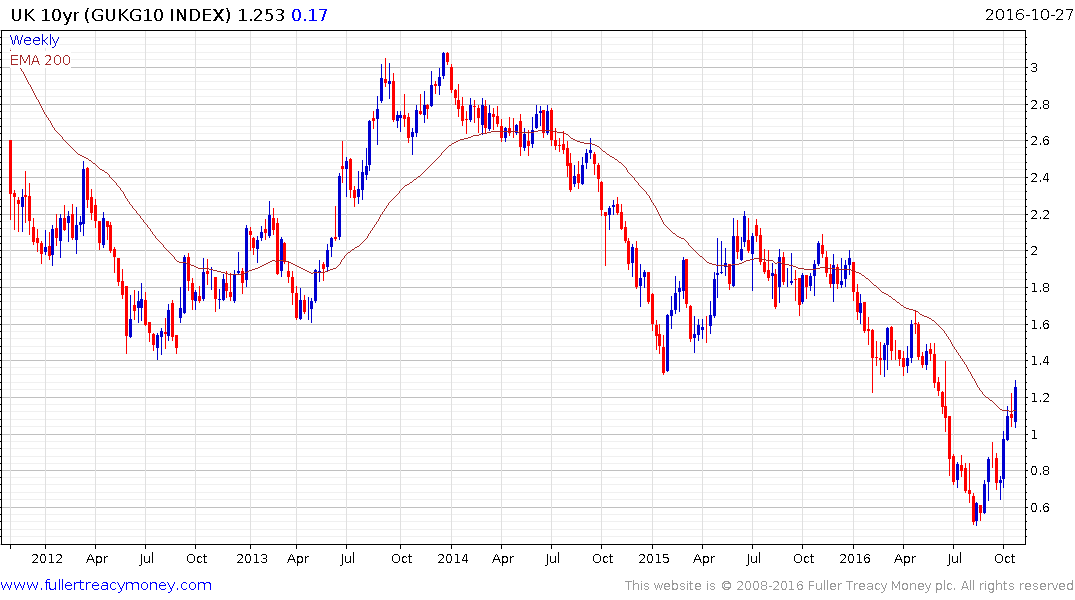

Selling Sweeps Global Government Bonds; U.S. 10-Year Yield Above 1.8%

This article by Min Zeng for the Wall Street journal may be of interest to subscribers. Here is a section:

The combination of low global growth, subdued inflation and ultra loose monetary policy among major central banks has been sending bond yields to unprecedented levels. Yet over the past few weeks, the narrative has appeared to shift.

Concerns have been growing over less support for the bond market from central banks in Japan and Europe as their bond buying is reaching limits. Economists and analysts have started talking about a shift toward fiscal stimulus to combat low growth. Such fiscal action typically raises supply of government debt for funding and is seen as a negative for long-term government bonds.

Demand for haven bonds has also been diminishing as data lately have pointed to some positive signs on the global economic outlook. Meanwhile, inflation expectation is rising, driven by a rally in crude oil prices this month and comments from major central banks to tolerate inflation slightly above their desired targets to tackle still low inflation.

Here is a link to a PDF of the article.

Central banks are expressing some reluctance to continue with the same tired strategies that have fostered perhaps the greatest asset price inflation across multiple asset classes in history while failing to stock the kind of inflation central banks measure. Concurrently inflationary pressures are mounting with healthcare and education leading but Chinese producer prices and wages are two important additional factors.

It’s safe to conclude that the brief sojourn below 1.5% was a failed downside break on 10-year Treasuries and that the rebound is more than a short-term bounce. A sustained move below 1.7% would be required to question that view.

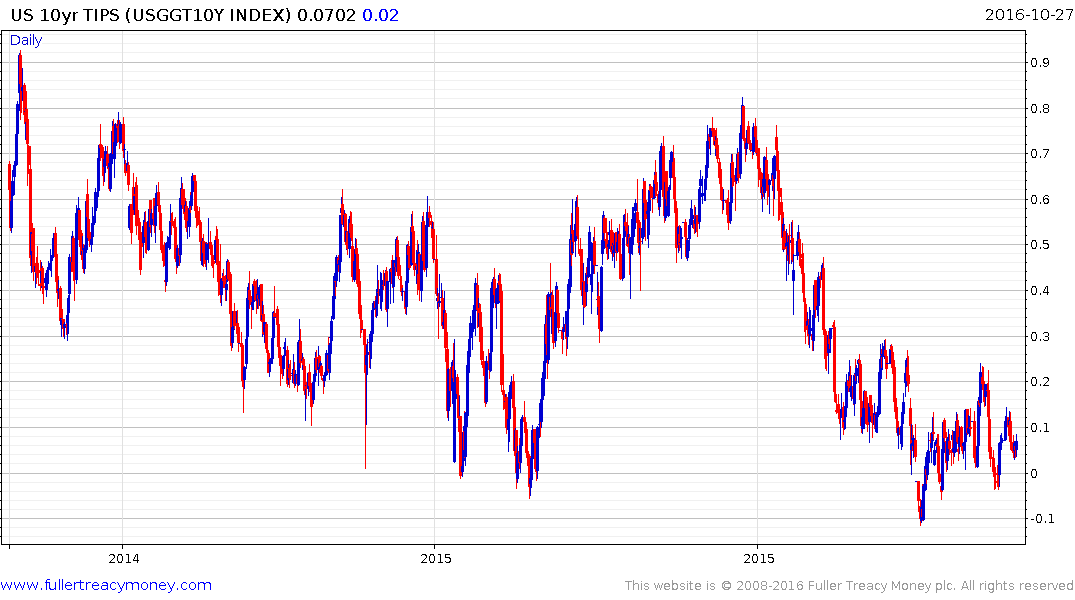

By contrast TIPS yields have been comparatively steady since their floating coupons will compensate investors for any uptick in inflationary pressures.

The surge in bond yields is not limited to the US market with Bund and Gilt yields both breaking medium-term downtrends while JGB yields are trading in the region of the trend mean. The big question is whether these moves will be sustained beyond the next few weeks if momentum for fiscal stimulus does not also accelerate.