Russia responds to sanctions by banning western food imports

This article by Jennifer Rankin for The Guardian may be of interest to subscribers. Here is a section:

The Kremlin's move comes in response to the grounding of the budget airline subsidiary of Aeroflot as a result of EU sanctions over Moscow's support for rebels in Ukraine.

Medvedev also said officials were considering a ban on European airlines flying to Asia over Siberia.Russia is Europe's second-largest market for food and drink and has been an important consumer of Polish pig meat and Dutch fruit and vegetables. Exports of food and raw materials to Russia were worth €12.2bn (£9.7bn) in 2013, following several years of double-digit growth.

?The UK is less likely to lose out; in 2013, its biggest food and drink export was £17m of frozen fish, followed by £5.7m of cheese and £5.3m of coffee.

Food has already been caught up in political tensions between Russia and the west. In recent days Russian food safety authorities have banned the import of Polish fruit and vegetables, while McDonald's cheeseburgers and milkshakes are being investigated by a regional branch of consumer protection agency Rospotrebnadzor.

EU pork was banned at the start of the year as the Ukraine crisis escalated, cutting off 25% of all European pig meat exports in a move that the European commission said exposed European farmers to significant losses.

Adidas announced last week that it will be reducing its exposure to Russia in response to a difficult trading environment. This highlights both how difficult it is to perform in the Russia consumer sector but also how small the exposure of European companies is to the market. The share extended its decline today.

I performed a search on Bloomberg for European and North American companies that generate more than 5% of revenues from Russia. The limitation of this search is that some companies such as Marine Harvest, Danone or Schlumberger do not report their Russian revenues separately so the results are not satisfactory. Today’s reciprocal sanctions hit individual farmers and are not good for sentiment but the effect is relatively minimal, so far, for the broader European economy.

Russia on the other hand has more to lose and will likely be courting Asia for trade relationships.

There is ample room for sanctions to be ratcheted up before energy joint ventures are affected but that has not stopped investors taking pre-emptive action. BP for example has failed to sustain its breakout from a four-year range and continues to extend its pullback. It is now in the region of this year’s lows and a clear upward dynamic will be required to check momentum.

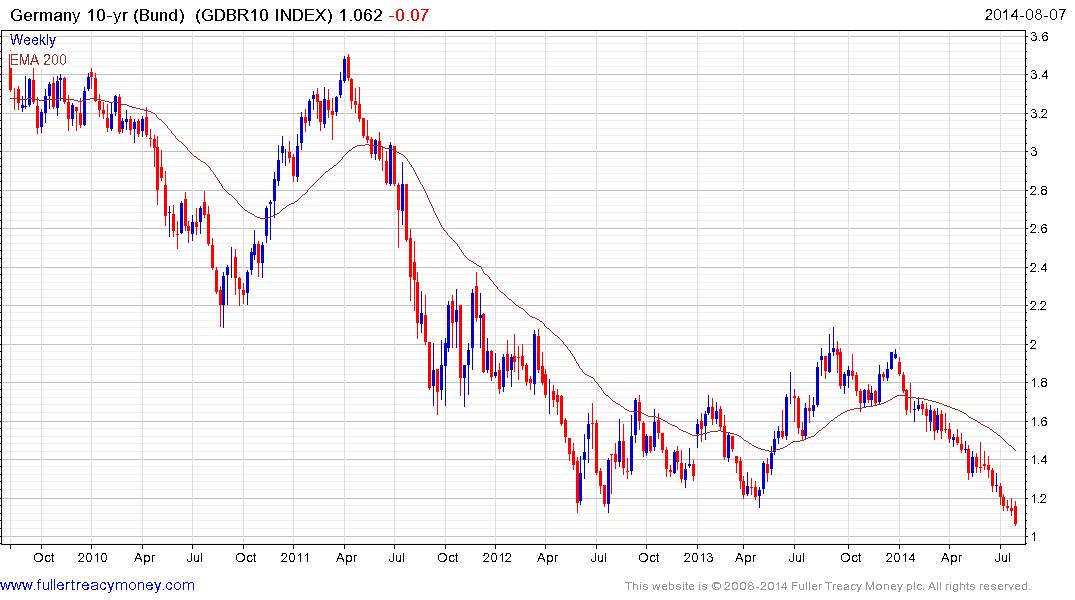

Meanwhile German 10-year Bund yields hit a new low today. While oversold in the short term, a clear upward dynamic will be required to question potential for additional compression.

Back to top