Segregating the resilience of EM banks to trying global macro outlook

Thanks to a subscriber for this heavyweight 101-page report from Deutsche Bank focusing on emerging market debt. Here is a section:

The debt stock of the EMs has increased significantly since the global financial crisis. In contrast to advanced economies in which governments are the main borrowers, the main driver of EM indebtedness is the private corporates (while banks and households are leveraged up as well), and the bulk of the financing is FX denominated, making EMs susceptible to financial stress, economic downturns, and capital outflows. We believe a correction has to an extent occurred in the EMs since the taper shock, and our base scenario foresees a slight rebound in economic growth in CEEMEA and LatAm in 2016. Under our central scenario that the Fed will raise rates only gradually, we recommend that investors Buy BZWBK (Poland), Doha Bank (Qatar), Garanti (Turkey), Standard Bank (South Africa), Bradesco (Brazil), and Credicorp (Peru).

There are two main risks to our base-line projections: 1) more aggressive rate hikes by the Fed than assumed under our base scenario, and hence, more adverse market adjustments to a tightening Fed; and 2) a sharper slowdown in China, which would have obvious knock-on effects on commodities, global trade, and EMs in general. The past few weeks have shown that those two risks are unlikely to materialize together in the near term, and we believe that the risk of a sharp increase in rates is now a very unlikely scenario. We believe, however, that if they materialize, they will weigh on banks via two main channels. The first is margins, as funding costs will climb higher at a much faster pace and may also force banks to put on the brakes in terms of lending. The second one is asset quality. We think EM corporates are likely to face two related but distinct risks associated with their recent rapidly rising leverage under a more bearish scenario: liquidity risk and FX losses.

?In the first part of this report, we opt to examine the refinancing risk and the associated deleveraging risk for the banking sectors in CEEMEA and LatAm. We look at the maturity structure of the external debt, as well as the FX liquid assets, and demonstrate the extent of ‘refinancing risk’. We then examine the extent of deleveraging if rollover ratios fall to the levels we witnessed during the global crisis. The second part of the report aims to assess the potential asset quality risks arising from the recent increase in private corporate debt. Accordingly, we stress-test our earnings estimates to a potential increase in risk costs under the assumption that some of the FX corporate debt will default this year. While sustained financial market volatility, slower lending, and weaker growth should inevitably affect other business segments as well, our focus here is on banks’ corporate exposures, which in most cases have increased significantly since the global crisis.

Under a bearish scenario in which top-line revenues are challenged and corporate loan qualities deteriorate, we see greater risks in Turkey (with Vakifbank and Yapi Kredi relatively more vulnerable), Russia (VTB), Brazil (Santander Brasil), and Chile (Banco de Chile). Conversely, CE3 (with BZWBK, OTP and Komercni relatively less exposed), South Africa (Standard Bank), Mexico (Banorte), and Peru (Credicorp) appear as relatively less exposed to a scenario in which banks have to reduce their lending due to unfavorable external borrowing conditions and the quality FX corporate loan books erodes.

Here is a link to the full report.

There are two sides to every argument. There is no doubt that the strength of the US Dollar over the last few years has been a major headache for companies that intended to pay back foreign loans in their own currencies. That is going to act as a headwind for their balance sheets for as long as it takes them to refinance. On the other hand they may be assisted by the boost to productivity and relative competitive advantage that comes from a sharply weaker currency.

The Brazilian Real dropped by 63.7% between its 2011 peak and its September low. The Indonesian Rupiah dropped by almost 60% over the same period. The South African Rand fell by almost 64% between 2011 and the accelerated low posted in January.

We do not yet have evidence that these currencies have reached medium-term lows but they have certainly reached near-term lows. There is no one predicting they are about to regain their previous strength and that is good news for their respective economies. Yes, the corporate sector is going to have a continued challenge with funding costs as they deal in a weaker currency but export oriented companies will experience a windfall. South African gold miners are a good example.

The most likely bullish scenario for the above currencies is that they move into potentially lengthy base formations, while additional economic deterioration would be required to send them meaningfully lower.

Governance is going to be central to this argument and right now Indonesia is out in front of major emerging commodity producers on that front. Ahok, Widodo’s previous right hand man, is running for Governor of Jakarta is next year’s election as an independent. He faces considerable opposition from non-Chinese ethnic politicians but a victory would put two staunch reform minded allies in two of the most powerful positions in the country so this is a story to watch.

The US listed Aberdeen Indonesia Fund trades at a discount to NAV of 14% and moved to a new 12-month high today to break back above the trend mean.

