Sector Cross-Currents: How to Surf the Swirl of Trump & Tech Disruption

This report by Maneesh Deshpande for Barclays may be of interest to subscribers. Here is a section:

Here is a link to the full report.

Here is a section from it:

On-premise IT hardware and software companies built high barriers to entry by creating integrated suites of hardware/middleware and application software involving multi-year relationships with enterprises, complete with licensing & support contracts and cash-rich streams of maintenance and service costs. High switching costs and entrenchment through customization of on-premise hardware and software based on enterprise-specific needs resulted in outsized profits for the incumbents. Amazon/Microsoft commoditized data center infrastructure, effectively transforming computing resources into storage, computing, database, and application software components running on centralized servers which could be used on an ad-hoc basis not only by their internal teams but also enterprise customers.

The cloud is becoming a disruptive force for IT hardware, software, and the services industry as the cloud’s greater efficiency, flexibility, and lower cost is reshaping IT spending patterns and vendor incumbency. Cloud displacement risk is high for companies participating in storage and servers, followed by managed services and application/middleware software as competitive pressures mount from elongating replacement cycle and greater price discounting. Even for large enterprises and governments, where decades of IT infrastructure and applications make the move from on-premise to the cloud difficult, the cloud’s pay-for-use model is changing how these enterprises evaluate and deploy on-premise IT workloads, and increasing the use of modular and customized IT solutions, which stands to hurt the cash-rich services and software maintenance streams of the disrupted legacy IT hardware and software businesses.

Moore’s Law basically ended in 2016 and we can already see that the speeds of computer chips have remained stagnant for the last few years. Enhancements have been delivered through longer battery life, more memory and separate drives for booting and storage but the speed of the chips has not moved much.

If companies cannot rely on personal devices getting faster and smaller on a predictable basis then they have little choice but to provide services remotely. That is one of the primary reasons behind the investment in cloud computing and software as a service.

Companies like Intel, Nvidia and AMD have benefitted from the buildout in server farms. That growth got a boost from increased capital expenditure flowing from the tax cuts and remittance of overseas income. News this week that Google is building a data center in Accra, Ghana suggests that companies have a clear interest in getting data to consumers as quickly. Frontier markets with burgeoning populations and increasing internet access are the last region when big companies have the potential to grow aggressively.

The end of Moore’s Law means companies have to experiment with completely new architectures and that represents an uncertainty as to what technology will eventually win out. Intel is pioneering optical computing in the data centre. IBM is developing quantum computing and AI. Memristors have long been on the horizon but are not yet commercially available. Hewlett Packard Enterprises is likely to be the first to market with such a product.

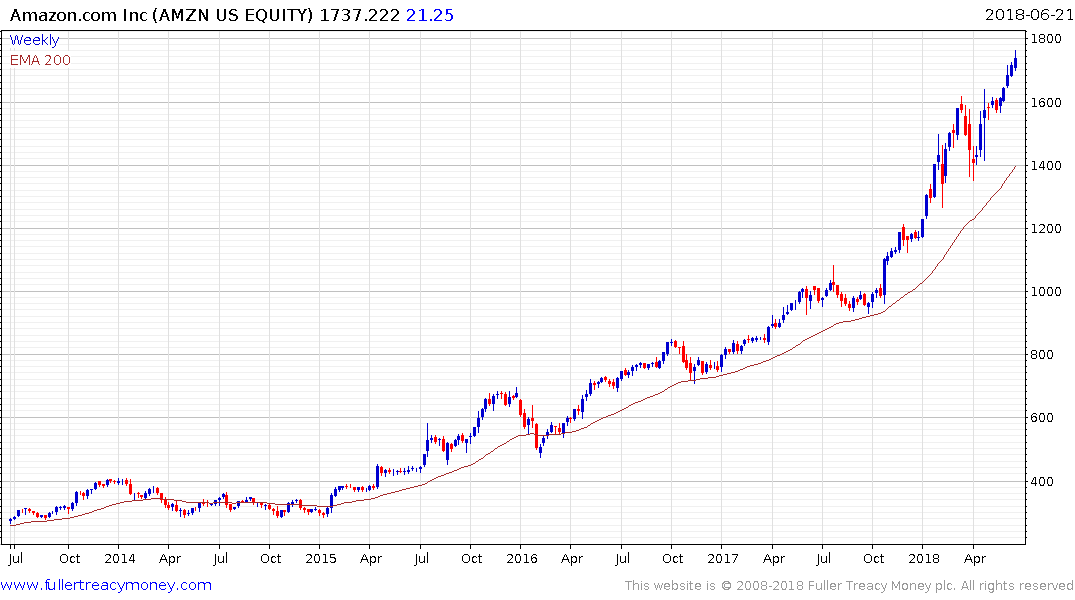

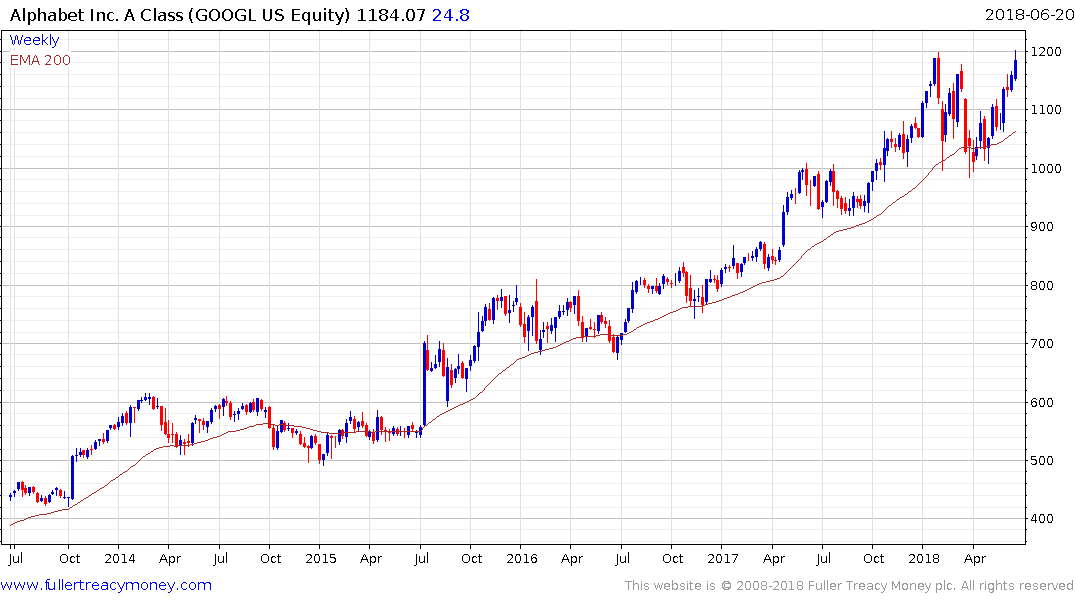

Meanwhile the data-centre companies continue to represent relative strength in this market with Amazon, Netflix and Facebook and Alphabet/Google remaining among the leaders. Nevertheless, they are all overextended right now and susceptible to some consolidation.