Shaken, Not Stirred

This article gained some attention in the last week as cruise lines experiment with replacing bartenders with robots. Here is a section:

Once the guests enter the bar, they virtually create their drink via a smartphone or tablet app. The sky is the limit as far as drink orders go. The robots can execute options ranging from alcoholic to non-alcoholic beverages as well as a full range of combinations.

As soon as the guest’s order has been sent, the KR 5 arc robots get to work. They grip the cocktail mixer, fill it with the desired ingredients, shake it and pour the finished cocktail into the glass. The robot only requires one minute to make two drinks. Their compact design makes the six-axis robots ideal for the bar environment. Thanks to the longest reach in their class as well as their low weight, the robots are practically predestined for use on a cruise ship.

“Makr Shakr is an excellent example of how robot-based automation can change the interaction between humans and products – a topic that we have researched substantially”, says Carlo Ratti, professor at the Massachusetts Institute of Technology and co-founder of Makr Shakr.

The evolution of robotics, optics and power consumption has revolutionised the utility of these machines and their cost continues to trend lower. Some will obviously worry at the loss of employment opportunities for lower skilled work this entails. On the other hand, for a cruise ship minimising the berths taken up by crew means more space can be allocated to fare paying passengers. These types of economic considerations are driving demand for machines.

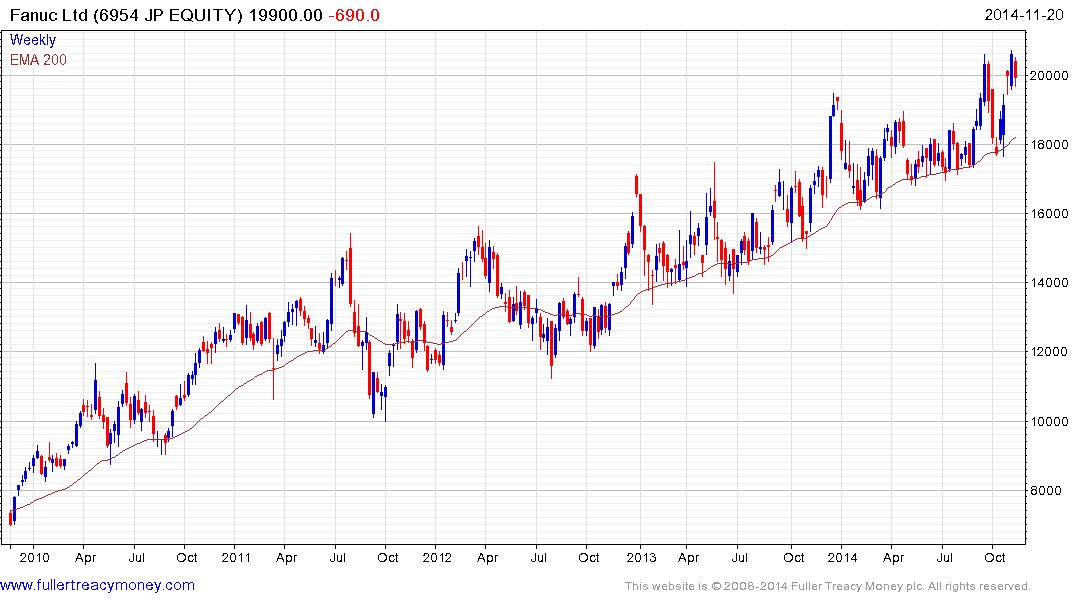

As export oriented companies Japan’s Fanuc and Germany’s Krones AG and Kuka AG are benefitting from the weakness of their respective currencies.

Fanuc remains in a reasonably consistent uptrend characterised by a progression of higher reaction lows.

Krones is somewhat overbought in the very short term, but a sustained move below the 200-day MA would be required to question the consistency of the medium-term uptrend.

Kuka has accelerated of late and the first clear downward dynamic is likely to signal a peak of a least near-term significance.

Back to top