Scottish Mortgage Writes Down Private Company Holdings by 28%

This article from Bloomberg may be of interest. Here is a section:

“An important influence over the last year has been the closing of the IPO market,” Burns said in the statement. “We had fourteen companies go public in 2021 but as the IPO market closed in 2022 companies postponed their plans with no private holdings going public.”

During the year the fund invested £281 million into private companies for follow-on investments as well as two new investments in UPSIDE Foods and Climeworks, Burns said. Private holdings made up 28.6% of the portfolio at March 31.

“We will continue to closely monitor the proportion of the company invested in private companies throughout the year recognising that the proportion can be volatile,” he added.

Scottish Mortgage is not the only fund to have to write down investments in private assets. The low interest rate, low inflation and abundant credit of the last decade allowed long duration assets like high growth, zero profit companies to expand rapidly. The right investment decision was to bet big on the private assets sector. The big mistake was to think the trend was immune to tightening credit conditions.

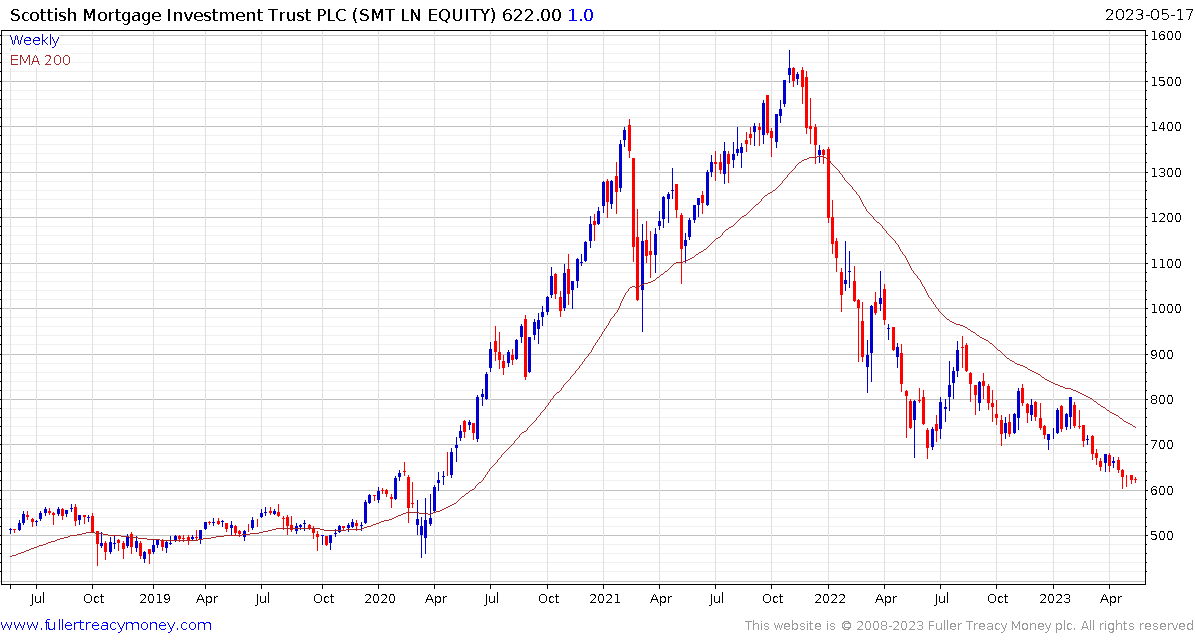

The trust continues to trend lower despite the rebound in mega-cap shares.

Meanwhile, the Renaissance IPO ETF is building a base formation and is currently testing the region of the 200-day MA. A sustained break above $30 would confirm a return to demand dominance beyond short-term steadying.

Meanwhile, the Renaissance IPO ETF is building a base formation and is currently testing the region of the 200-day MA. A sustained break above $30 would confirm a return to demand dominance beyond short-term steadying.