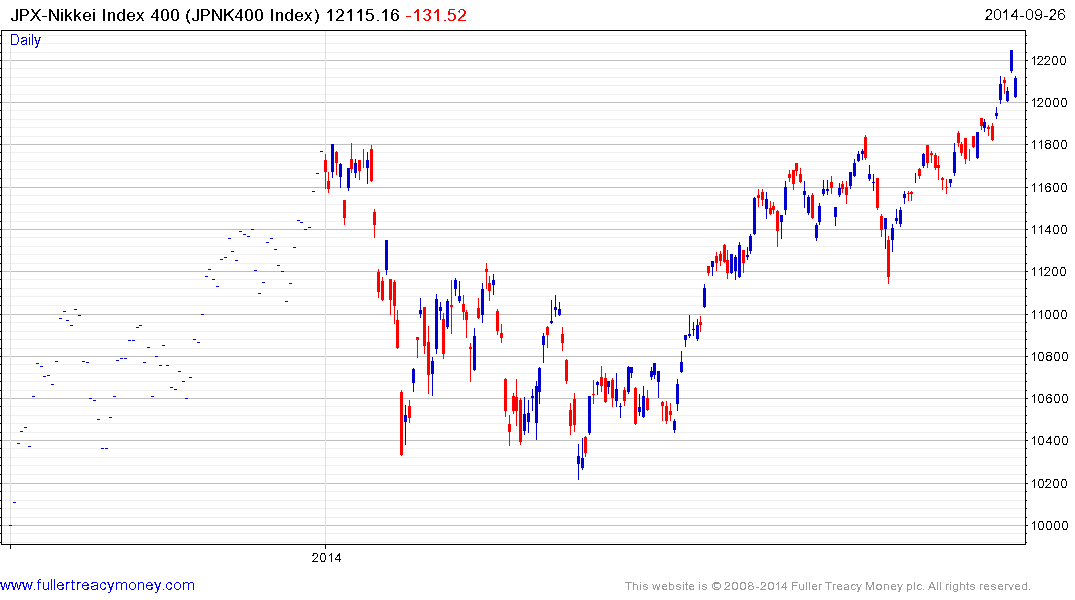

The creation of the JPX-Nikkei 400 with a focus on corporate governance is a welcome development and its outperformance relative to the Nikkei-225 is a testament to its positive reception by investors.