Review of recession lead indicators

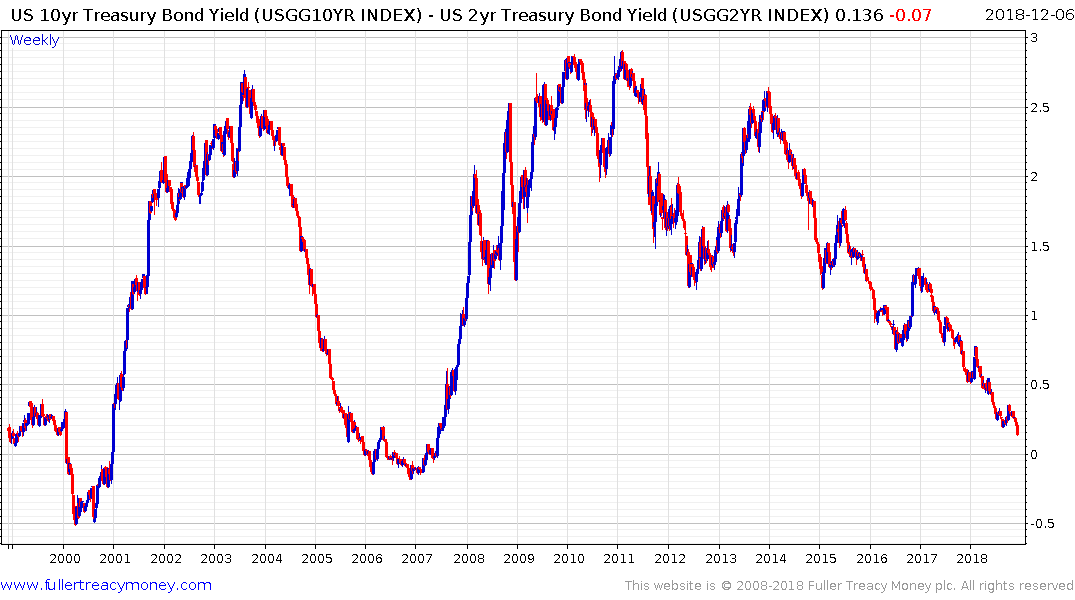

The yield curve spread has been in the news lately and with good reason considering how much of a move we have seen in the last week and because it has such an impressive record as a lead indicator for future recessions. With volatility on stock market increasing and perhaps more importantly some stress becoming evident in the credit markets I think it is timely to spend some time to do a thorough review of lead indicators for future recessions.

The yield curve spread expanded by 2-basis points today but at 14 it is close to inverting and is certainly tighter than the 280 basis points available in 2010 and 2011. The most basic business model of the banking sector is to borrow short and lend long. When short-term interest rates rise faster than long-term yields the margin banks earn contracts so they lend less. When the spread is this narrow, they are working on razor thin margins, and if it inverts, they lose money on loans so liquidity dries up.