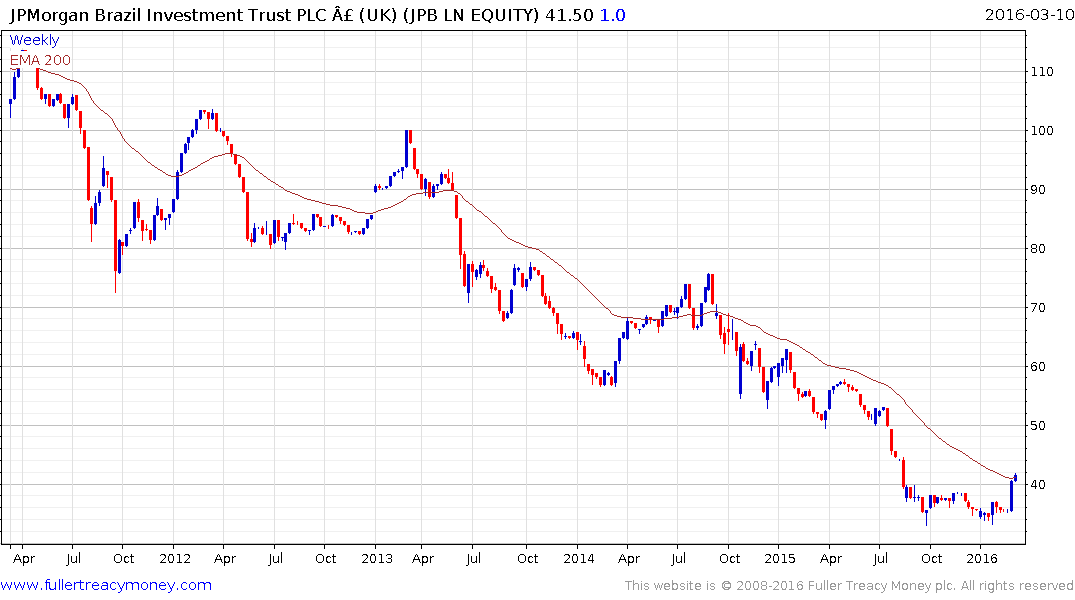

The UK listed JPMorgan Brazil IT is trading at a discount to NAV of 10.84% and also broke back above tis 200-day MA this week.

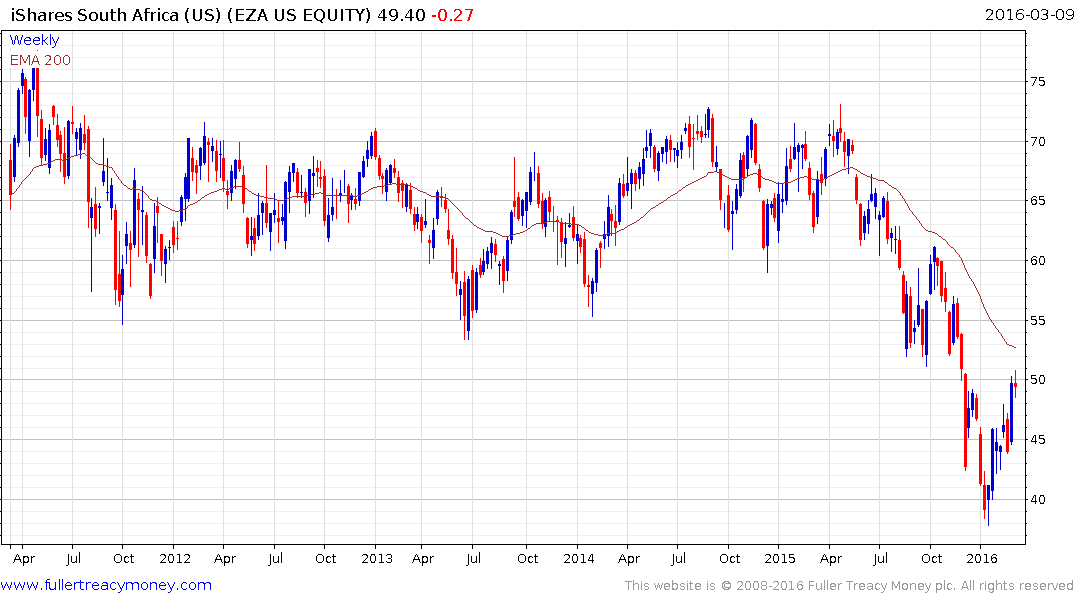

The US listed iShares South Africa ETF broke downwards from a type-3 top in November and is currently engaged in a reversionary rally. It will need to find support above the $40 area on the first significant pullback to demonstrate a return to demand dominance beyond short-term steadying.