Secular Themes Review and Chart Seminar report June 10th 2022

The future of technological innovation and wonderful solutions to the many issues facing society is undimmed. However, the market is also a discounting mechanism.

Secular bull markets make lots of big promises about what is possible in the future. They even deliver on those promises. The biggest lesson from the history of markets is that happens independently of the share price.

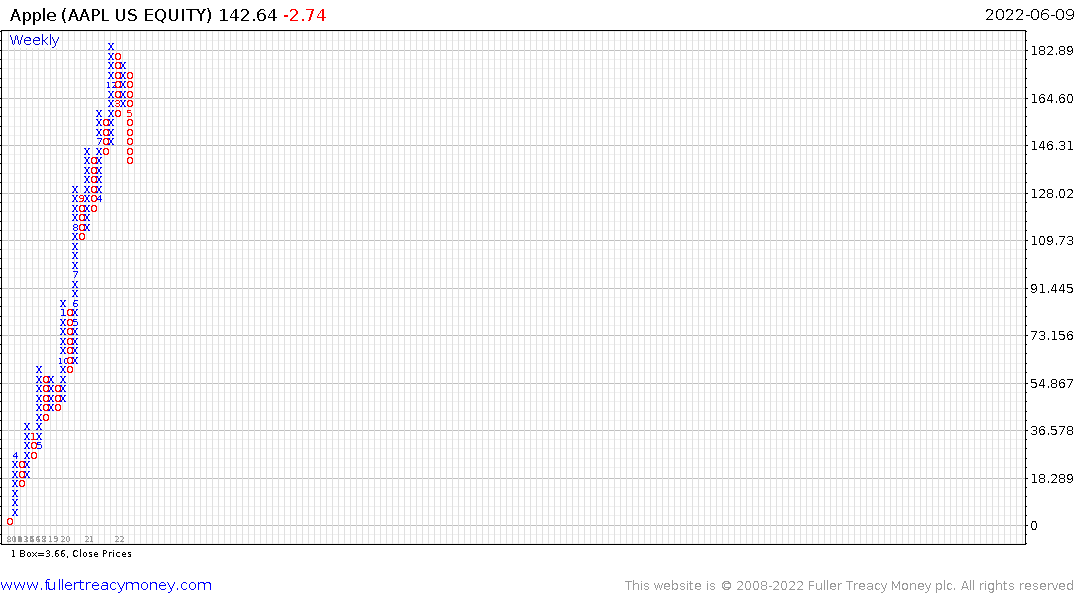

This point and figure chart of Apple is enough to given anyone pause. It’s taking the entire history of weekly closes and is a clear break of the secular trend.

This point and figure chart of Apple is enough to given anyone pause. It’s taking the entire history of weekly closes and is a clear break of the secular trend.

This version takes daily closes and also exhibits significant deterioration in uptrend consistency.

Amazon is encountering resistance in the region of the 1000-day MA. That implies the secular uptrend has been broken. That conclusion will remain in force until it can sustain a move above the secular trend mean.

The Nasdaq-100 is also trending lower.

The FANGMAN/Total Market Cap ratio is now also breaking lower.