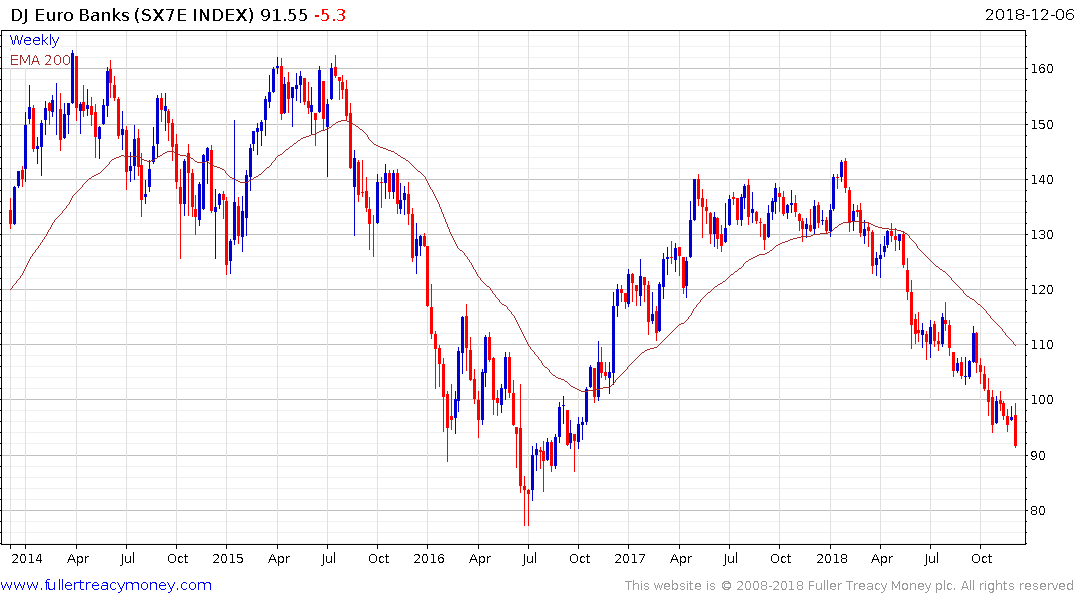

Systemically Important Financial institutions (SIFIs) are trending lower on a global basis which reflecting the global tightening of credit.

Eurozone banks are leading on the downside suggesting that it is in Europe where the greatest credit risk resides.

The underperformance of Deutsche Bank as it continues to make new lows is a worrisome sign because it will require a significant bailout if it goes bust in order to avoid a liquidity crisis considering how large its derivatives exposure it.

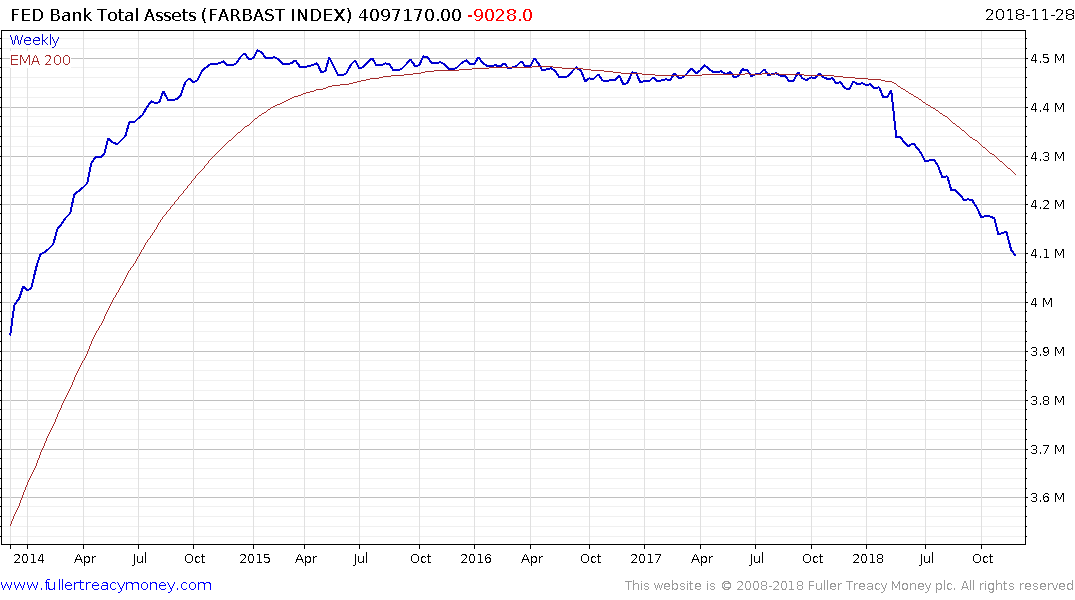

The Federal Reserve is reducing the size of its balance sheet. Quantitative tightening is removing liquidity from the market.

Removing Dollar’s from the market is creating a shortage of Dollar funding on the international market and also pushing up the value of the currency which is restricting liquidity for many other markets.

