Russell Napier A Dearth of Dollars

Thanks to a subscriber for this interesting interview of Russell Napier by David McAlvany. Here is a section:

It is impossible to talk about the strength of one currency without talking about the weakness of another since by buying one you are necessarily selling another. By investing abroad over the last decade US Dollar based investors benefitted from currency market and capital market appreciation as well as the high yields on offer in emerging markets. In effect this amounted to a short Dollar position. On the other side of the equation emerging market borrowers benefitted from capital market inflows, falling yields and steadier financial conditions but this also amounted to a long Dollar position. As an increasing number of major economies need a weak currency more than the USA, the potential for those who had engaged in what amounted to a Dollar carry trade to come under pressure has increased.

It is impossible to talk about the strength of one currency without talking about the weakness of another since by buying one you are necessarily selling another. By investing abroad over the last decade US Dollar based investors benefitted from currency and capital market appreciation as well as the high yields on offer in emerging markets. In effect this amounted to a short Dollar position. On the other side of the equation emerging market borrowers benefitted from capital market inflows, falling interest rates and steadier financial conditions but this also amounted to a long Dollar position. As an increasing number of major economies need a weak currency more than the USA, the potential for those who had engaged in what amounted to a Dollar carry trade to come under pressure has increased.

A Peruvian delegate at the Chicago venue for The Chart Seminar last month explained that the Sol’s relative weakness against the Dollar was having a major knock-on effect for demand in his consumer businesses. He also said that this was not a situation limited to Peru but was present across Latin America. Logically, the countries under the least pressure will be those that have been able to fund themselves in their own currencies.

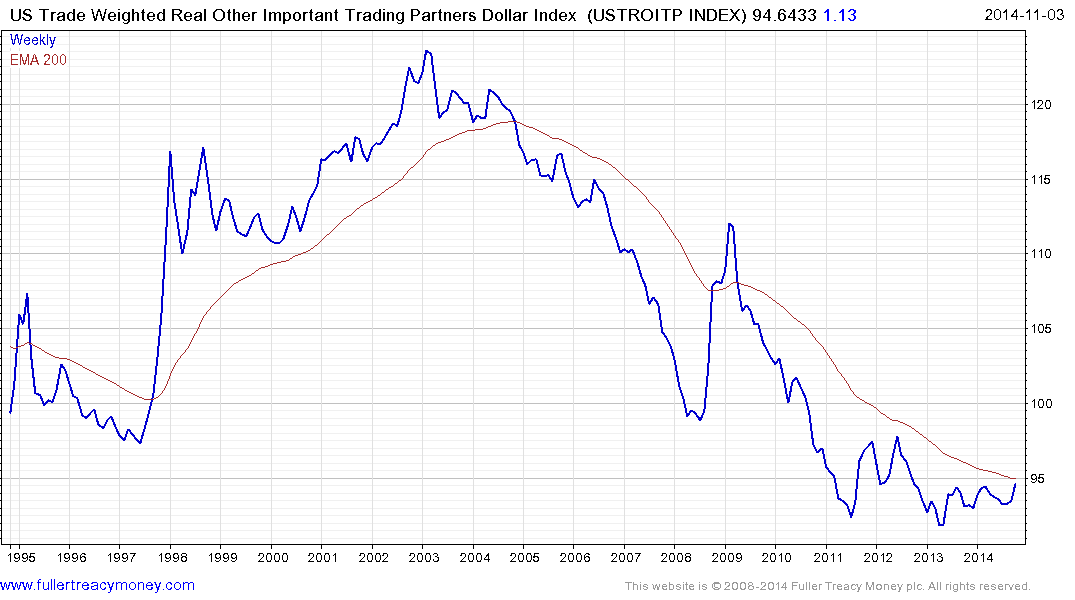

The Fed’s Trade Weighted Other Important Trading Partners US Dollar Index includes Mexico, China, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Thailand, Philippines, Indonesia, India, Israel, Saudi Arabia, Russia, Argentina, Venezuela, Chile and Colombia. It is not a timing indicator since it is only updated once a quarter. However Type-2 bottoming activity is evident.

There are clues here that the Fed’s cessation of additional QE purchases could have considerable knock-on effects elsewhere.