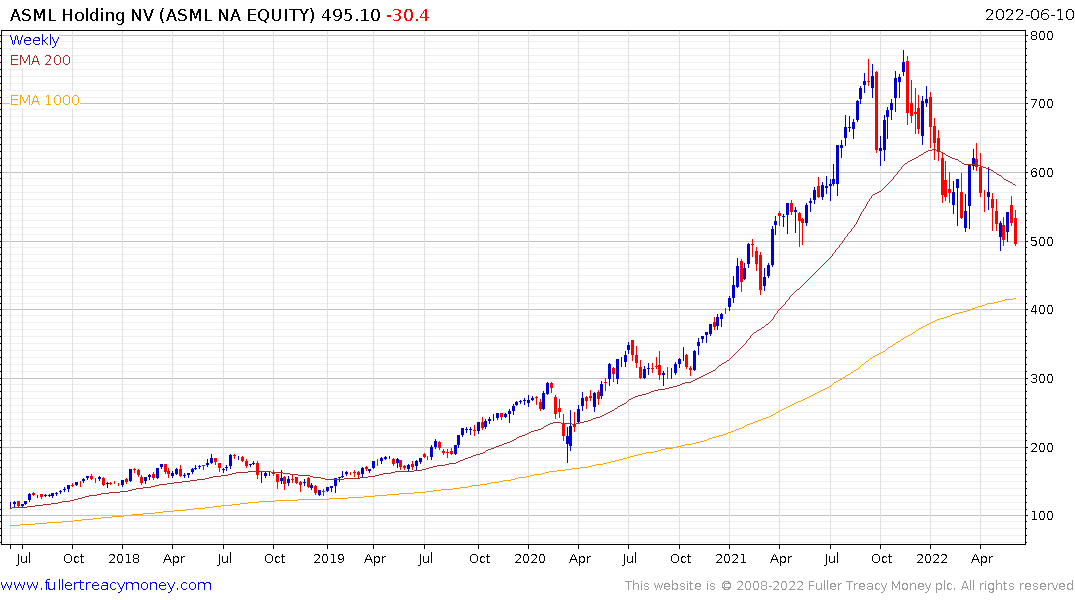

The biggest challenge for investors who successfully exited positions in technology sectors is buying back too early. ASML is a classic example. The company has a monopoly on supplying machines to manufacture cutting edge chips. It has a full order book stretching years into the future. The company is going to continue to thrive for years to come. That is fully priced in.

It trades on a price/sales of 11.4. That implies it would take a decade of current sales and no new spending to earn back the price. It could halve and still be expensive.

It trades on a price/sales of 11.4. That implies it would take a decade of current sales and no new spending to earn back the price. It could halve and still be expensive.

I have long maintained that bitcoin is a liquidity play and a handy barometer of risk appetite. Buying the dip always works in a secular a bull market. When it fails, it is a painful lesson for long-term investors that can have a terminal effect on sentiment.

Bitcoin has bounced from the region of the 1000-day MA every time it has gone through a crypto winter. There is also the well-known phenomenon that all one has to do is hold for four years to make money.

Bitcoin has bounced from the region of the 1000-day MA every time it has gone through a crypto winter. There is also the well-known phenomenon that all one has to do is hold for four years to make money.

Armed with this knowledge, crypto investors should be buying the dip. The price is now in the region of the 1000-day MA but has so failed to improve on flurries back above $30,000. Ethereum is also testing the secular trend mean. A sustained break to new reaction lows would be a significant trend inconsistency for both assets.

The challenge for investors is valuations floated higher on an upswell of enthusiasm fueled by free money and lots of it.

During the pandemic the world experimented with Modern Monetary Theory. Policy makers were willing to suspend disbelief and printed trillions assuming no discernable negative repercussions.

They looked at more than a decade of experience where outsized money creation did not lead to inflation and concluded they had discovered a magic money machine that would fund all spending. Level-headed analysts decried this profligacy and were ignored.