High yield spreads in Asia, Europe and the USA are all on an upward trajectory suggesting

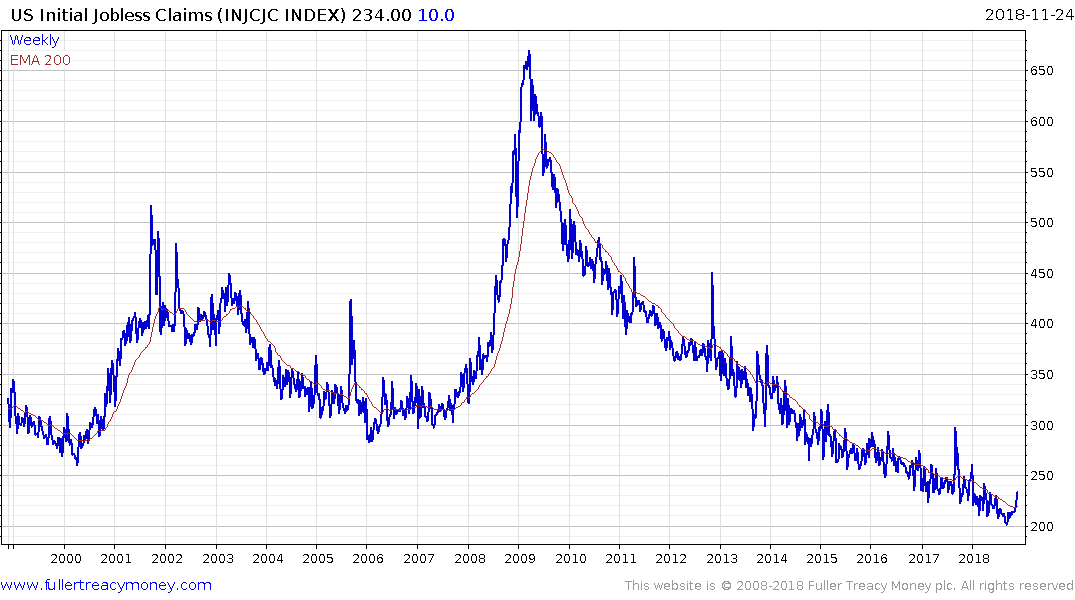

It’s almost a truism but you can’t have a recession without people losing their jobs. US Initial Jobless Claims rallied at the last release but the sequence of lower rally highs evident since 2009 is still intact.

Credit card Delinquencies are another measure not such much credit but the ability to pay. The 30-day measure was inert when last reported (with a one-month lag) in October but the Beige Book release last week suggests it may now be coming under pressure.

Delinquencies as a percentage of total loans continues to range below 5% and a break above that level would likely signal credit tightness.

All of these measures reflect a tightening of liquidity conditions which stems from the commitment of central bankers to remove stimulus from the market. These measures tell us we are late in the cycle and it is likely going to require a range of confidence supporting measures from central banks, globally, as well some Dollar weakness, driven by excess supply, to help repair sentiment.

The rebound in emerging market currencies has resulted in my measure of total central bank assets moving higher over teh last few weeks which is a postive sign.

The clearest evidence of stress is in interest rate sensitive sectors but most especially those which binged on cheap debt with little concern for how it was to be paid back. Additionally, sectors with a focus on Chinese manufacturing such as semiconductors are leading on the downside.

Meanwhile the outperformance of defensive sectors is both a testament to their credentials as reliable income producers but also of rising fear for more leveraged investments.

Finally let’s not forget that the stock market itself is a lead indicator for recessions. The Russell 2000’s underperformance and its commonality with the performance of small and mid-cap sectors globally, particularly in Europe, Australia and Canada.

Generally speaking with a medium-term correction, which is a part of any medium-term bull market the resumption of credit growth is one of the deciding factors in the continuation of the trend. Right now, we have a medium-term correction and liquidity is tightening; globally, Germany, Sweden, Switzerland, Japan, Italy, Canada and Mexico all having reported a negative growth quarter.

The extraordinarily choppy action on the S&P500 since October is not confidence inducing and the lows near 2500 need to hold if support building is to be given the benefit of the doubt.