Run It Cold: Why Xi Jinping Is Letting China's Economy Flail

This article from Bloomberg may be of interest. Here is a section:

But where Biden has opted to run his economy hot, spending trillions of dollars on household stimulus and infrastructure to goose the economy, Xi is running his cold in a bid to finally break China’s addiction to fueling growth with speculative apartment construction and low-return projects funded by opaque local borrowing. If China is a “ticking time bomb,” Xi’s aim is to defuse it.

The clash of economic philosophies between the world’s two largest economies is already shifting investment flows and may delay the date at which China overtakes the US, or perhaps mean that moment will never arrive. The risk for Xi and his team, led by Premier Li Qiang and Vice Premier He Lifeng, is that the determination to avoid excessive stimulus undermines confidence across the nation’s 1.4 billion people.

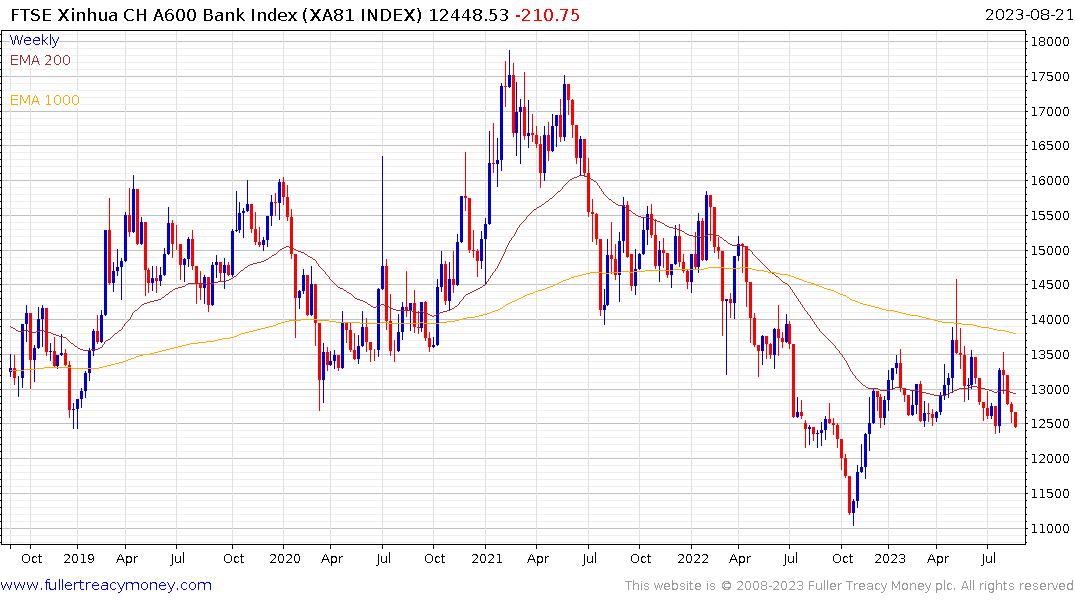

China’s banks are organs of the state so they will have to make loans if so directed. Today’s data suggests they are not going to do so until directed. When credit is withheld from the property sector it has a self-reinforcing effect. If consumers can’t get loans, they can’t buy homes and developers are unable to finance construction. China is looking at a very dangerous environment because property development and infrastructure represent a massive chunk of the economy. That has potential repercussions in every commodity exporting country.

Meanwhile, China’s sovereign bond yields are approaching the 2020 lows. This is the only major bond market where yields are testing their lows. Everywhere else government finances and inflationary pressures are pushing yields to new recovery highs. There is clearly the potential China views the crusade against property speculation as a dual purpose initiative. They wish to reorient the debt driven part of the economy and simultaneously aim to reposition the economy as a deleveraged relative to the unsanitised debt burdens of the OECD. In other words, it is just one more piece of the geopolitical competition puzzle.

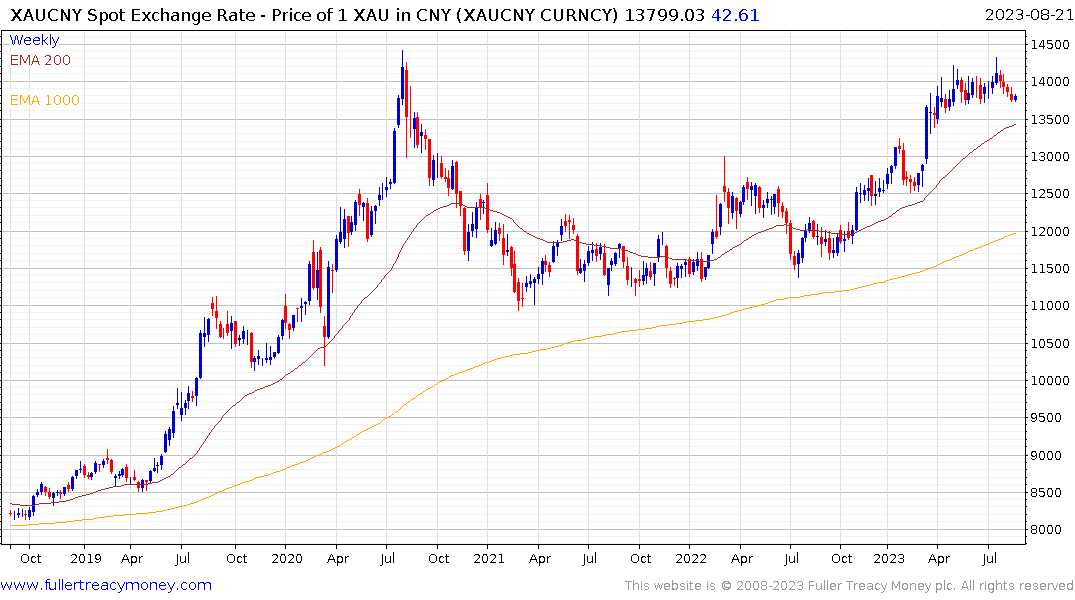

Gold in Renminbi continues to consolidate in the region of the 2020 peak. If China’s efforts to deleverage the economy and support the economy are successful, that would likely keep a lid on gold’s appreciation. The fact the prices is locked in a tight range suggests investors are less than confident the deleveraging will be painless or move in a straight line.

Gold in Renminbi continues to consolidate in the region of the 2020 peak. If China’s efforts to deleverage the economy and support the economy are successful, that would likely keep a lid on gold’s appreciation. The fact the prices is locked in a tight range suggests investors are less than confident the deleveraging will be painless or move in a straight line.