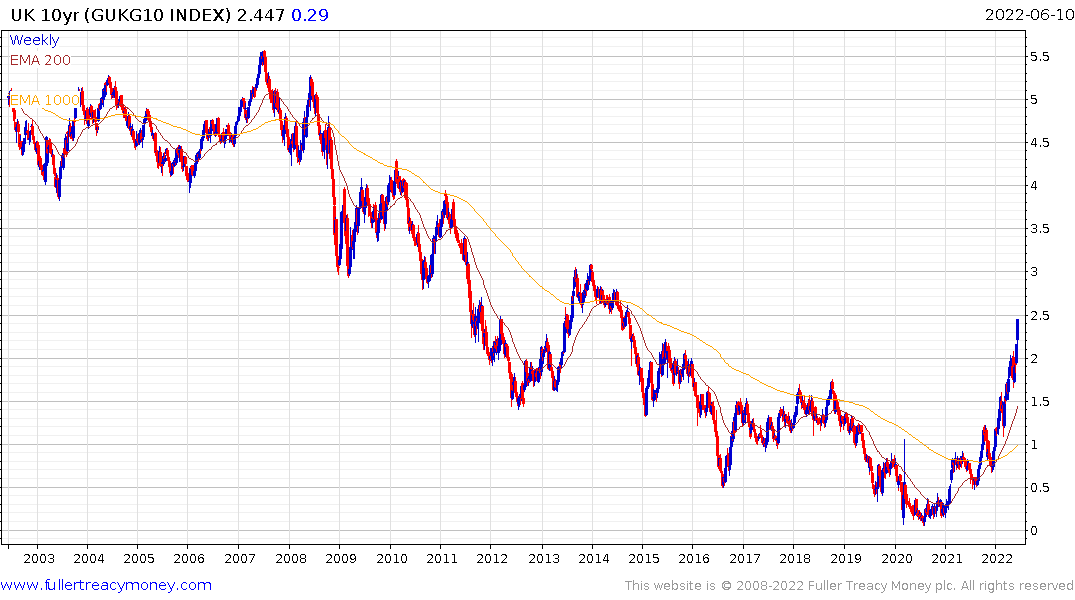

Today bond yields are trending higher. This is most clearly evident in UK Gilts, where the inflation scare is now quite a bit larger than in 2007/08. That was the only other time when the 200-day MA trended up through the 1000-day MA. A wide overextension is evident, but the trend shows no sign of reversing just yet.

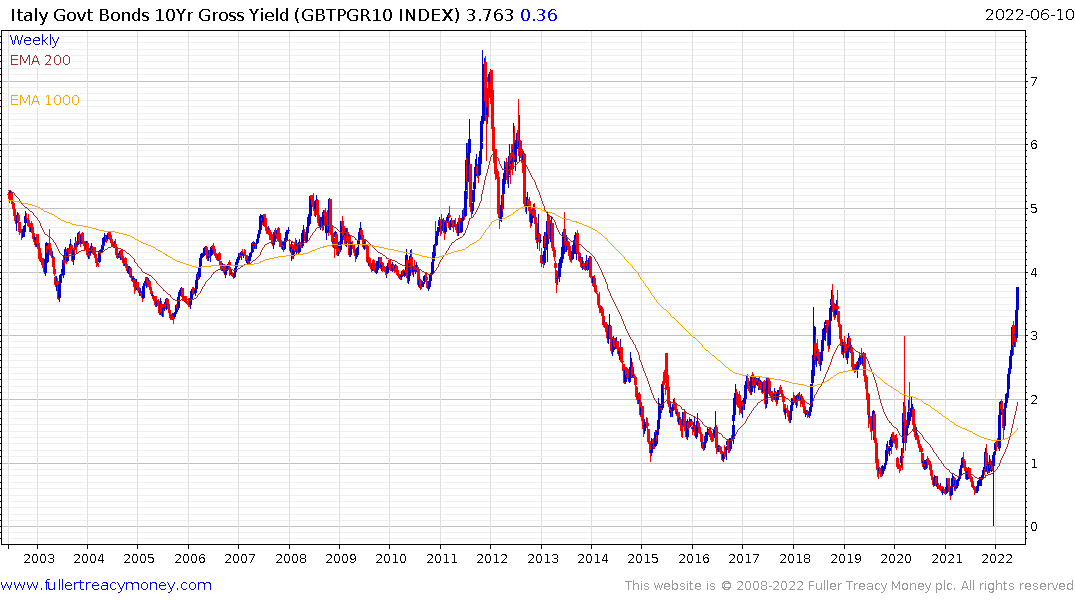

Italy’s government bond yields are trending back towards the upper side of the base. Every time the yield has approached this level it has prompted remedial action by the ECB. The Italian economy continues to thrive with economic activity surprising on the upside again at the latest reading (April).

Italy’s government bond yields are trending back towards the upper side of the base. Every time the yield has approached this level it has prompted remedial action by the ECB. The Italian economy continues to thrive with economic activity surprising on the upside again at the latest reading (April).

