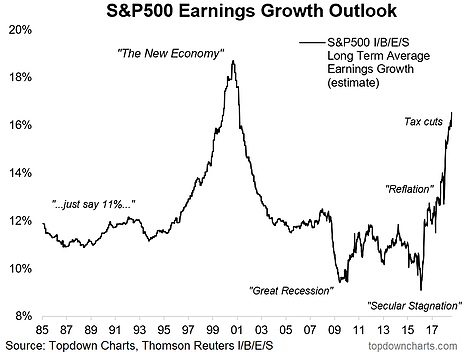

S&P500 Long Term Earnings Growth Outlook

This note by Callum Thomas for topdowncharts.com may be of interest to subscribers. Here it is in full:

This is quite the chart - it shows the consensus estimates of the longer-term earnings growth outlook for the S&P500, and it's the highest since the later stages of the dot com bubble. But back then it was all about "the new economy" as dot com companies were disrupting industries left right and center and promising a tech revolution. Now it's tax cut euphoria, and the hope of a shaking of the old "secular stagnation" fear that took hold in 2015/16. Indeed, it's interesting to reflect on the history of this chart, it seems to speak more about sentiment than fundamentals (or maybe some mix of the two). With the US economy still going strong, one may be tempted to channel Irving Fisher's "permanently high plateau" quote...

Expectations for further earnings growth are an important rationale for supporting stock prices at new all-time highs. The surge in the bullish expectations following the shift from monetary to fiscal stimulus in the USA certainly stands out on this chart and helps to highlight just how enthusiastic investors are about growth potential.

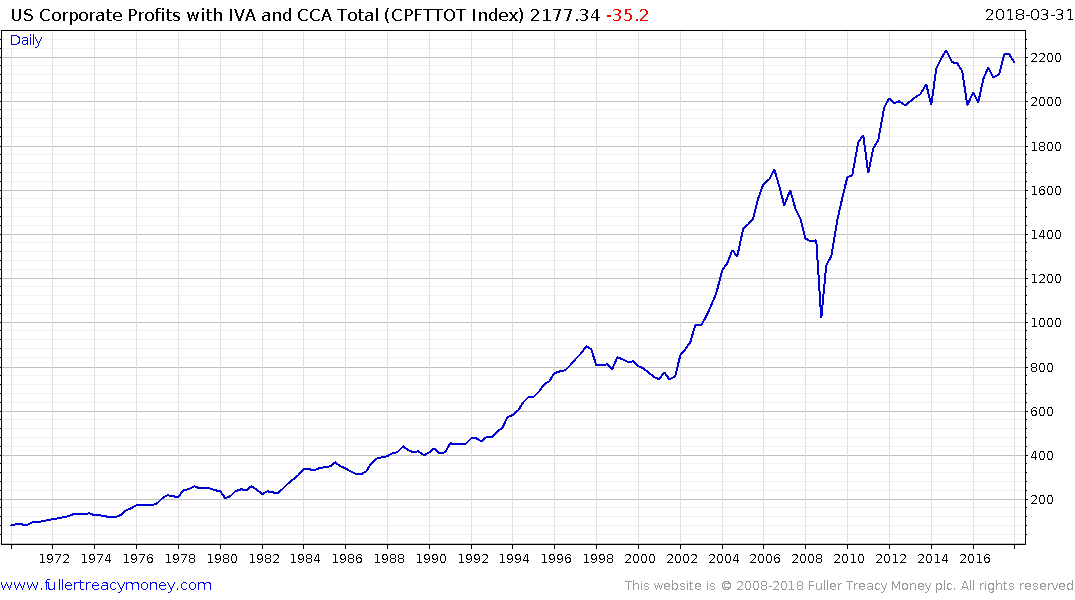

The next update for the US Corporate Profits chart will be on August 29th, at least according to Bloomberg. That measure has been ranging below the 2014 peak but has held an upward bias since the late 2015 low. Considering the expectations for earnings growth the market has probably already priced in a move to new all-time highs for corporate profits.

The S&P500 is hovering in the region of its all-time peak and while it may pause for a while longer to unwind the short-term overbought condition, a sustained move below the trend mean would be required to question medium-term scope for continued upside.

The Dow Jones Transportation Average closed at a new all-time high yesterday but is also susceptible to some consolidation

The Dow Jones Industrials Average bounced impressively from the 25,000-level last week and is also likely to pause to unwind its short-term overbought condition but a sustained move below the trend mean would be required to question recovery potential.