Risk Parity and new Central Bankers?

On Friday the bond market pulled back and so did the stock market.

That’s doesn’t happen very often.

Ray Dalio’s Bridgewater, one of the most successful hedge funds in the world, originated ‘risk parity’ to take advantage of the fact that bonds and the stock market seldom move in the same direction.

The whole rationale for the strategy is that when the stock market pulls back, investors will naturally seek a haven in the bond market. Dalio might have pioneered the approach but it has subsequently been employed across a wide swathe of the financial sector. A conservative estimate is more than $500 billion is devoted to this strategy.

Part of the reason it has had such appeal is because it did so well during the credit crisis because as stocks went down, bonds went up. The strategy is employed by making calculations about the likely volatility of the two asset classes, then netting one off against the other, in real time so that you get a hedged long position in the equity market.

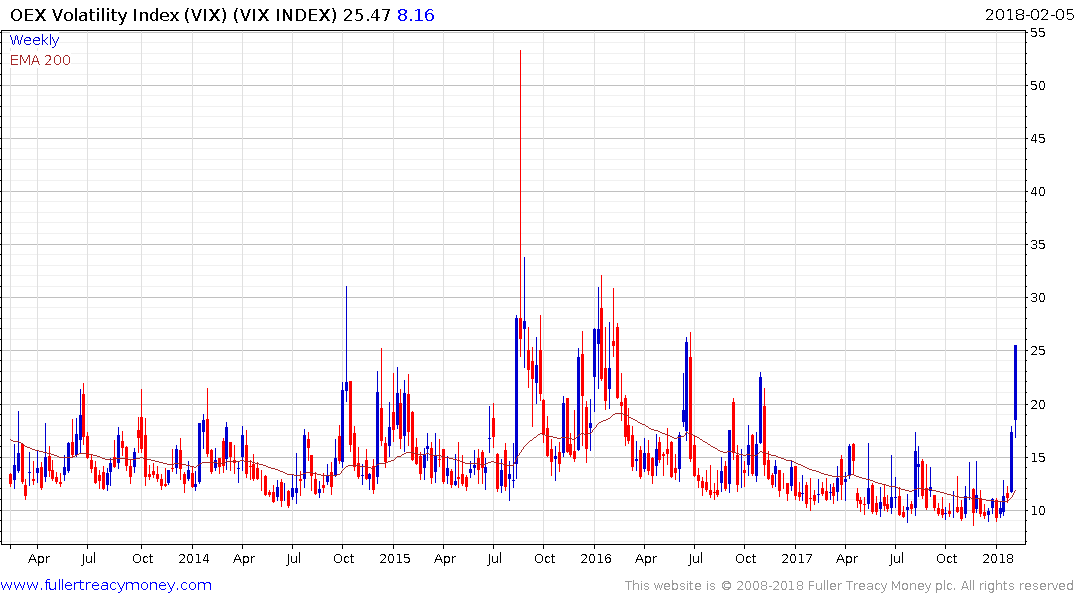

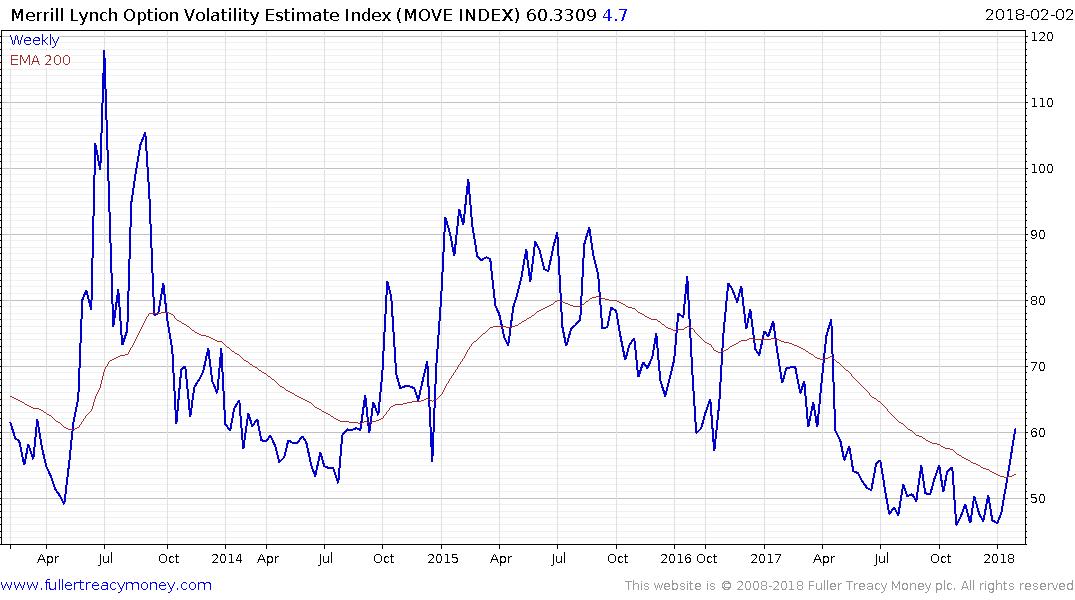

On Friday the Dow Jones finished down 665 points and the 10-year Treasury future was also in negative territory. That represented a rare losing day for risk parity strategies and contributed to the uptick in volatility witnessed on the CBOE SPX Volatility Index (VIX) and the Merrill Lynch Option Volatility Estimate MOVE Index which tracks bond market volatility.

We should be asking why? What was so special about Friday that had so many people on tenterhooks? Was it the fact that US unemployment was at a new low? Was it the fact that US wage growth picked up to a new high of 2.9%? Was it that the market was overbought and due a pullback? Was it that Apple’s earnings disappointed, with shrieks that the global mobile handset trend has peaked? Was it that the bond market earlier in the week pierced 2.6% and appears well on its way to 3%; a level last seen in the teeth of the taper tantrum in 2013?

There is a rational argument for any of these reasons being the animating factor behind pull back on Friday. However, there is one other event that happened on Friday which I believe does a better job of explaining what is going on in the market right now that seems to be getting missed in the media. It was Janet Yellen’s last day as Fed Chair. Jerome Powell was sworn in today and was quick to assert that he wants to be very transparent with how the Fed communicates its actions to the market.

The market has become accustomed to Fed chairs who have their best interests in mind but when presented with a new Fed Chair an air of uncertainty takes hold. We all might have opinions about what kind of policies the next Fed chair will pursue but the simple fact is we don’t know how someone will react in a crisis until they are presented with one. The market seems to have a habit of testing Fed chairs soon after they take office.