Larry Summers makes the clear point “If you look at history, there has never been a moment when inflation was above 4% and unemployment was below 5% when we did not have a recession within the next two years,”

That also means recessions follow periods of strong growth and benign employment conditions. Another way of thinking about it is inflationary busts follow inflation booms.

There is no reason to believe that Italy or any other country is different, even if the absolute 4% hurdle is not equally applicable.

US 10-year Treasury yields are breaking on the upside. I was willing to bet that 3% was a significant point of support when I opened an investment long in the iShares 20+yr Treasury ETF (TLT) in May. Steadier action lasted for about a week before dissipating. I don’t believe I was the only one to be tempted by higher yields and a former area of support who is now much less willing to buy the dip.

The longevity of this inflation scare is perhaps the most surprising event for investors. Predictions that inflation is peaking have been wrong for nearly two years. That does not mean they will always be wrong but investors have been chagrined by taking losses.

Meanwhile the short end of the curve is still trending higher at a more modest pace than the long end. That suggests continued flight into low duration bets that are less interest rate sensitive.

Tightening financial conditions lead to recessions. That can be driven by central bank action in restricting liquidity and raising rates or by surging energy prices. Crude oil jumped by 109% between December and the peak near $140 in March.

The one thing everyone is talking about is higher fuel prices. £2 a litre equates to about $9.31 a US gallon. In California it’s about $6 and in Texas it’s about $4.60. The big difference is UK drivers average about 7500 miles whereas US drivers tend to average around 14000 so spending on fuel averages out and the news is not good. Freedom of mobility is being impaired and that has negative economic consequences.

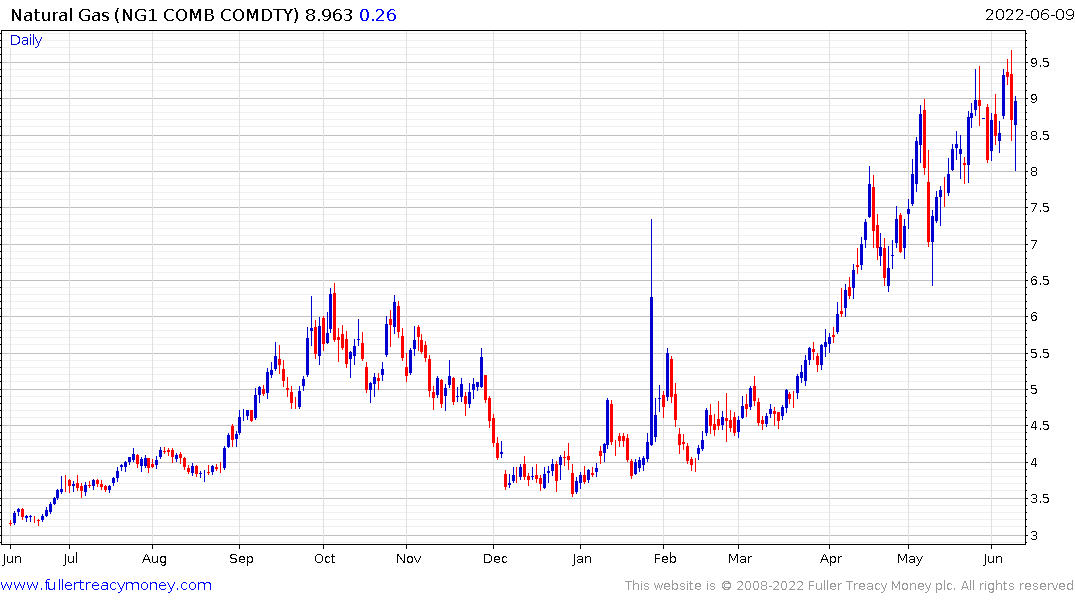

Crude oil remains stable near $120. I feel like I missed the opportunity to buy the breakout while I was on holiday and do not believe the risk/reward is in my favour for a leveraged position at present. Meanwhile natural gas has posted two downside key day reversals in the last month. That suggests demand destruction may already be evident in this section of the commodity markets.

