Saut Strategy October 28th 2019

Here is a link to the full report and here is a section from it:

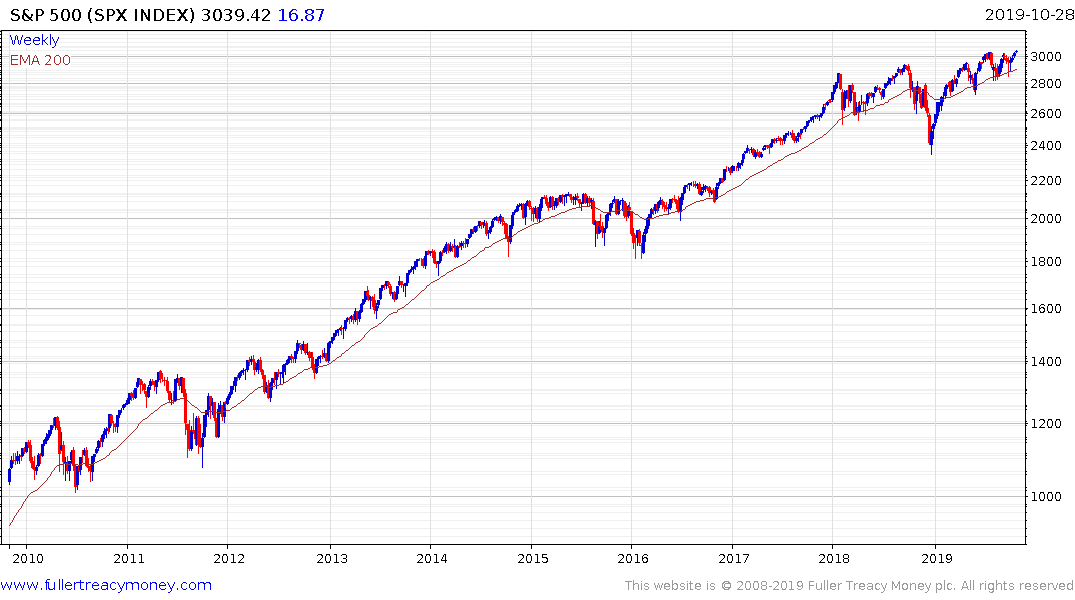

Ladies and gents, when stocks ignore bad news that’s good news. And that is what happened to a number of stocks last week as the bulls snorted “Caterpillar who?!” Such examples were punctuated by one portfolio manager we spoke with who remains in 60% cash. Indeed, last week was notable for the stock market’s ability to shake off several bear attacks. Take Amazon (AMZN/$1761.33), the bears went after AMZN Friday morning to the tune of nearly 100-points, yet the stock closed lower by only some 20points. The “beat rate” by sectors is worth a look (chart 2). The rally by the SPX since the October 8, 2019 low (2892.68) is now at session 14. As long-time readers of these missives know such upside skeins tend to last 17 – 25 session. Some actually go 25 – 30 sessions, but it is rare to see one go for more than 30 sessions.

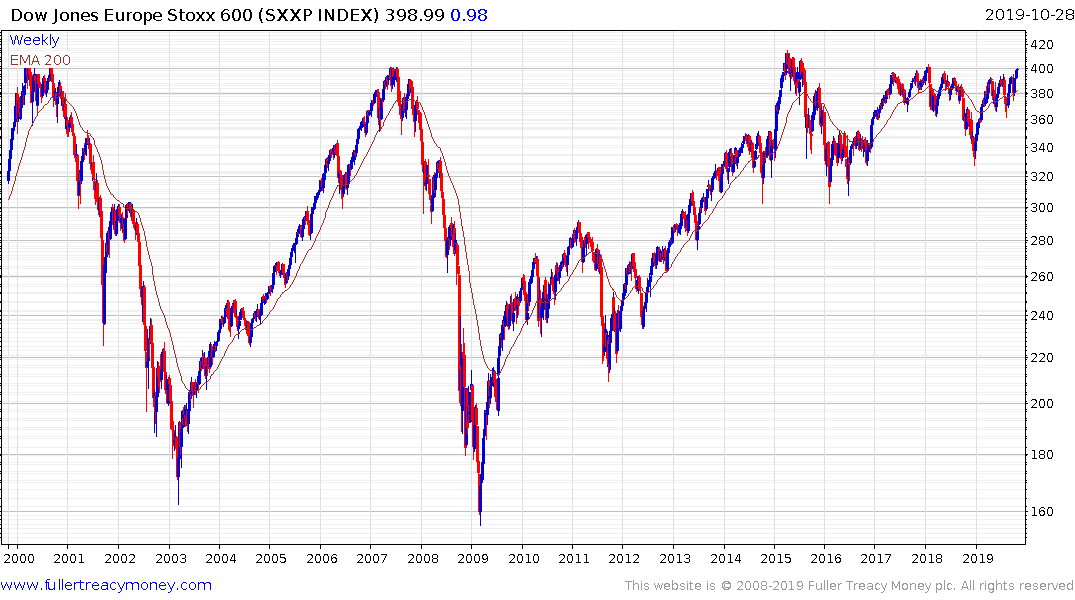

Yet it is not only the U.S. equity markets that are acting ebullient for the Stoxx 600 (Europe) has tagged new all-time highs despite the Gloomy Gus predictions of an impending recession (chart 1). Solid earnings, and an appetite for risk assets, set the stage for the upside breakout. And it wasn’t just the Stoxx 600 that is breaking out to the upside, but European bank stocks, autos, construction & materials, and European tech stocks are all at new all-time highs. Not to be outdone, Swedish stocks are at new all-time highs and Spain has broken above a multi-year down-trend line. Amazingly, despite the Brexit hoopla, the British Pound has strengthened again the U.S. dollar (chart 3).

