Risk Off

The vast majority of markets pulled back today and the Dollar strengthened. The tightening on restrictions on movement and economic activity in Europe and the prospect of taxes rising in the advent of a Democrat clean sweep in next week’s election have sapped demand. The failure of the USA’s political parties to agree on additional stimulative measures represents a loss of the liquidity which has helped to support earnings and speculation.

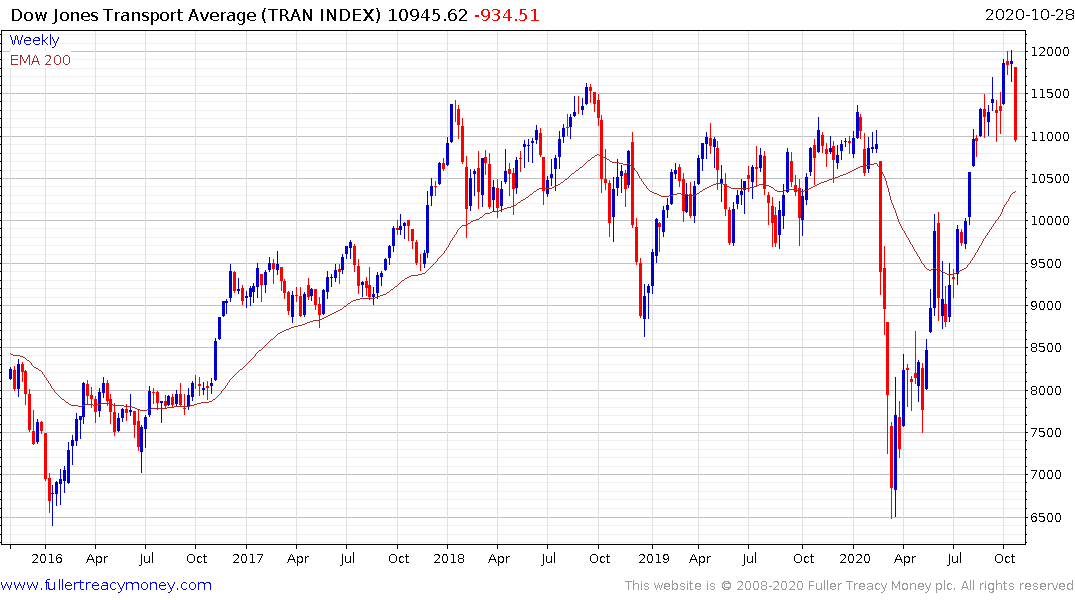

The Dow Transportation Average will need to rally soon if a failed upside break is to be avoided.

The Russell 2000 will need to continue to demonstrate support in the region of the trend mean if recovery potential is to be given the benefit of the doubt.

The Nasdaq-100 still has ample room in which to consolidate, with 10000 now coinciding with the region of the trend mean.

Gold dropped back to test the lower side of the month-long range and will need to rebound tomorrow to avoid a swifter process of mean reversion.

The Dollar Index steadied in response to the risk-off environment but the most was not nearly as dynamic as we have seen on previous occasions. Everyone knows that supply is inevitably going to increase once monetary and fiscal responses to market and economic weakness are put into action. Nevertheless, until that occurs the currency is likely to continue to experience upward pressure.

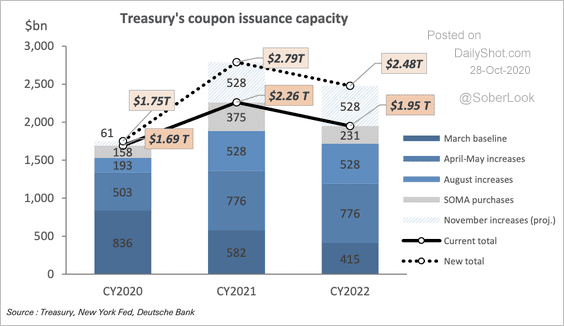

That lack of a dynamic response to broad stock market pressure was also evident in the Treasury market. 10-year futures finished the day unchanged because supply in 2021 and ’22 is likely to be significantly higher than this year.

Liquidity is what is keeping the wheels of commerce turning while we wait for broad reopening. Without it we are likely to see additional volatility. That is particularly true when we are in such close proximity to major events like the US election.