US natural gas prices have surged because of export demand but European gas prices are correcting so that is reducing the urgency for prices to rise. There is scope for prices to rebound in Q4 as the winter sets in and the extent to which Europe can fill reserves ahead of that event will be a significant swing factor in how high prices go.

This article by Charles Gave for the Institut Des Libertes may be of interest. Here is a PDF of the English translation and here is an important section:

I have them for inflation, for economic activity in the USA, in Europe, in Asia, for international trade, for oil, for interest rates, for exchange rates, for gold, to the point that from time to time, when I do a staff review, I sometimes get lost.

Not this time.

Please believe me, but all my indicators that have a relationship (or try to have one) with so-called risk assets (stocks, private sector bonds) are in the red, which has never happened to me in my fifty-year career.

And I can only draw one conclusion: the idiotic policies followed in the US and Europe for the last twenty years are reaching their limits and we may be much closer to the final fireworks than many people think.

And there is nothing the authorities can do. The central banks can't do anything anymore, the states are completely overwhelmed, all our politicians are Lilliputians, the universities have become factories for morons, the free press has disappeared...

Perhaps the time has come, at last, to make the great reset, i.e. to abandon all these idiotic policies and return to market prices. We are (perhaps) coming to the end of the social-democratic experiment that began in 1945 and which, like the communist experiment in 1990, is collapsing under its own contradictions. And this is what Schumpeter predicted. Like the fall of the Berlin Wall, this would be very good news, but it could shake a lot... I fear for my savings, and for yours...

I have tried to prepare the ground, but when the avalanche starts, it is better not to be on the slope below. My advice is simple.

As part of the IDL 50% fragile, 50% anti-fragile portfolio, I will stop periodic re-balancing as we are in for a big hit in the equity markets. The anti-fragile part will go up, the fragile part may go down, hard. If I'm right, you'll have time to buy back your shares.

There are three potential options for consideration. The most optimistic is no longer being discussed because both bond and equity prices are falling in tandem. This argument would be that inflation will soon peak, productivity growth will prove to be persistent and technological progress will deliver medium-term disinflationary forces. This also implies central banks will no longer feel pressured into raising rates and the Powell put will remain in play.

The second potential outcome is inflation proves sticky. This is what is currently being priced in. This will result in central banks tightening until there is clear evidence of growth faltering. That should temporarily reduce inflation by killing demand. They will then relent and cut rates quickly which will contribute to higher inflation later. I think this is most investors’ base case.