Deteriorating sentiment about how much of a drag on global growth the trade war has represented has been one of the primary reasons investors have stuck to cash over the last couple of years. The volatility in the last quarter of 2018 and the even faster rebound unsettled a lot of investors with the result a wait and see attitude has been adopted. The big question they will now be raising is whether the breakout can be sustained before jumping back in.

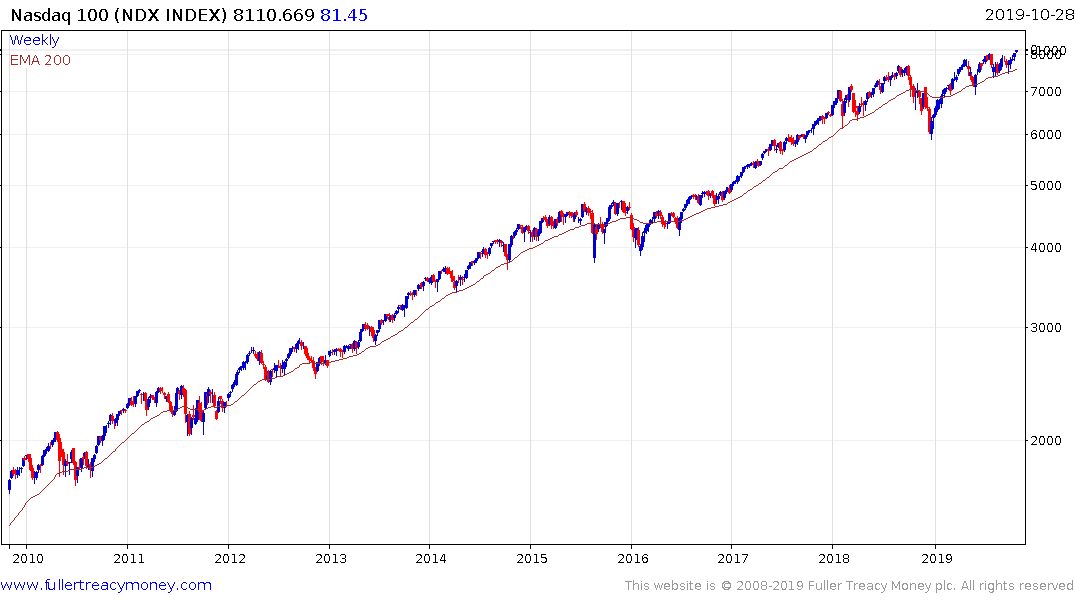

The commonality of performance across the S&P500 and Nasdaq and the recent strength in the banking sector support the view that latest of three medium-term corrections in this decade long bull market will be resolved on the upside.

One of the most notable consistency characteristics of this bull market has been the tendency of the 200-day MA of offer support during trending phases but the 1000-day MA to offer support during medium-term corrections. Each of the other medium-term corrections has seen the region of the previous high hold following the breakout so a sustained move below the 200-day MA would be required to question upside potential.

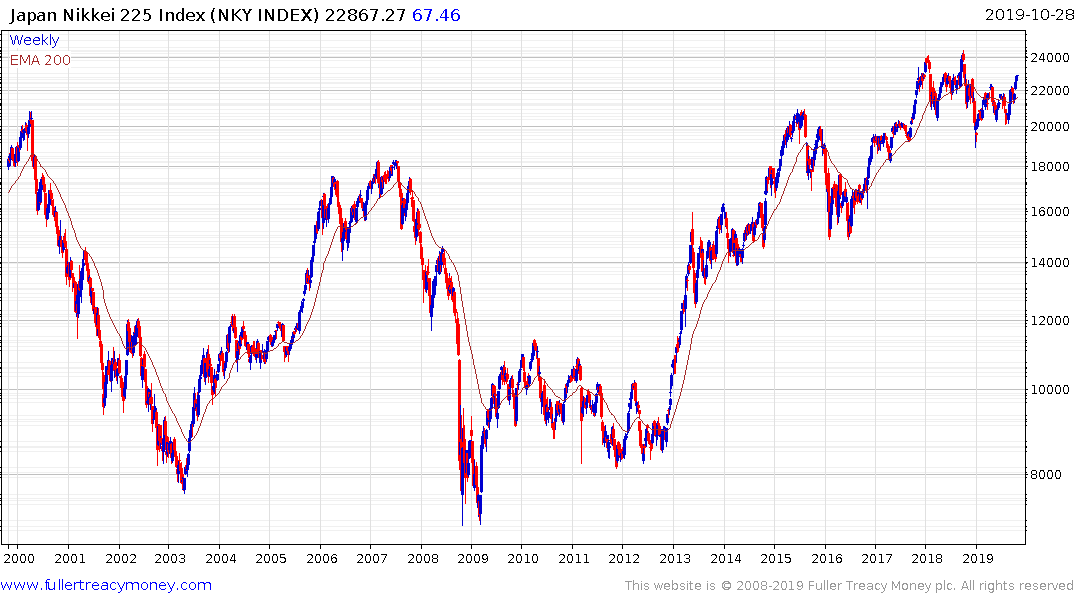

The fact that the Nikkei-225 has confirmed support in the region of the upper side of its long-term base and that the Europe STOXX 600 is one the cusp of completed a 19-year range are supportive of the view investors are both willing to further support momentum but are also looking at catch-up potential in other developed markets.