S&P's Best Earnings Run Since 1999 Meets Rebalance

This article from Bloomberg may be of interest to subscribers. Here is a section:

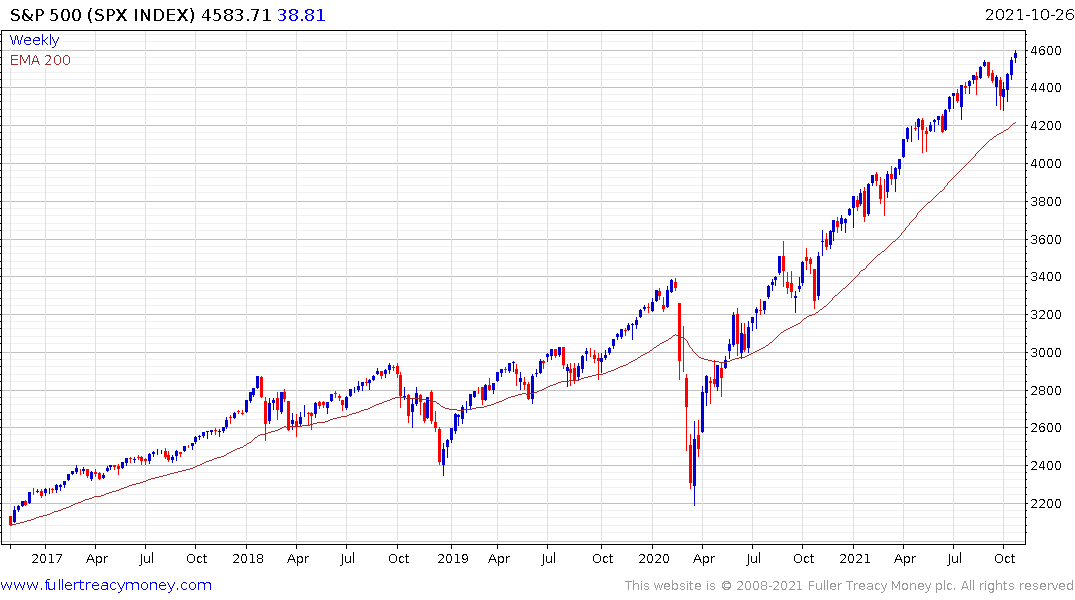

The S&P 500 has advanced 5% since JPMorgan Chase & Co. kicked off the earnings season nine days ago, in the best start to a reporting cycle since the dot-com mayhem 88 quarters ago. Along the way, the index slipped only once, with a 0.1% drop on Friday doing little to derail the benchmark from its best month since the election.

Now institutional investors with large stock and bond holdings will need to balance out their positions, buying dips on losers and taking profits on winners. How big will the impact be? A regression analysis done by strategists at BNP Paribas SA shows that the outflow needed to compensate for a divergence between this month’s drop in the bond market and rally in stocks could translate into a 2.6% decline in the S&P 500 when the rebalancing takes place.

End of month reweighting of portfolios is a predictable event and represents a solid rationale for the recent bounce in Treasury futures. It’s unlikely to contribute to more than temporary strength because none of the underlying factors have changed.

The short-term overbought condition on the S&P500 is also susceptible to some consolidation, despite strong earnings continuing to come through. The strong rebound over the last couple of weeks has taken the Index to another incremental new high. The pattern over the last year has been these moves are not sustained but the pullbacks that follow them tend to bed mild. It suggests there will be better buying opportunities arising over the coming weeks.

As we head into the last couple of months of the year, we are now in the most favourable seasonal period so it is reasonable to expect a continued firm performance. That’s particularly true since the Fed is unlikely to surprise the market by hiking rates before they fully taper.

Back to top