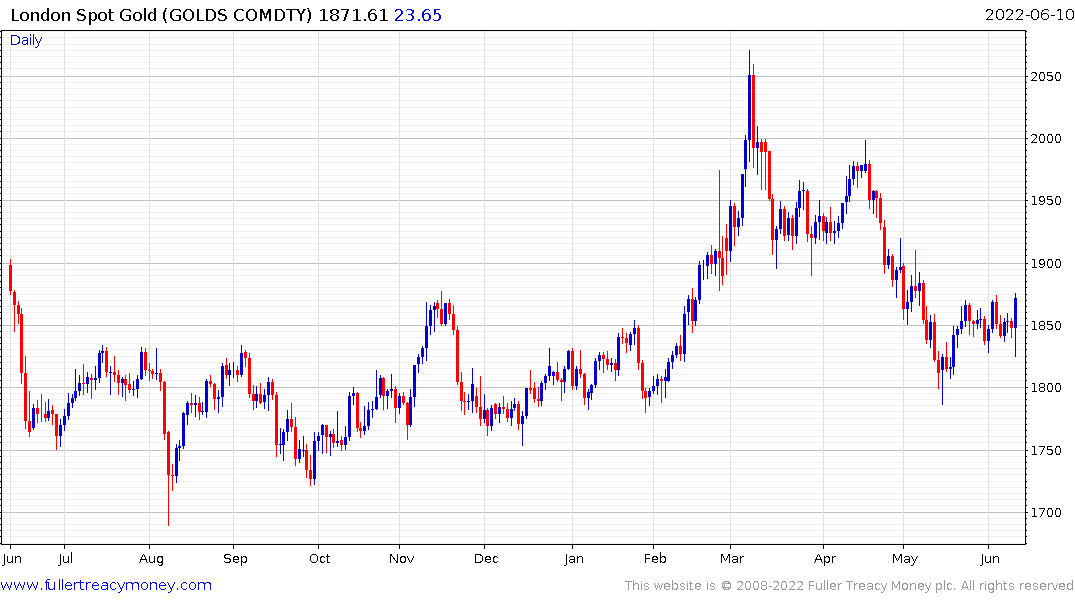

It’s also why gold is now firming. There is increasing speculation the Fed will not be able to hike as much as required to create positive real rates. Today’s upward dynamic was the best sign in weeks that demand is returning to dominance.

The third is inflation is sticky and will persist despite growth faltering. Central banks will then have to raise rates in a Volcker-like fashion to snuff out demand, reset valuations of financial assets, including property, and reseed the global growth engine through an exceptionally deep recession.

Europe is in the most difficult position. They no longer get to pay Russia in Euros for oil and gas. That means the region is facing the dual challenges of surging commodities prices and a weak currency. Raising rates aggressively would mean facing up to the internal contradictions of the Eurozone so market control measures are much more likely than in other jurisdictions.

The USA has the benefit of a strong currency because it is currently deemed to be the most likely to pursue tight money policies. It is also close to being energy independent and is not reliant on Russian exports of vital commodities.

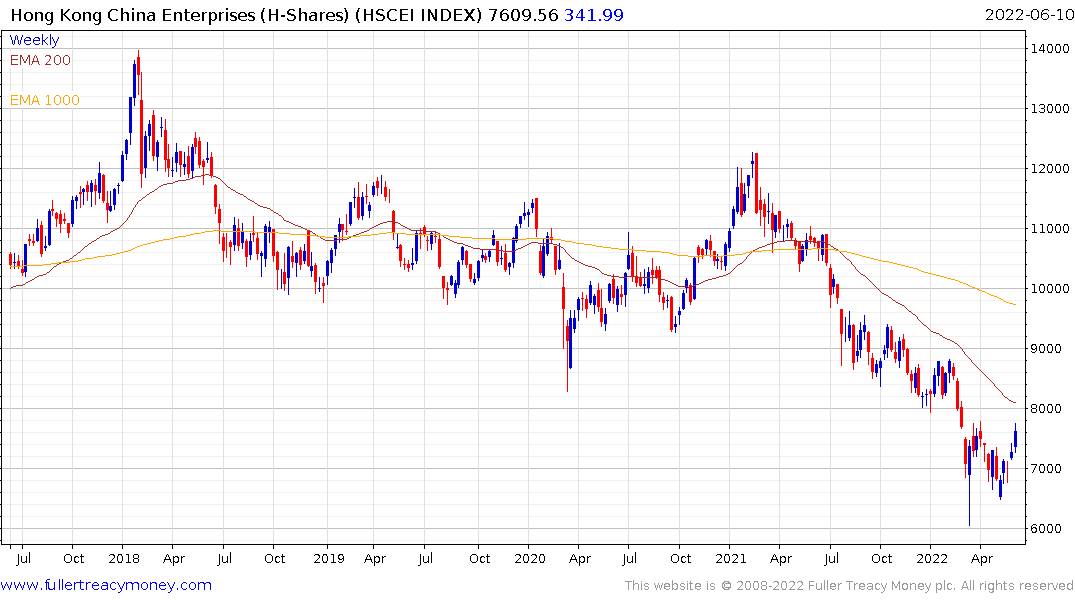

China avoided the experiment with modern monetary theory and instead used the pandemic to embark on an even riskier experiment. The Communist Party put has been even more reliable than the Federal Reserve’s version. Every time the economy looked shaky, the Party has stepped in to boost infrastructure development and support for the property market. Whether they are still willing to do so now is in question.