Alan Greenspan, the so-called Maestro, took office in August 1987. The was the same month the impressive bull market, that had seen the S&P500 more than double in three years, peaked. No one will forget that the market crashed less than two months later. It was then that Greenspan’s mettle was tested and he rode to the rescue with the government sponsored rescue of Long-Term Capital Management. Nevertheless, the S&P500 peak to trough decline was 35.94%.

Famous ‘Helicopter’ Ben Bernanke assumed office in February 2006. He had written extensively about the economic malaise that occurred during the Great Depression as well as Japan’s lost decade and what it could have done better. In 2002 he gave the famous helicopter speech where he referenced Milton Friedman’s ‘helicopter drop’ of money to end deflation. Even with those monetary easing credentials the market saw fit to test his resolve and pulled back by 2.67% immediately after his inauguration and by 8.08% in May 2006.

Janet Yellen assumed office on January 1st 2014. As an Obama appointee, and a well-known social progressive, Yellen was expected to offer a repeat of the policies followed by Bernanke. However, the market hit a peak on December 31st 2013, went nowhere for the first two weeks of January and then pulled back by 6.1%.

Jay Powell took over today. The most widespread opinion for why he was chosen as Fed chair is the Trump administration wanted to have the most market friendly person possible at the helm. However, the Federal Reserve has raised rates five times in the last two years and the Trump administration is pursing outright inflationary policies by stimulating when the economic expansion is already one of the longest in history and there is little spare capacity. If history is any guide, then we can expect the market to test Powell’s resolve and the decline we saw last week appears to be the start of that process.

There is every likelihood Powell is going to do exactly as was expected of him and come out dovish on rates with a view to a slow and steady pace of increases. The hallmark of Janet Yellen’s tenure was to keep a close eye markets. Investors will be keen to hear just how much attention Powell will pay to markets now that he is at the helm of the world’s most significant central bank. Everyone believes they have a dove and they are in all likelihood correct.

However, the fine handed down to Wells Fargo on the last day of Yellen’s tenure suggest there is appetite within the Fed for a more proactive approach to regulation, which has previously been absent. That represents an uncertainty for investors with a new Fed governor. The stock market has probably seen a peak of at least near-term and potentially medium-term significant, while there is also evidence of a rotation underway.