Russia: assessing the impact of trade restrictions

Thanks to a subscriber for this informative report for Deutsche Bank which may be of interest to subscribers. Here is a section:

Russia’s import profile also suggests that the share of food imports from the countries that are subject to food sanctions accounts for more than 45% of food imports to Russia, with the EU being a major supplier (35%, of which Germany 4.6%, Netherlands 4.6%, Poland 3.8% and France 3.7%), the United States accounting for 3.9%, Norway 2.8%, Canada 1.1% and Australia 0.8%.

The most significant impact of food restrictions is likely to come from the import bans versus EU and Norway, which hold dominant positions in the delivery of meat, fish, poultry, cheese, and fruit and vegetables.

Overall, out of the USD41bn of food imported in 2013, the restrictions are likely to affect USD11bn-worth of deliveries, i.e. 40% of total imports of these categories for meat, fish, poultry, and fruit and vegetable products (USD28bn). The restrictions will affect more than 60% of total imports from restricted countries.

While the trade effect of restrictions is significant, the impact on consumption is contained. We estimate the total level of food imports at roughly 12% of total food consumption. Although the imports of meat, fish, poultry, cheese, and fruit and vegetables account for around 20% of the consumer basket, the share of consumption from the sanctioned countries is around 8.4%.

Given the necessity for the substitution of food imports from the European Union, the United States, Norway, Australia and Canada, the Russian authorities have negotiated with Latin American countries, with possible imports of fish from Chile, meat from Brazil and Argentina, and the importing of more fruit and vegetables from Turkey, Azerbaijan and other countries.

?In our view, as the ban was set for the duration of a year, the ability of domestic import substitution is quite limited, so that the bulk of products will be imported from the above-mentioned counties. For example, according to Vedomosti sources, given Russia’s conditions, it is possible to increase salmon production to 50,000-70,000 tons, while imports from Norway in 2013 amounted to 105,000 tons.

Here is a link to the full report.

Russia’s reciprocal sanctions on Europe’s food producers are aimed at the soft underbelly of the European economy since they affect farmers and those who had been less affected by the fiscal constraints imposed on a number of countries without threatening sectors on which Russia remains highly reliant.

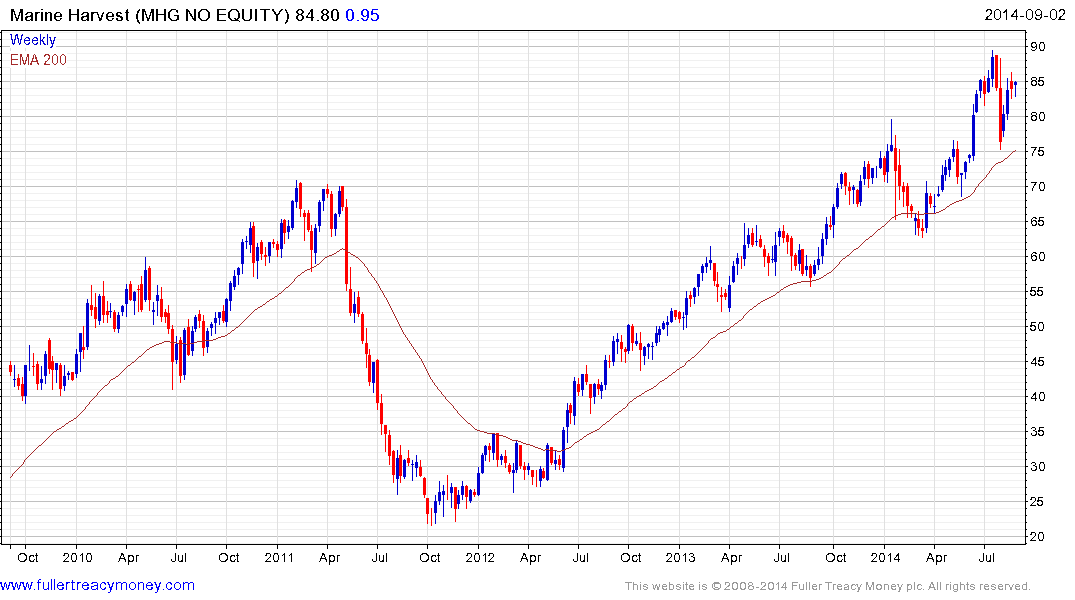

Norwegian listed Marine Harvest pulled back sharply in August following the announcement of sanctions but found support in the region of the 200-day MA and a sustained move below NOK75 would be required to question the broad consistency of the two-year uptrend.

Brazil is a clear beneficiary of sanctions against Europe and US competitors which helps to explain the relative strength of its meat exporters, not least its number three exporter Marfrig which had previously been languishing.

There is no guarantee that the sanctions will only last a year and the inflationary impact of disrupting the food supply chain has implications for the Russia economy. The US Dollar continues to hold a progression of higher reaction lows against the Ruble and moved to a new high last week. A sustained move below RUB35 would be required to begin to question medium-term scope for continued upside.

Back to top