At least some assistance is being provided so the H-Shares are exhibiting relative strength as the Index firms from a deep short-term oversold condition.

The big question for China is whether the property market’s high valuation can be sustained with overt central government eagerness to provide whatever liquidity is required. The Dollar remains on a recovery trajectory compared to the Renminbi.

The resources sector has been a significant source of relative strength in the stock market over the couple of years. Many of the largest companies have broken out to new all-time highs and have been consolidating above their pre-financial crisis peaks.

Anglo American was an example we discussed at The Chart Seminar. The share has rebounded impressively from the 200-day MA and the region of the previous peaks. The discussion centred on whether this occasion was similar to other large ranges being resolved on the upside or whether it was going to be a failed upside break like the post GFC surge in 2011.

I am of the view that breakouts should be given the benefit of the doubt unless they fail. The issue at present is the share has now posted two relatively large downside key day reversals in the last six weeks.

Resources companies tend to experience very strong performance heading into recessions. Demand increases in line with inflationary pressures as consumers pre-empt price increases by buying more. We have not had a large mining investment cycle on this occasion so, any recession-linked decline is likely to be transitory. Nevertheless, volatility cannot be ruled out considering the weakness in the wider market.

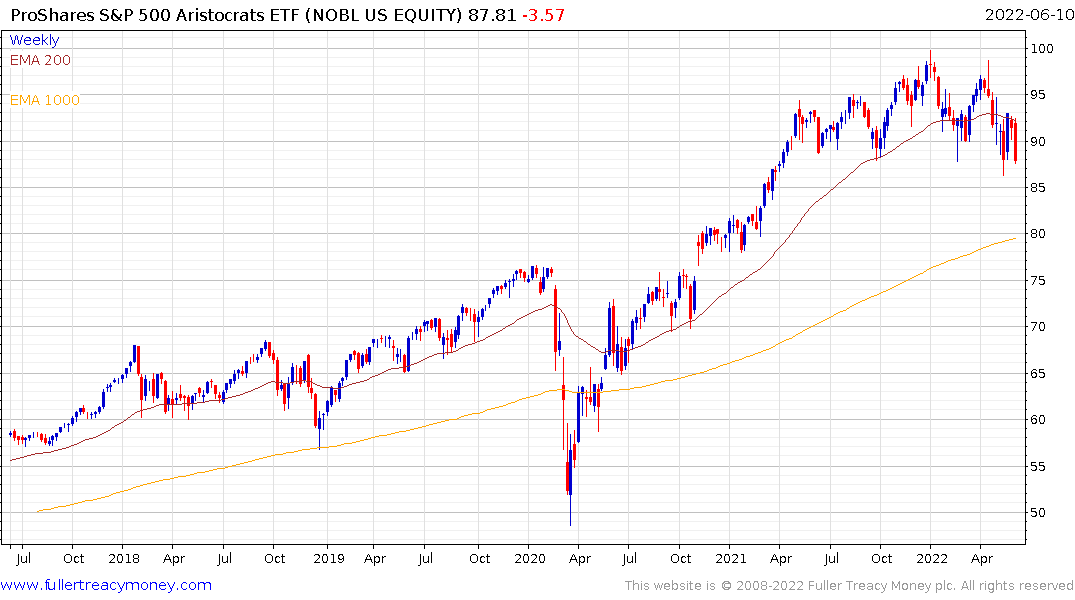

Defensive sectors like the Dividend Aristocrats tend to fall last. This week’s downward dynamic suggests a reversion towards the 1000-day MA is looking more likely.

The harsh reality today is the global economy is beset with challenges ranging from wars between great powers, the lingering effects of COVID-19, inflationary pressures, high commodity prices, climate volatility, incompetent politicians, social discontent and central banks struggling to fulfill their mandates.

Corrections in equities will not end until liquidity becomes more available. Corrections in bonds will not end until inflation is under control and interest rates decline. Commodities have been a safe haven, but they become riskier as growth falters.

Back to top