Russia confirms BRICS will create a gold-backed currency

This article from Bloomberg may be of interest to subscribers. Here is a section:

"Talk of BRICS gold backed currency seems like an echo chamber. They do not have the gold to back a currency meaningfully," said Marc Chandler, managing director of Bannockburn Global Forex. "Have we not learned anything from the EMU experience of monetary union without fiscal union. Color me profoundly skeptical."

Many analysts have been speculating about a new global currency to challenge the U.S. dollar's role as the world's reserve currency. In late March, Former Goldman Sachs chief economist Jim O'Neill wrote in a paper published in the Global Policy Journal that the U.S. dollar's dominance is destabilizing global monetary policies. He added that a BRICS currency, challenging the U.S. dollar's dominance, would bring stability to the global economy.

"Whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic," he said.

A competing reserve currency group to the US Dollar would act as a competing force and promote responsible monetary and fiscal action over the long term. In the short term, the scrabble to accumulate gold would be enormously disruptive and would result in a devaluation of every other asset relative to the metal’s price. That kind of pain tends to be sprayed around and would not be confined to the financial sector.

Regime changes in the currency markets don’t generally happen without a war. Russia, supported by China, is currently facing off against Ukraine, supported by NATO. The fact that Russia and China represent almost half of the BRICS and NATO represents the USA and its European allies suggests the route to an alternative reserve currency lies in the Ukraine conflict expanding with obvious ramifications for the security of naval commerce.

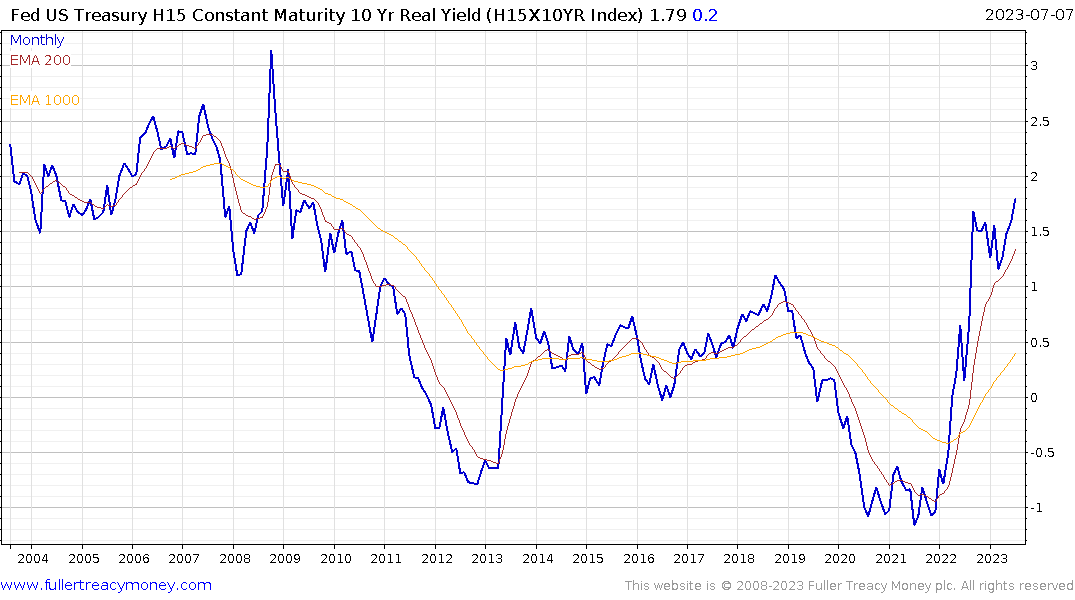

For now this is just speculation. Gold is unmoved as it tests the region of the 200-day MA. The most compelling bullish narrative remains that the USA is not far from its interest rate hiking peak and when the trajectory of real rates reverses it will be a strong tailwind for gold. Since the price has been ranging in an orderly manner for three years, the breakout to new highs is likely to be surprising in how powerful it moves.

For now this is just speculation. Gold is unmoved as it tests the region of the 200-day MA. The most compelling bullish narrative remains that the USA is not far from its interest rate hiking peak and when the trajectory of real rates reverses it will be a strong tailwind for gold. Since the price has been ranging in an orderly manner for three years, the breakout to new highs is likely to be surprising in how powerful it moves.